December 2020 - Monthly Market Update

/Monthly Update || December 2020

“There are three ingredients for success—aggressiveness, timing and skill—and if you have enough aggressiveness at the right time, you don’t need that much skill.”

Opening Remarks

Greetings from inside Ikigai Asset Management¹ headquarters in Marina del Rey, CA. We welcome the opportunity to bring to you our twenty-seventh Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, we’re here. The wait is over. Just a few weeks shy of three years after peaking at an all-time high of $19,666 (Bitstamp price), Bitcoin closed out November at $19,704 (Bitstamp price), for its highest daily close ever. Bitcoin’s price increased a stunning 42% in November - its largest nominal monthly gain *ever*.

I believe I can speak on behalf of the entire crypto industry when I say it has been a WILD ride. The ups and the downs over the last three years have been unlike anything I’ve ever experienced in my career. The December 2017 blowoff top. The series of lower highs throughout 2018. The November 14, 2018 price crash. The April 1, 2019 pump. The Q2-19 insane run. The September 24, 2019 price crash. The October 25, 2019 President Xi pump. The brutal subsequent fade. Black Thursday. The October 2020 “decoupling”. And finally, a new ATH. Craziest part about it is, we’re just getting started.

I left Point72 on December 1, 2017 to pursue crypto investing full time. We launched Ikigai Asset Management on December 1, 2018. The first nine months of our fund’s history, we underperformed BTC. But we kept pushing. Evolving our investment strategy. Trying to figure out how to consistently generate attractive risk-adjusted returns in this wild market. In September 2019, we launched the strategy Programmatic Discretionary – systematic, models-driven exposure to BTC with the purpose of outperforming BTC through-cycle on a risk-adjusted basis. And, since that time, we’ve done just that almost exclusively trading BTC and we’ve done it with very limited leverage. I can’t tell you how proud of that I am.

Again, craziest part about it is, we’re just getting started. We’re just now at the end of the beginning. It took this space a full three years to get the pieces in place to get back to $19.7k and now that we’re here again, NO ONE WANTS TO SELL. Far from it, in fact. Folks are tripping over themselves to get Bitcoin exposure. Things change on a dime in crypto, but something big is going to have to change to knock this bid off.

The macro backdrop for that three-year roundtrip to $19.7k has been as dynamic as the underlying asset class we’re focused on here. As a reminder, three years ago the Fed was trying to end the largest monetary experiment in human history – Quantitative Easing while simultaneously running increasingly larger deficits on top of increasingly untenable debt levels. Two years ago, Jay Powell was still on autopilot, and the President of the United States was tweeting things like this:

Then came the Fed’s dovish capitulation in January 2019. That was a big deal. Then the rate cuts in summer 2019. Then the repo market blew out in September 2019. Then “not QE” QE in the fall. And by the time Covid came around and Treasury market seized up, the Fed had no choice. Markets were on the brink of collapse due to their decades long slide towards fragility. They cut rates 100bps, ripped $4tn of QE and $3tn of fiscal, and just like that, Paul Tudor Jones started buying Bitcoin.

Now that we’re back at $19.7k again nearly three years later, the macro setup is quite different than last time. It’s clear there is no plan to end the largest monetary experiment in human history. In fact, it’s abundantly clear the opposite is true. We’re going to print much, much more. Every major central bank and government official globally is going to ride that train till the wheels fall off, then they’re going to hand the mess off to their successors to let them deal with it. It’s not going to be Jay Powell’s problem. Or Janet Yellen’s problem. It’s going to be *our* problem.

The best solution we have to that problem is Bitcoin. Bitcoin is a non-sovereign, hardcapped supply, global, immutable, decentralized, digital store of value. It is an insurance policy against monetary and fiscal policy irresponsibility from central banks and governments globally. The world is going to need that store of value tomorrow more than they’re going to need it today, and it appears the world is starting to actually realize that.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international and qualified accredited U.S. investors.

Contact us to see if you qualify.

November Highlights

Stanley Druckenmiller Announces Bitcoin Position

Bill Miller Strongly Recommends Bitcoin

Citigroup Research Publishes YE 2021 BTC Price Target as High as $318k

Blackrock Fixed Income CIO Rick Rieder Says Bitcoin Could Replace Gold

Guggenheim Files to Buy Up to 10% GBTC Position in $5.3bn Macro Fund

BTIG Research Publishes YE 2021 BTC Price Target of $50k

AllianceBernstein Recommends Allocation to Crypto

Skybridge Files SEC Amendment to Invest in Bitcoin with $3.6bn Fund

Ray Dalio Says He “Might Be Missing Something” With Bitcoin

Niall Ferguson Writes Bloomberg Opinion “Bitcoin Is Winning the Covid-19 Monetary Revolution”

Square Reports Q3 Bitcoin Revenue and Gross Profit +11x & 15x YoY

Wyoming Elects Bitcoin Bull Cynthia Lummis As US Senator

Jay Clayton Steps Down as SEC Chairman

Alameda Research & FTX Founder Sam Bankman-Fried Donates $5mm To Biden Campaign

OCC’s Brian Brooks Testifies to Senate on Importance of Crypto

China Construction Bank to Issue $3bn in Bonds on a Blockchain, Tradeable for Bitcoin and Dollars

OKex Exchange Resumes Withdrawals After More Than A Month Frozen

Source: TradingView. As of 11/30/20.

| Asset Class | Nov | Oct | Q3-20 | Q2-20 | YTD | Instrument |

|---|---|---|---|---|---|---|

| Bitcoin | 42% | 28% | 18% | 42% | 173% | BTC |

| NASDAQ | 11% | -3% | 12% | 30% | 41% | QQQ |

| S&P 500 | 11% | -3% | 8% | 20% | 12% | SPX |

| Total World Equities | 12% | -2% | 8% | 19% | 10% | VT |

| Emerging Market Equity | 9% | 1% | 10% | 17% | 9% | EEM |

| Gold | -5% | -1% | 6% | 13% | 17% | GLD |

| High Yield | 3% | 0% | 3% | 6% | -2% | HYG |

| Emerging Market Debt | 4% | -1% | 2% | 13% | 0% | EMB |

| Bank Debt | 2% | -1% | 2% | 4% | -4% | BKLN |

| Industrial Materials | 11% | 3% | 11% | 10% | 16% | DBB |

| USD | -2% | 0% | -4% | -2% | -5% | DXY |

| Volatility Index | -46% | 44% | -13% | -43% | 50% | VIX |

| Oil | 23% | -11% | 1% | -17% | -70% | USO |

Source: TradingView. As of 11/30/20.

The Great “Sellside Liquidity Crisis”

Crypto Telegram chats for active traders are funny places. As you can probably imagine, they’re littered with slang, jargon and inside pseudo-jokes. If you weren’t intimately familiar with the ecosystem, you would find it impossible to follow the discussion there. One of those slang terms, used in jest, is “vertical accumulation” - describing very rapid price appreciation. Another slang term also used in jest is “sellside liquidity crisis” – describing a situation where a strong bid meets a thin offer. There is no supply available to be sold. While usually said in jest, what we’ve experienced with Bitcoin over the last several months has been a true “sellside liquidity crisis.” Allow me to explain what I mean.

HODL Waves

The below chart shows BTC price (black) and the percentage of all Bitcoin that has move in the last 180 days (purple). Currently 29% of all Bitcoin in existence has moved in the last six months.

Source: CoinMetrics & Ikigai. As of 11/30/20.

A few things to note here. First, 29% x 18.6mm = 5.4mm. So the circulating supply, if you wanted to define it as “BTC that’s moved in the last six months” is slightly over $100bn, rather than the ~$360bn headline market cap number. Second, note how low that 29% is relative to prior periods. The last time BTC price was $19.7k, 49% of all Bitcoin had moved in the last six months. Third, last month when BTC price was ~$11k right before rocketing higher, only 26% of all Bitcoin had moved in the last month. $11,000 x 18.6mm x 26% = $53bn. That’s smaller than the market cap of Sherwin Williams. Lastly, note that 26% was within a couple % of decade lows. Simply put, there was not much Bitcoin supply available to satisfy incremental demand. If you’re wondering whether there’s incremental demand to own Bitcoin, go back up and re-read the November Highlights. The makings of a “sellside liquidity crisis.”

The Halving

This one is pretty straightforward. For four years, ~1800 new Bitcoin were created per day. At the prior ATH in December 2017, that was ~$35mm of new Bitcoin per day. In May of this year, that 1800 was programmatically cut in half to ~900. Price at that time was ~$8.8k. So you went from $15.8mm of new supply per day to $7.9mm of new supply per day overnight. Now we’re back at $19.7k, but this time only $17.7mm of new Bitcoin are created per day. The makings of a “sellside liquidity crisis.”

Strong Hands & New Market Participants

Black Thursday was a massive shakeout. A stunning amount of Bitcoin changed hands sub-$5.5k on March 12-13 and in the days that followed. It takes conviction to buy when there’s blood in the streets. The monetary and fiscal policy actions taken in the spring of this year only served to strengthen that conviction. If you bought in March or simply didn’t sell, you believe in Bitcoin.

Bitcoin got a lot of new buyers in 2020. The anecdotal evidence of this was all around us. New investors into Ikigai and our peers. Ramping volumes on spot exchanges. Massive Square Bitcoin revenues. Famous investors publicly announcing Bitcoin positions. Enormous inflows into GBTC. Sure, some of those investors were there for a trade. But many others were playing for new ATHs and beyond, not a 20% flip. When the United States creates 22% of all the dollars *ever* created in 2020, your Bitcoin position has some staying power. The makings of a “sellside liquidity crisis.”

Michael Saylor and Market Makers

When the history books are written about all this, Michael Saylor is going have at least a couple pages, if not his own chapter. First, in late July he personally bought 17,732 Bitcoin at an average price of $9,882. Next, on August 11th he purchased 21,454 Bitcoin at an average price of ~$11,650. Finally, on September 14th he purchased 16,796 Bitcoin at an average price of ~$10,400. All in, in less than two months, Saylor purchased 55,982 Bitcoin at an average price of $10,722 for a total of just over $600mm. That’s an enormous supply shock in a very short period and he was able to get it done in secret and with surprisingly little price impact. Saylor says he’s holding “for 100 years”.

Market makers turn their Bitcoin supply over very rapidly, buying and selling small amounts of Bitcoin thousands of times every day. They use their spot Bitcoin supply as collateral to lever up and make markets on Bitcoin derivatives. Market makers can make 100 Bitcoin act like a 1,000 in the market. When you pull 55,982 Bitcoin away from their available stack of supply, it gets hard to keep making a market while keeping price flat. The makings of a “sellside liquidity crisis.”

Green Grass on the Chart

Technical analysis is a lot about support and resistance levels. Those levels are established based on historical price and volume patterns.

Source: TradingView. As of 12/1/20.

Even a novice trader can glance at the chart above and see once we broke $14k, there was nothing between there and ATH. If you had held through ALL that wild ride from $20k back down to $3k, up to $14k, back to $4k and finally back up to $14k, who’s selling before a new ATH? The makings of a “sellside liquidity crisis”.

BitMEX/OKex/Huobi – The Hamstrung Gambler

On October 1ˢᵗ, the CFTC and DoJ filed charges against BitMEX. BitMEX traders immediately began rapidly pulling Bitcoin off the exchange and Open Interest dropped heavily.

Source: Glassnode. As of 11/29/20.

On October 15ᵗʰ, Chinese authorities arrested the co-founder of OKex and all withdrawals from the exchange were suspended. OKex traders immediately began panicking. Internal transfers on the exchange remained open, and an OTC market opened up whereby traders were transferring their account balance for 80c on the dollar or even lower. OKex trading activity declined significantly as uncertainty hung in the air.

On November 2ⁿᵈ on the back of the OKex situation, rumors emerged that a Huobi co-founder was arrested by Chinese authorities. While Huobi denied the rumors and withdrawals from the exchange remained open, it was enough to spook Huobi traders, who began collectively pulling large quantities of Bitcoin off the exchange.

Source: Glassnode. As of 11/29/20.

In aggregate, BitMEX, OKex and Huobi accounted for over half of Bitcoin spot and derivatives trading volume. In a single month, all three exchanges experienced significant confidence-shaking events. These events not only caused Bitcoin supply on exchanges to plummet, but also contributed to a feeling of fear amongst Asian traders – the primary users of BitMEX, OKex and Huobi. These traders were left hamstrung, which left them pessimistic, which prevented them from levering long and blowing out derivatives funding to unsustainable levels, which usually leads to a pullback. In the meantime, on the other side of the Pacific, US traders were seeing PayPal, Druckenmiller, Bill Miller and many other strongly positive news events. So they bought. The makings of a “sellside liquidity crisis.”

GBTC

This is the big one, in my opinion. The Grayscale Bitcoin Investment Trust is a publicly traded vehicle that issues tradeable shares based on the amount of Bitcoin held in the trust. GBTC has been around for years but has exploded in popularity recently. The trust has a Net Asset Value (NAV) which is the amount of Bitcoin held per share issued. GBTC trades at a premium to NAV. This premium has averaged nearly 20% over the last year.

Source: Ycharts. As of 11/30/20.

Here’s where it gets interesting. You give Grayscale money, say $1mm. The OTC desk Genesis then goes and sources $1mm of BTC in the open market. Grayscale issues you $1mm of shares in GBTC and puts the $1mm of Bitcoin into the trust. Those shares are issued to you at NAV. You’re restricted from selling the shares for six months, at which time they become freely tradeable. Assuming the premium is 20% when you come off restriction, you can sell GBTC and pocket the 20% “for free”. This has been dubbed the “GBTC NAV trade”.

Here’s where it gets more interesting. You can also contribute “in-kind”. So instead of giving $1mm, you give a $1mm of Bitcoin and Grayscale issues you $1mm of GBTC shares at NAV. You can even borrow the Bitcoin that you give to Grayscale, then post the GBTC shares as collateral against the BTC borrow….lol.

Here’s where it gets even more interesting. Once the Bitcoin goes into the trust, it never comes out again. There is no mechanism for redeeming the Bitcoin back out of the trust. A black hole of spot Bitcoin supply.

Source: bybt. As of 11/30/20.

This trade is getting really, really popular. How popular? Well since September 21ˢᵗ, Grayscale has shoved 103,129 Bitcoin into the GBTC spot Black Hole. That’s 1.6x the entire mining supply over that time.

THE MAKINGS OF A SELLSIDE LIQUIDITY CRISIS.

Market Update – Liquid Crypto Asset Investing

| Symbol | November | October | Q3-20 | Q2-20 | Q1-20 | YTD | 2019 | % ATH |

|---|---|---|---|---|---|---|---|---|

| BTC | 42% | 28% | 18% | 42% | -11% | 173% | 92% | -2% |

| ETH | 59% | 7% | 59% | 69% | 3% | 374% | -3% | -57% |

| XRP | 177% | -1% | 38% | 1% | -10% | 244% | -45% | -82% |

| BCH* | 14% | 7% | 5% | -1% | 26% | 58% | 30% | -89% |

| EOS | 29% | -2% | 9% | 6% | -14% | 26% | 0% | -86% |

| BNB | 10% | -3% | 90% | 22% | -8% | 129% | 123% | -19% |

| XTZ | 25% | -10% | -7% | 46% | 20% | 84% | 192% | -36% |

| XLM | 160% | 4% | 12% | 64% | -10% | 347% | -60% | -78% |

| LTC | 58% | 20% | 12% | 6% | -5% | 112% | 36% | -77% |

| TRX | 25% | -2% | 61% | 41% | -13% | 143% | -29% | -88% |

| Aggregate Mkt Cap | 46% | 16% | 32% | 44% | -5% | 206% | 51% | -30% |

| Aggr Alts Mkt Cap | 50% | 1% | 58% | 45% | 4% | 262% | -1% | -60% |

Source: CoinMarketCap. As of 11/30/20. BCH includes SV.

Last month, we discussed Bitcoin’s decoupling from “it’s all one trade”. It gives me great pleasure to announce “it’s all one trade” is now over. Note Bitcoin (orange) blew out so bad that if I scaled the chart to include the top of the line, the rest of it wouldn’t make sense.

Source: TradingView. As of 12/1/20.

To give a bit cleaner and zoomed out look, BTC (orange), SPX (red), DXY (green, inverted) and Gold (yellow).

Source: TradingView. As of 12/1/20.

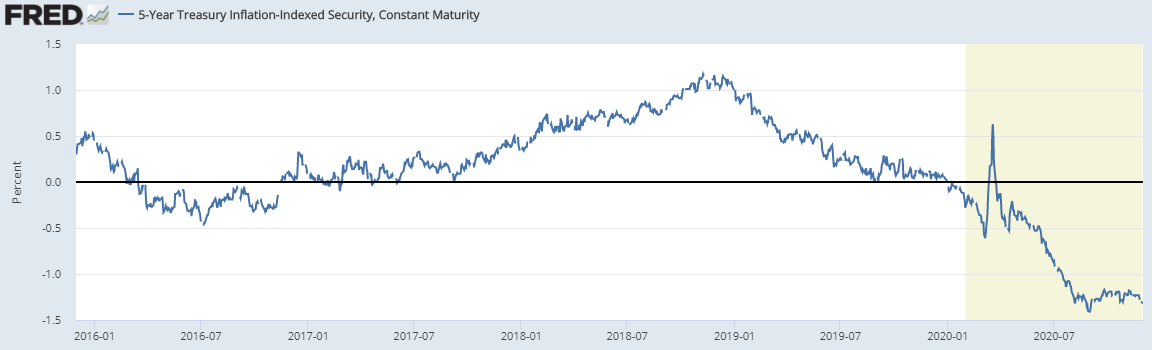

It’s impossible to look at this chart and not think the election was a significant catalyst to ending “it’s all one trade”. We discussed that possibility here in prior months. The SPX also unequivocally loves the vaccine. The weakness in gold is most likely attributable to flows. Gold got highly overbought on an “end of the world” scenario that’s not playing out just yet. And why buy an old rock when the Russell 2000 is going absolutely bananas? Although with real yields at these levels, my guess is gold will find a bottom sooner rather than later.

Source: FRED. As of 11/30/20.

In any case, we can thank ridiculously positive news flow and the “sellside liquidity crisis” for BTC’s rocket ship price action over the last two months. We’ve spoke about reflexivity here many times in the past. As a refresher, I invite you to read this monthly from April 2019. Reflexivity coupled with the “sellside liquidity crisis” makes for a potent combination, and it doesn’t appear to be done here. If you thought it was a green grass from $14k to $20k, then it’s Dixie Chicks-style “wide open spaces” above $20k.

How do we think about the path upward from there? It’s an inexact science at best. We also don’t run Ikigai with price targets like that in mind. With our fund’s exposure, we will be taking it level by level. But it’s at least worth considering some different projections.

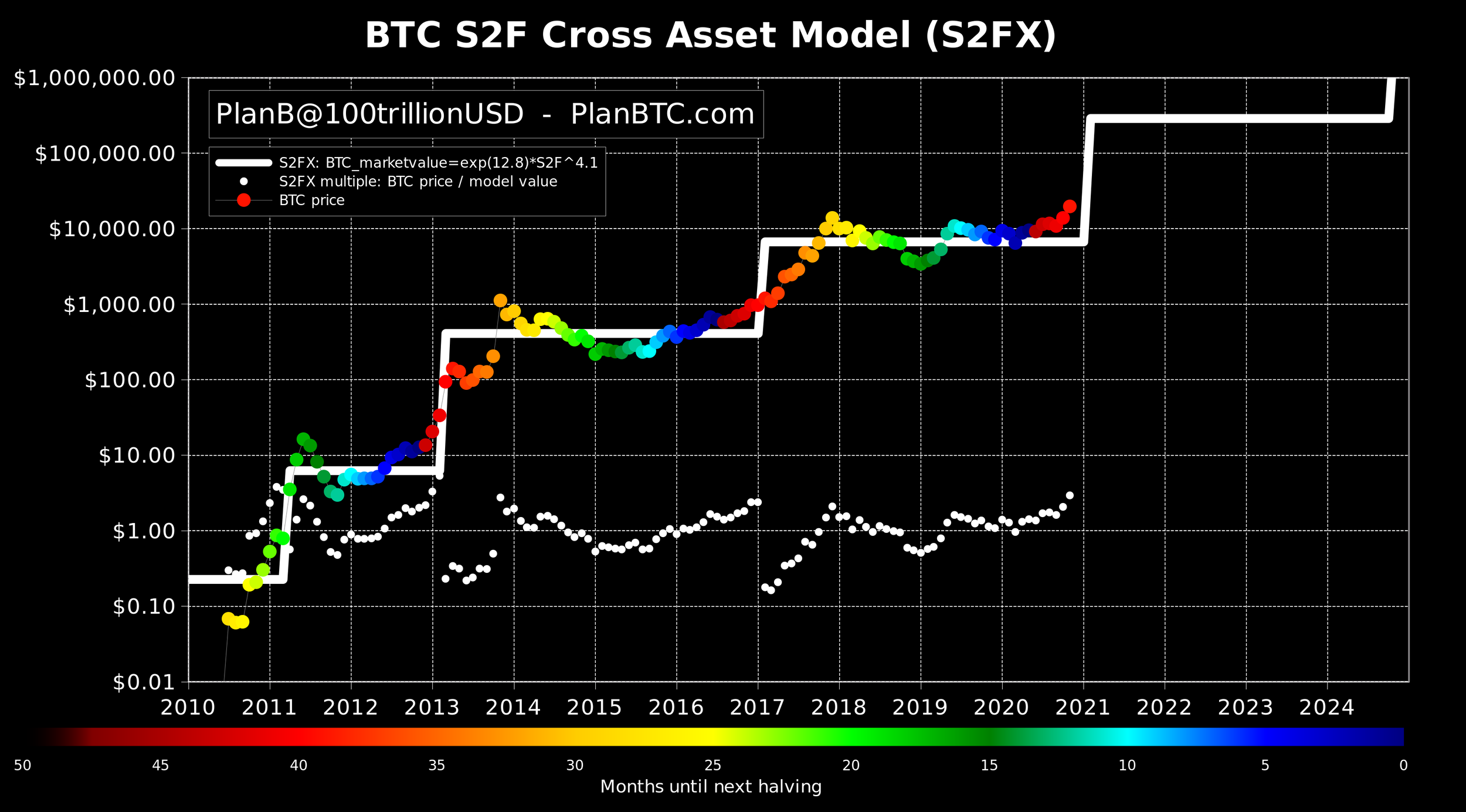

Stock-to-Flow says $100k by YE 2021.

Source: PlanB@100trillionusd

Willy Woo’s proprietary “Top Model” is calling for $200k by YE 2021 and potentially higher.

Source: @woonomic. As of 11/30/20.

Net Unrealized Profit/Loss predicts this cycle will top at $133k-$590k.

Source: @n3ocortex & Glassnode. As of 11/30/20.

$270k based on Fib extensions.

Source: @Pladizow. As of 12/1/20.

Fib channels give you $250k.

Source: @Pladizow. As of 12/1/20.

Fib circles give you $220k.

Source: @Pladizow. As of 12/1/20.

At time of writing, we have pulled back a few % from ATH and are consolidating around the $19k range. We are highly overbought on high timeframes at the moment, but guess what? We were overbought in 2017 too and BTC did a 13x.

Source: TradingView. As of 12/1/20.

Despite that overall run in 2017, BTC price action produced plenty of pullbacks along the way. Big ones. We tried to do a mini version of that over Thanksgiving last week and by now, we know exactly how that turned out.

Source: TradingView. As of 11/26/20.

It is not my base case that 2021 will produce six pullbacks of >25% and four of >35%. It’s just a drastically different market than 2017 in pretty much every way. Bitcoin’s realized volatility has been declining significantly over the last several years and its my expectation that will continue into 2021 and beyond. Is 17% the new 34%? That actually makes good sense to me. I have no doubt BTC will do at least one or two ugly down moves in 2021. It always does. It’s our job to figure those out. We’ve been pretty good at it for over a year. We have good reason to believe we’ll continue being good at it.

As long as the “sellside liquidity crisis” market structure is in play, deep, long pullbacks are likely going to be tough to come by. Instead, we’ll have a series of “Ape Cleansers”. Apes are traders that use too much leverage and haphazard capital deployment. Apes buy too many derivatives too aggressively, spiking OI and blowing out funding. We call this activity “apeing”. These apes deserve to have their capital separated from them until they can learn prudent risk management. On the Thanksgiving dump, we liquidated $900mm of BTC longs. That’s an Ape Cleansing.

Source: Coinalyze.net.

Source: Coinalyze.net.

>$1.1bn of OI was wiped out on the down move, and then we subsequently made a new high a few days later on $900mm less of total OI. That’s an Ape Cleanser and it’s healthy.

Source: Coinalyze.net.

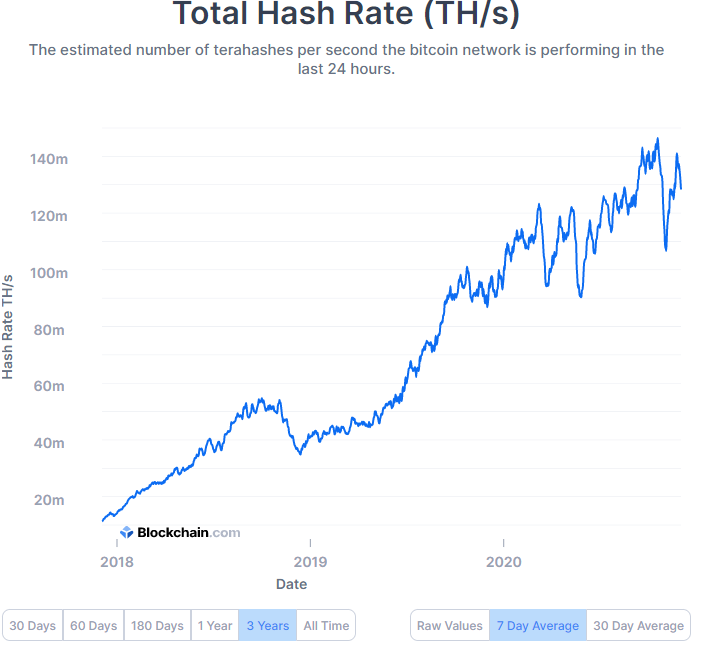

Checking in with hash rate, we saw a big bounce after the end of rainy season in mainland China. This is a healthy and secure network.

Source: Blockchain.com. As of 12.1.20.

Dominance rallied hard the first three weeks of November before topping out 67 and pulling back several points as large-cap Alts ran up the last week of the month. Go back and take a look at the table at the beginning of this section. While BTC was +42% in November, ETH was +59%, XRP +177% and XLM +160%. Those are absurd numbers for XRP and XLM. XLM is worthless. XRP likely is too. Never underestimate the ability for worthless Alts to rally hard for no reason. You’d love some of these Alts outside of ETH to actually get a story around them. Not holding my breath there though.

Source: TradingView. As of 12.1.20.

For months now, we’ve been touching on DeFi here. First in the summertime as the yield farming mania reached a fever pitch and then in September and October as they collapsed. Well, the death of DeFi appears to have been greatly exaggerated. After pulling back more than 50% from the highs over two months, the DeFi index rallied more than 60% off the lows in November.

Source: TradingView. As of 12.1.20.

To drill down a bit further, there was massive dispersion amongst DeFi names in November. Some lagged BTC by a lot. Many were massive outperformers. The performance dispersion appears to be driven be perceived “quality”. This is worth watching closely.

Source: @zhusu. As of 11.30.20.

Closing Remarks

We stand at the dawn of a new day. A three-year round trip of $19.7k. Bitcoin is +173% YTD and up 400% off the Black Thursday low. The journey has been paved with potholes. Exhilarating ups and crushing downs. In some ways, the progress over the last three years has been disappointing. I still consider crypto a 1 ½ asset asset class (I think ETH is about half an asset). The use cases that have materialized for Distributed Ledger Technology outside of money, and specifically store of value, remain nebulous at best.

To unpack that a bit more, I want be clear – we’re not Bitcoin maximalists. None of this has been done before. We’re in entirely uncharted territory with this new technology and new asset class. So if you’re building a firm, a culture, and an investment engine without prudent flexibility, adaptability, and growth as pillars, you’re eventually going to fail.

We’re not married to Bitcoin. That may make some of you reading this upset, but it’s the truth. Bitcoin could very well be Ask Jeeves and we haven’t seen Google yet. But Bitcoin has presented us with quantitative data and a market structure that we can extract meaningful alpha from right now through our Programmatic Discretionary strategy. If/when that changes, our investment process will allow us to see that early and we’ll adapt along with the new market opportunity.

The benefit of having greater than 99% of our portfolio in liquid crypto assets is we can change our mind at a moment’s notice. In a world as dynamic as this one, we want to be able to change our mind quickly.

So while much uncertainty remains, as it relates to Bitcoin, the asset class and technology have come so far. Infrastructure has made great strides. Regulation is generally favorable (although not without risk). Price manipulation on unregulated exchanges has diminished. Price discovery on regulated exchanges has grown. Bitcoin is championed as a superior store of value by some of the most successful and well-respected investors of all-time. The investment case for Bitcoin has become so compelling that Wall Street is running to it droves.

That investment case is as an insurance policy against monetary and fiscal policy irresponsibility from central banks and governments globally. Make no mistake about it, Bitcoin is here because of what these entities are doing with their fiat currencies. Covid-19 served as The Great Accelerator in many respects. None so apparent, or so important as the manner and degree to which it pushed governments further off into the abyss with their money. There is no turning back. Bitcoin stands as the best alternative we have. I believed that three years ago. My conviction has grown significantly since then. It appears others are beginning to feel the same way.

“We learn little from victory, much from defeat”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2020 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS