May 2021 - Monthly Market Update

/Monthly Update || May 2021

“Prices are too high” is far from synonymous with “the next move will be downward.” Things can be overpriced and stay that way for a long time…or become far more so.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our thirty-second Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, the price of Bitcoin ended April slightly below where it started the month, after increasing 10% in the first part of the month, decreasing 27% off the top mid-month, and rallying strongly into month-end. The rest of the crypto market diverged from Bitcoin’s price performance to a degree not often seen. ETH was +44%. BNB +102%. SOL +126%. XRP +174%. DOGE +500%. In the month of April, BTC Dominance slid from 60% to 50% - a topic we will discuss in detail later.

In the meantime, the crypto industry continued to be the most rapidly advancing ecosystem on planet Earth. Check those Highlights below. If you’re not paying close attention for a few weeks or a month, you’ll miss out on step-changes in crypto. In a period of just a few quarters, Wall Street has gone from broadly shunning the asset class and technology to running at it as fast as those bureaucracy-laden institutions can move (which isn’t very fast, but still). They’re not just voting with their mouths either. Traditional financial institutions are voting with their wallets – pouring equity capital into crypto companies and launching new products to get their clients into crypto as well.

While BTC price stalled in the month of April, the advancement of the ecosystem around it accelerated. This bodes well for price in the coming quarters. There’s simply too much human and financial capital flowing into this space for the bull run we’ve been on to top out here, neither from a price nor time perspective.

The other critical part of all this is the macro overlay and specifically, what are US monetary and fiscal policies doing. As I have said many times, Bitcoin loves Quantitative Easing and detests Quantitative Tightening. It needs egregiously irresponsible monetary and fiscal policies to act as a forcing function on increasingly more capital to flow into this wacky magic internet money. And like all asset prices, it’s more about rate-of-change than the absolute levels.

As such, we are closely watching where monetary and fiscal policies are heading, and my current view is that all signs are a go for Bitcoin to continue heading higher. The Fed is still not thinking about thinking about tapering. Any upcoming increase in inflation on a Y/Y basis has already been deemed transitory due to easy comps, so the Fed will look through that. Labor market conditions are still a ways away from pre-Covid levels and the Fed and Treasury have both been clear that policies will remain exceedingly accommodative until the labor market sees sustained improvement.

I certainly don’t want to come off as callus towards this situation. Millions of people’s lives were upended by Covid and the government response to Covid. Families were torn apart. Over 575,000 Americans have lost their lives. It’s deeply saddening. I’m also not passing judgement here on the actions of our elected and appointed officials in response to Covid. That’s not the point I want to make.

The point is that those actions cause fluctuations in prices of every asset on the planet. Ikigai is an investment fund with a mandate to generate attractive risk-adjusted returns in the crypto asset class for our investors. As such, we spend a lot of time on Bitcoin. It is my assessment that Bitcoin price performance is closely intertwined with monetary and fiscal policies. It acts as a hedge against mistakes made in those policies. A Credit Default Swap on the outcomes of those policies. The current macro backdrop is one that is driving up the cost of that CDS and the world is paying close attention.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

April Highlights

Public Japanese Gaming Giant Nexon Purchases $100mm of Bitcoin on Balance Sheet

2nd Oldest U.S. Bank State Street with $3.2tn AUM to Start Trading Crypto

Former OCC Head Brian Brooks Named CEO of Binance US

Former CFTC Chair Chris Giancarlo Joins BlockFi’s Board of Directors

Venmo Launches Crypto Purchases

Goldman Prepares to Offer Crypto to Private Wealth Management Clients

Morgan Stanley Files to Add Bitcoin Exposure to a Dozen Institutional Funds

JPMorgan To Launch First Bitcoin Fund This Summer

$230bn AUM CI Global Asset Management Launches CI Bitcoin Fund

US Bank to Launch Crypto Custody

Wealthfront To Enable Crypto Purchases Later This Year

MicroStrategy Purchases $15mm BTC at $59,339, Total BTC Purchases 91,579 at $24,311 Average Price

TSLA Sells $272mm of Bitcoin

FinCEN Appoints Former Chainalysis CTO Michael Mosier As Director

Former Acting Director of CIA Michael Morell Publishes Independent Paper Strongly Supportive of Crypto

#1 NFL Draft Pick Trevor Lawrence Signs Deal with Blockfolio To Receive Bonus in BTC, ETH and SOL

Paxos Receives Federal Bank Charter From OCC

Paxos Raises $300mm at $2.4bn Valuation

NYDIG Raises $100mm (After Raising $200mm Last Month) From Liberty Mutual Insurance, Starr Insurance and Others

Consensys Raises $65mm From JPMorgan, Mastercard, UBS, Others

$445bn AUM Baillie Gifford Leads $100mm Investment in Blockchain.com

Rothschild Capital Management Takes Stake in Kraken

Alchemy Raises $80mm Series B Led by Coatue to Be AWS for Blockchain

RobinHood Announces 9.5mm Users Traded Crypto in Q1-21, Up From 1.7mm in Q4-20

Revolut Expands Crypto Offering By 11 Names, Now Totaling 21 Cryptos

Canada Launches Three ETH ETFs

European Investment Bank Sells EU100m Bonds on Ethereum Network

Ray Dalio Says of Bitcoin, “I like the diversification of this kind of asset. It should be party of any portfolio. It’s got merit.”

Goldman CEO States Bitcoin Is on Inevitable Path to a Higher Market Cap Than Gold

Gary Gensler Confirmed as SEC Chair

Brevin Howard Main Hedge Fund to Begin Buying Crypto

Dