February 2 - Monthly Market Update

/Monthly Update || February 2026

“I like to be very patient and then when I see something, go a little bit crazy.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our eighty-ninth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, January was a really crazy month. Kinda crazy in crypto. But honestly more crazy in macro events, geopolitical, etc. As I sit down to write this, I am now realizing how LONG January has felt. Maduro was captured January 3rd! That feels like three months ago to me, just because of everything else that has happened since then.

So you can see the crypto-specific highlights in their usual bullet points further below. And there are some significant ones. But before that I’ll just do a list here of the big non-crypto events that happened in January –

Kevin Warsh nominated for Fed Chair (Druck mentioned in fourth line of the announcement tweet)

Gold and Silver spike and partially collapse on last day of the month (one of the largest single day declines ever)

Maduro is captured in VZ by Delta Force (a historic show of force)

Trump gave a speech at Davos (it may end up being famous)

Enormous Somali fraud found in Minnesota (NY and CA next and it will be massive)

Minnesota ICE shooting (likely justified but still obviously not good)

War with Iran may start any minute (Feb 28 is trading 51c on Polymarket; Trump demands regime change)

President Xi experiences some kind of attempted internal coup, two of his top officials were “purged” (hard to tell how serious this is, at least so far)

A huge amount of Epstein files were released, implicating dozens of well-known people (here is a 1,000 word Grok summary as of Sat afternoon)

Trump and other senior admin made very real statements about buying or somehow taking over Greenland (Trump will likely settle somewhere in the middle, imagine that)

The FBI raided Fulton County Election Office over 2020 election fraud (there’s a good chance they will prove Trump won Georgia)

Trump and other senior admin making credible threats of regime change in Cuba (seems like there’s a real chance this happens, Monroe Doctrine 2.0)

SCOTUS continues to decline to rule on tariffs, timing on ruling unclear (could be weeks, could be months)

US withdraws from the World Health Organization (US not doing favors for free anymore)

Yeah that’s a lot. Not all of it was immediately market-moving, although some was (we will dive into Warsh and Druck in more detail below). There were VERY significant geopolitical events that happened. All of it can be described as Monroe Doctrine 2.0, or as some have come to call it, “The Donroe Doctrine”. Lmao.

But it is serious and has major implications that could significantly reorient the entire planet. You should watch Trump’s Davos speech. You can skip the intro and the Q&A at the end. His “prepared” remarks last an hour. Watch it. The Trump admin is attempting to reorient the world’s relationship with the United States. A lot of it he can do without controlling both houses, so he has another few years to make progress on this Donroe Doctrine. And if R’s win in 28 (they could run Rubio/Vance) that will be a continuation of this expression of MAGA.

And then there were more cultural events that nevertheless had a profound impact on many people’s psyche. The Minnesota ICE shooting was certainly one of those. The Epstein files were significant. The Minnesota Somali fraud was significant, and what’s probably coming in other states will be even more significant. The Fulton County FBI raid could end up being enormously significant.

That list is too extensive, too diverse, and too new to do a full-blown synthesis and conclusion of it all. I just wanted to lay it all out there for you so you can appreciate the quantity and scale. Some of these will likely be central topics for months or years to come.

January Highlights

Senior UAE Royalty Secretly Purchased 49% of Trump’s WLFI Project for $500mm, Four Days Before Inauguration

CLARITY Act Makes It Out of Senate Ag Committee By 12-11 Partisan Vote, Negotiations Ongoing

Chris Wood, Head of Jefferies Global Equity Strategy, Removes BTC From Model Due To Quantum Risks

MSTR Buy $3.8bn in Four Tranches

BTC ETFs See $1.6bn of Outflows, ETH ETFs See $342mm of Outflows

Changpeng Zhao Receives Massive Backlash for 10/10 Market Crash

NYSE Announces Plan To Tokenize Equities Trading, Blockchain and Timing Unclear

Zcash Core Dev Team Resigns Over Governance

CFTC Chair Selig Announces Overhaul and Modernization of CFTC

Tether Launches US Complaint Stablecoin “USAT”

Ondo Finance Launches Tokenized Equity Trading of 200 Names on Solana

BitGo Goes Public, Raises $213mm at $2bn Valuation, Collapses 40% From Opening Price

Onchain Tokenization Platform “Superstate” Raises $83mm Series B, Led By Bain and Distributed Global

Dragonfly Leads $75mm Round Into Crypto Payments App “Mesh” at $1bn Valuation

RobinHood Invests In Crypto Trading Platform “Talos” at $1.5bn Valuation

Fidelity To Launch “FIDD” Stablecoin on Ethereum

Trump Crypto Project “World Liberty” Applies For Banking Charter

Standard Charter To Launch Crypto Prime Brokerage

SEC Clarifies Rules On Tokenized Securities

SEC Dismisses Lawsuit Against Gemini

| Asset Class | Jan | Q4-25 | Q3-25 | Q2-25 | Q1-25 | 2025 | 2024 | 2023 | Instrument |

|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -10% | -23% | 6% | 30% | -12% | -6% | 121% | 155% | BTC |

| NASDAQ | 1% | 2% | 9% | 18% | -8% | 20% | 25% | 54% | QQQ |

| S&P 500 | 1% | 2% | 8% | 11% | -5% | 16% | 23% | 24% | SPX |

| Total World Equities | 3% | 2% | 8% | 10% | -1% | 20% | 14% | 19% | VT |

| Emerging Market Equity | 8% | 2% | 11% | 10% | 4% | 31% | 4% | 6% | EEM |

| Gold | 12% | 11% | 16% | 6% | 19% | 64% | 27% | 13% | GLD |

| High Yield | 1% | -1% | 0% | 3% | 0% | 3% | 2% | 5% | HYG |

| Emerging Market Debt | 0% | 1% | 3% | 2% | 2% | 8% | 0% | 5% | EMB |

| Bank Debt | -1% | 0% | 0% | 1% | -2% | 0% | -1% | 3% | BKLN |

| Industrial Metals | 5% | 12% | 4% | 3% | 2% | 22% | 3% | -6% | DBB |

| USD | -1% | 0% | 1% | -7% | -4% | -9% | 7% | -2% | DXY |

| Volatility Index | 17% | -8% | -4% | -24% | 28% | -14% | 39% | -43% | VIX |

| Oil | 15% | -6% | 1% | -5% | 2% | -8% | 13% | -5% | USO |

SOURCE: TRADING VIEW. AS OF 1/31/26.

Druck Is in Charge of the Global Economy

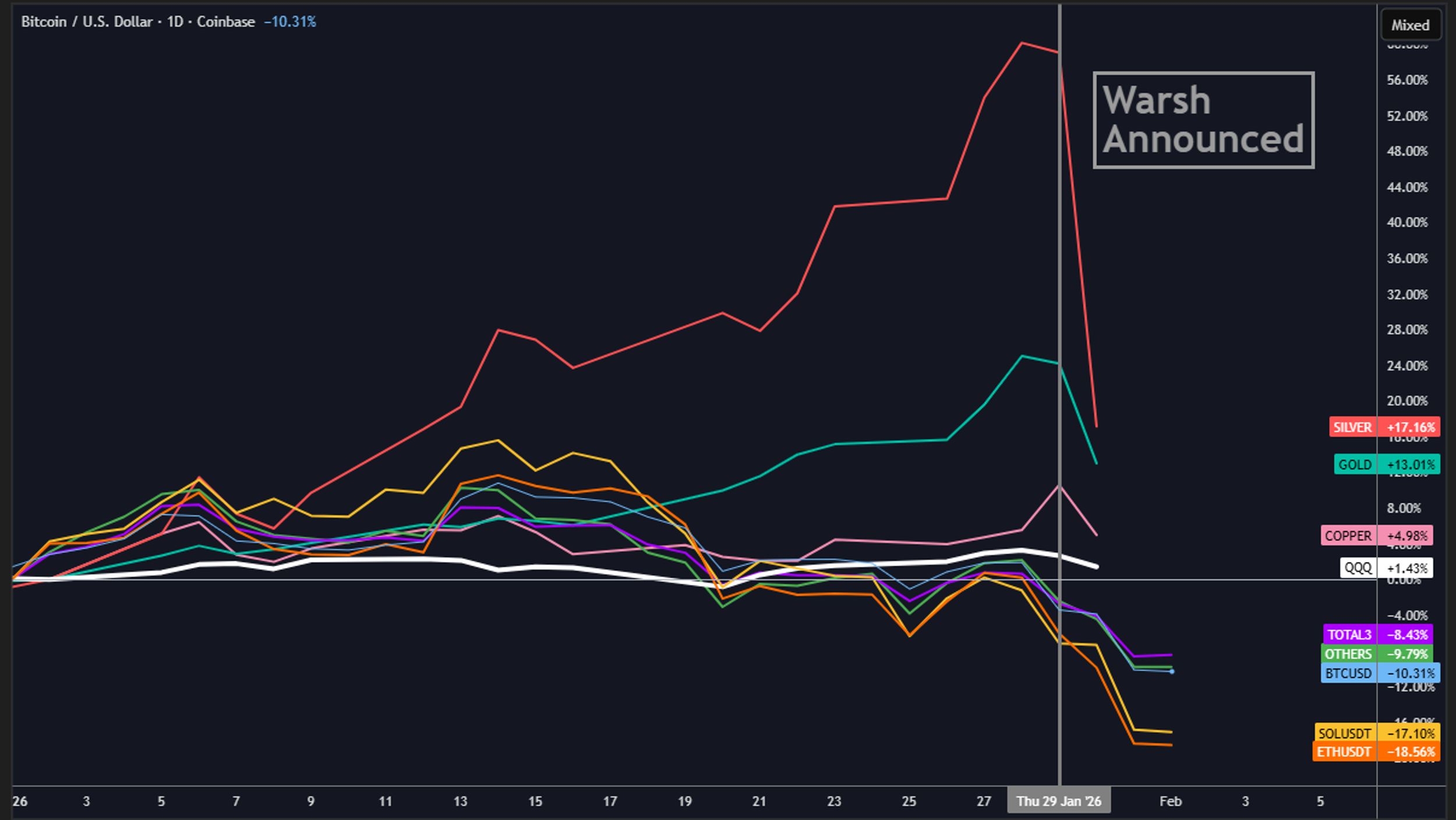

Gold and silver had quite the run in January, punctuated by quite the collapse on the last trading day of the month, which happened to be the day Kevin Warsh was announced as Trump’s Fed Chair nominee, which happened to be at least somewhat of a surprise to markets.

Below is YTD returns, focus on the metals for now (we’ll cover crypto later) –

Source: TradingView. As of 1/31/26.

Silver was down 26% on Friday. That’s the worst single day silver performance in 100 years. Gold was down 10%. Worst since 1983.

Now granted, both silver and gold had run HARD in Jan up to that point. Silver was +60% on the money at the peak. Gold +25%. They both still had very strong monthly performances.

Now, this Fed Chair race. This thing was moving around a lot. On December 2nd, Kevin Hassett was trading 85c –

source: PolyMarket. As of 1/31/26.

Below is the graph of Kevin Warsh. He was trading 27c the DAY before he was announced –

Source: PolyMarket. As of 1/31/26.

Which is to say, we got a pretty decent sized surprise on our hands with the Warsh pick. When it got leaked Thurs night, my first reaction was – “well this had to of been approved by Bessent”. Trump loves Bessent. He likely had significant influence over who would be the next Fed Chair.

And while silver and gold were both down massively on Friday, they were also in the midst of blowoff tops and there were plenty of other reasons to think they were due for a major pullback any day. Equities took the news fine on Friday – SPX was -43bps. QQQ was -120bps. VIX closed 17.43. DXY was up 1%, which is a big move, but it was off of very oversold levels. Yields were mostly fine – front end a bit tighter and back end a bit wider but nothing crazy.

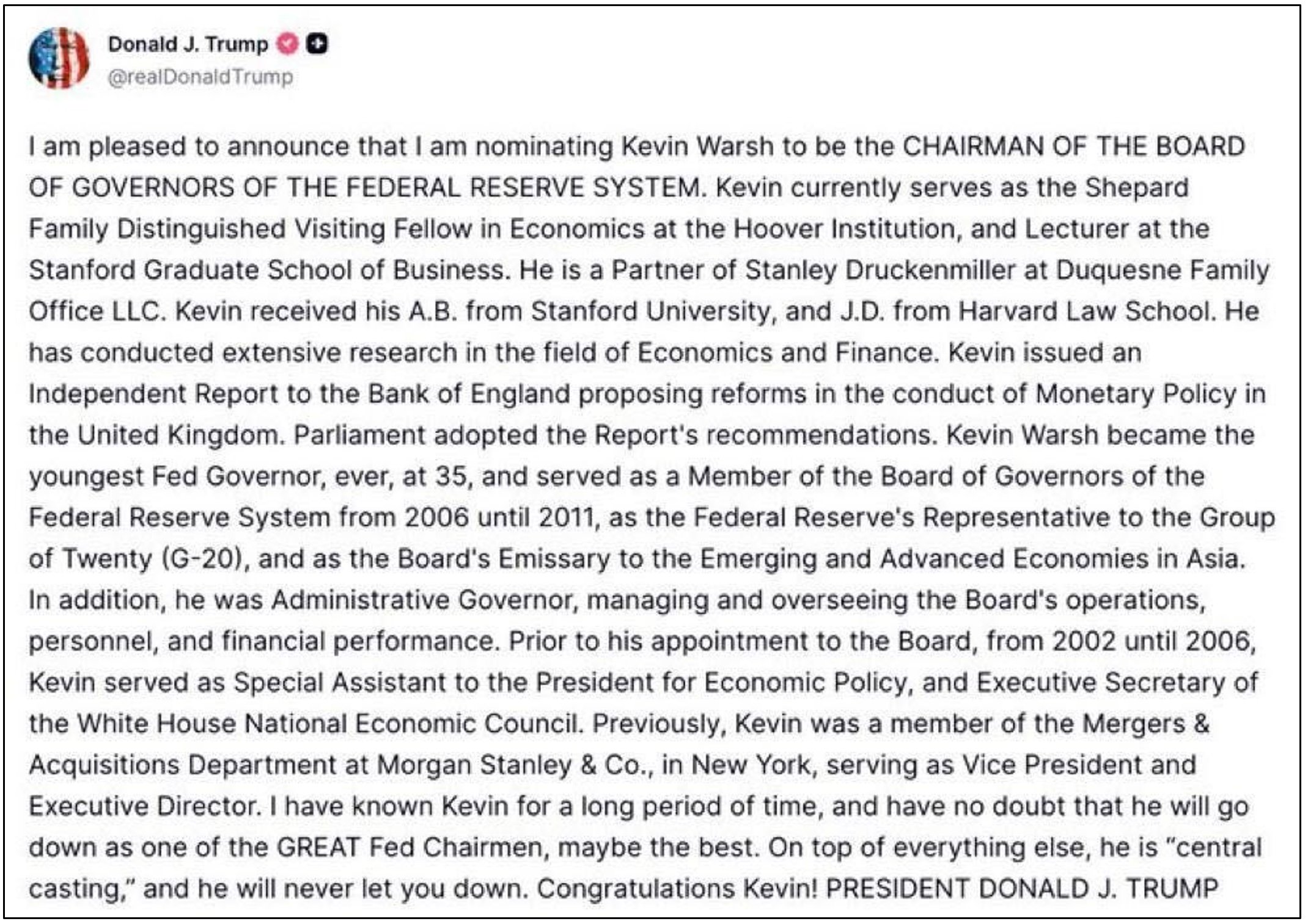

After the Warsh news leaked Thurs evening, the next morning Trump made the official announcement –

And after chewing on it for a while, I realized that Stanley Druckenmiller made it into the FOURTH LINE of this announcement about Warsh. Bessent is a Druck guy and Warsh is a Druck guy. We can expect the Treasury and Fed to work closely together as long as Bessent and Warsh are in their roles. And Druck is one of the most successful and well-respected macro investors of all time. So it seems like it’s a pretty safe bet to assume the Treasury and the Fed are going to kinda run about like how Druck would want to run them.

Some might say this is too great of a concentration of power into the Druck camp. My kneejerk reaction is that I can’t really think of someone I’d want to have this concentration of power more. Probably the best hands we can possibly be in. What might be in store for US and global financial markets with Druck one thin layer removed from running the Treasury and the Fed?

I won’t pretend to have really locked-in answers here. I don’t. I’ve long been an admirer of Druck, but I’m not like some acute expert on his way of thinking and the event just happened yesterday, so I haven’t read too many analyses that seem to totally nail what’s probably about to happen. But we can come up with at least some things, in part by tying in what we’ve heard from Bessent and what we’ve heard from Warsh. Let’s refer to Druck, Bessent and Warsh as the Three Amigos going forward.

The Three Amigos are generally against loose expansion of the Fed’s balance sheet. They think QE went on way too long after Covid and caused price distortions and wealth inequality. The Three Amigos are probably pretty serious about asset price appreciation causing huge wealth inequality and that wealth inequality causing societal problems. Bessent has been consistent in saying he wants to help Main Street, and I think the Warsh pick adds to that. The Three Amigos are going to want a Fed that is quicker to react in both directions. Warsh will likely cut rates multiple times this year. It is a misnomer to call Warsh a “hawk” – he just doesn’t want to use the Fed’s balance sheet so much. He wants the private sector to drive growth. The Three Amigos want to grow their way out of the government debt problem. Cut taxes, reshore, deregulate and grow fast. Let an AI productivity boom bail us out of the debt problem. The Three Amigos will have a less demand-side focus (QE, low rates, government outlays) and be more focused on supply side (boost productive capacity). They don’t want to needlessly expand the Fed’s balance sheet. They don’t want to pump asset prices without juicing the economy as well. The Three Amigos want banks to hold a lot more Treasuries, so the Fed can hold less. And they want less Treasuries issued in general.

So What?

I wish I had some super strong directional opinion to share on this… but I don’t. I get why silver and gold were down so much on Friday, because they had run crazy hard and directionally, the Warsh pick SHOULD be a move away from “the debasement trade”. And you could make the argument that less balance sheet expansion and money printing should mean lower asset prices in general. I get that. I think that’s a valid point.

But also, Trump def isn’t trying to crash asset prices. And the Three Amigos aren’t either. So getting super draconian about the direction of asset prices here doesn’t make a ton of sense. Perhaps this Warsh announcement gives us a few months of a breather after a pretty hot start to the year. I could see that.

But Trump and the Three Amigos are trying to GROW. They want to pump GDP every way possible. And it’s kinda hard to imagine the stock market going down by all that much if GDP is running 5%+ with low inflation. Much lower stock prices in that scenario would not be my kneejerk reaction.

Overall, it’s worth watching closely. I’ll be interested to see what all the Macro Talking Heads have to say about the Warsh announcement and what to expect going forward. This overall situation – how the Three Amigos plan on running the global economy, will likely be a headline deal in 2026. So more to come for sure.

Market Update— Liquid Crypto Asset Investing

| Jan | Q4-25 | Q3-25 | Q2-25 | Q1-25 | 2025 | 2024 | 2023 | |

|---|---|---|---|---|---|---|---|---|

| BTC | -10% | -23% | 6% | 30% | -12% | -6% | 121% | 155% |

| ETH | -18% | -28% | 67% | 36% | -45% | -11% | 46% | 91% |

| XRP | -11% | -35% | 27% | 7% | 0% | -12% | 238% | 81% |

| BCH* | -15% | 6% | 10% | 59% | -31% | 27% | 36% | 157% |

| EOS | -43% | -60% | -31% | -8% | -20% | -80% | -8% | -2% |

| BNB | -10% | -14% | 53% | 9% | -14% | 23% | 124% | 27% |

| XTZ | -6% | -26% | 24% | -18% | -49% | -61% | 28% | 39% |

| XLM | -10% | -44% | 51% | -10% | -20% | -39% | 157% | 81% |

| LTC | -23% | -28% | 24% | 4% | -19% | -26% | 42% | 4% |

| TRX | 1% | -15% | 19% | 17% | -6% | 12% | 136% | 98% |

| Aggregate Mkt Cap | -10% | -24% | 16% | 24% | -19% | -11% | 96% | 119% |

| Aggregate DeFi* | 10% | -37% | 40% | 20% | -19% | -15% | 50% | 132% |

| Aggr Alts Mkt Cap | -17% | -24% | 34% | 25% | -34% | -16% | 72% | 90% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 1/31/26. BCH INCLUDES SV.

Crypto prices crashed the last few days of January. After trading very poorly in Q4-25, many market participants were expecting a bounce in January, as year-end tax loss and fund redemption selling abated. We didn’t get that. BTC couldn’t even sniff $100k – it was rejected at $97k on 1/14 and then slid the rest of the month, with a significant acceleration occurring the last few days of the month.

So the current picture for BTC looks like this –

Source: TradingView. As of 2/1/26.

BTC is currently 38% off the top from early Oct and sitting exactly at the tariff fear lows from last April. This level is ~6ish% above prior cycle ATHs and about 12% above where BTC was trading immediately before the 2024 election. So those are the levels immediately under us currently.

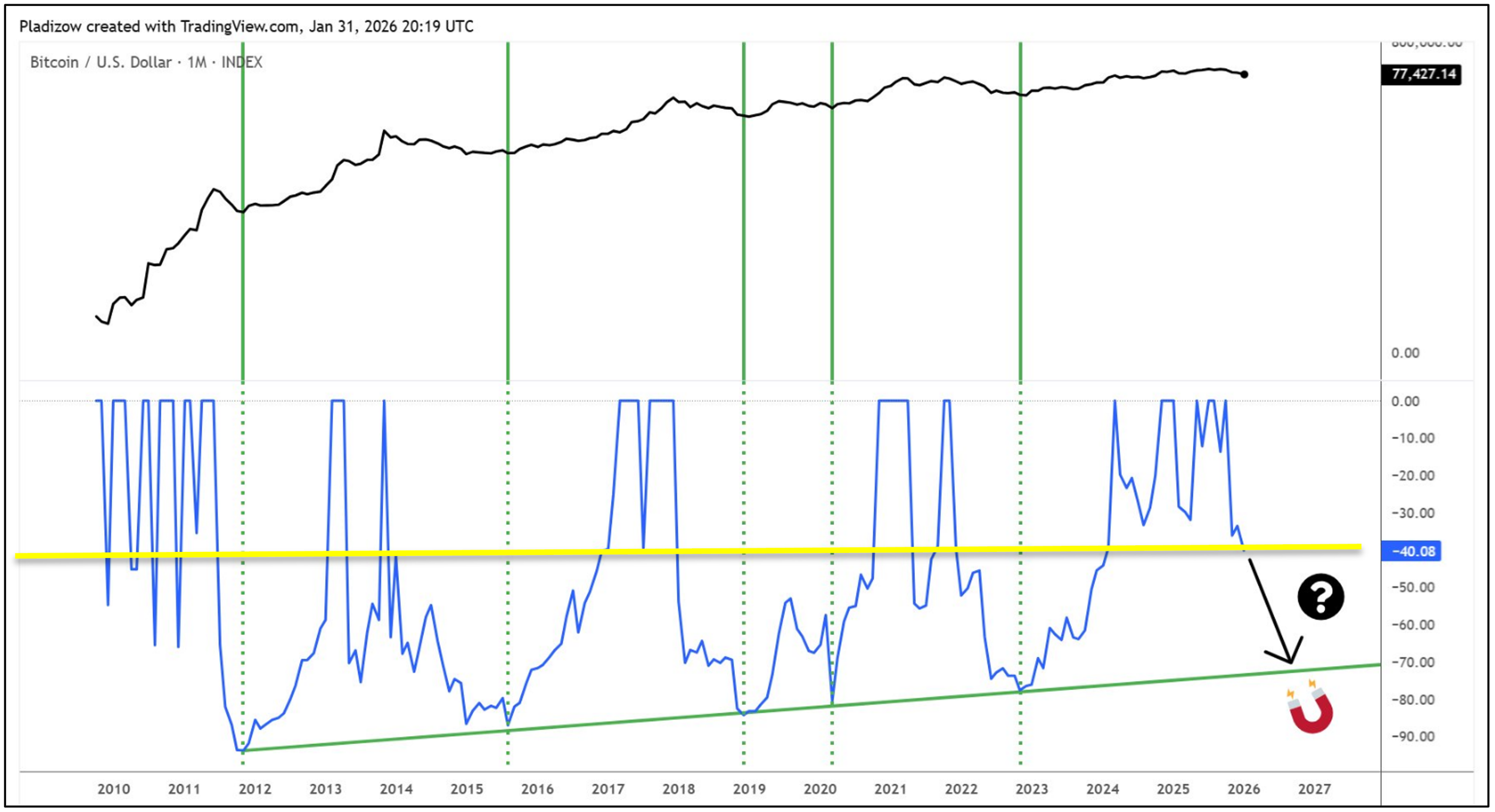

That 38% is now the deepest pullback we’ve had since the FTX collapse. And it is noteworthy that when BTC pulls back 38%, it usually goes down considerably more. This point is show below in blue –

In past monthly letters, I have expressed doubt about whether BTC would see the dramatic 75-85% drawdowns that we’ve seen every other cycle in BTC’s history. I have mentioned new types of market participants - deep-pocketed institutions, less leverage-driven retail madness. In recent letters, I have mentioned the quantum risk for BTC that has been getting increasingly more airtime. Well, after watching BTC trade this month and continuing to think about how this quantum risk for BTC might unfold, I think I need to readjust my expectations. I am no longer particularly confident that BTC won’t do another -75% off the top in the coming quarters (down 75% would be ~$31k).

BTC traded MUCH worse than I would have imagined in January and I think a very significant reason is the quantum risk, which is not being addressed at all by BTC Core Devs. In fact, a meaningful portion of BTC Core Devs apparently do not see quantum as a risk whatsoever. This is now a major problem for BTC’s price for calendar year 2026 and beyond. It is a problem today. It was a problem in Jan.

Watching how weak the price action was for BTC in Jan, I am reminded how “bidless” BTC can get. Enough institutions are now fearful of the quantum risk, that much of the dip buyers we thought would be there on BTC are probably not going to be there at all, or will be there much lower. Quantum risk is the perfect boogeyman – no one really understands it, but everyone understands it enough to be really scared of it. And it has the perfect nightmare scenario for the ultimate FUD – you wake up one morning, maybe a year from now, maybe a decade from now – and Satoshi’s coins have moved. And the price goes down 75% in a day. This is a VISCERAL FUD. And now it’s firmly in price action, and will likely remain in price action until Core Devs take concerted action towards a real solution. I am not confident this will occur in 2026 without much lower prices.

It is worth pointing out that BTC is quite oversold here. Weekly RSI show below-

Source: TradingView. As of 2/1/26.

The last time the weekly RSI was lower was when 3AC collapsed in June 2022. That period is circled in blue. Note that the weekly RSI chopped at these low levels from June – November 2022, punctuated by the collapse of FTX, which sent prices lower but also served as the cyclical bottom. Perhaps we have something similar play out in 2026, and whenever BTC Core Devs finally get their act together on quantum, we get a cyclical bottom.

Some have said that this quantum risk serves as an opportunity for ETH and SOL, which have cultures that promote regular protocol changes, and thus they are likely to address quantum risks much faster than BTC. In fact on Jan 23rd, the Ethereum Foundation formally elevated quantum risk to a top strategic priority. Additionally, on Dec 16th, the Solana Foundation announced a partnership with Project Eleven to address quantum risks head-on. Some have said this could lead to ETHBTC and SOLBTC outperforming in the coming months, as BTC protocol changes move at a glacial/nearly non-existent pace.

While it’s possible, I struggle to have significant ETHBTC and SOLBTC outperformance as my base case. If you’re worried enough about quantum risk for BTC that you’re selling BTC (or at least not buying dips), I’m not sure you’re going to shove those dollars into ETH or SOL. You’re probably going to put them somewhere outside of crypto entirely.

ETH in particular, at $283bn market cap, is also just not at all “cheap” in any traditional sense of the word. In fact, ETH could get cut in half from here, and be trading $140bn, and still would not be cheap by any stretch.

ETHBTC looks vulnerable to me here –

Source: TradingView. As of 2/1/26.

SOLBTC also looks vulnerable to me –

Source: TradingView. As of 2/1/26.

Neither of these charts look like they’re at cyclical bottoms to me right now. They’re both pretty oversold at the moment, so maybe we get some kind of neat-term bounce. But I doubt the lows are in here. Both frankly look like they could go retest prior cycle lows, which is down 40-50% from current levels. If that occurs WHILE BTC price is also going down, you are looking at MUCH lower prices for ETH and SOL.

I’m not going to spend any more time here today discussing other cryptos. There is no bidder for any of this stuff and many, many sellers that want out. Below is a chart of the top cryptos with YTD and 1Y performance. For the most part, it’s been a bad month and a bad year. I think it gets worse before it gets better.

Source: TradingView. As of 2/1/26.

Closing Remarks

A massive month for global current events and a painful month for crypto. That’s what we got in January. Crypto sentiment and overall activity levels were already quite washed out going into January, due to the painful year that was 2025. So, this really was kicking a man while he’s down. Unfortunately, it does not feel like the bottom here. I struggle to imagine a scenario where we don’t see lower crypto prices in 2026. Current prices have not declined enough from the top to draw in dip buyers to a significant enough degree that they overwhelm the selling that is occurring and will continue to occur.

The crypto ecosystem continues to march onwards towards a scenario I have been discussing for years here – the slow, painful, grind down, washout of an industry overrun with overvalued scams, grift, vaporware and solutions looking for problems. Eventually, if you get enough of a washout in terms of time, price and market participants, crypto will find firmer footing. That might be in 2028, and it might be at an aggregate market cap of ¼ the current size, but eventually you would get an industry that is less fugazi, less of a mirage. This would be a good thing. Painful in the interim, but directionally a good thing.

As for BTC, for years I have thought about and talked about BTC as being separate from all this, but now BTC has a quantum problem that is as big of a problem as any of these other cryptos face. BTC had product-market-fit as an alternative store of value, but quantum now calls that value proposition into question. IBIT has a $68bn AUM. FBTC has $17bn. That’s a lot of BTC that could come out. Now eventually, the quantum risk will likely be resolved. TBD on timing and how much pain will get in the interim, but eventually should get sorted out, and that will open the door to much higher prices, $200k and beyond. A move from $20k to $200k is a 10x! BTC might give you a shot at that in the years to come.

Wish I had better news for you, but I don’t. If you were looking to deploy additional capital into crypto in the near term, I’d wait for lower prices. I really doubt this thing runs away from you.

“Giving birth is easier than worrying about it.”

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS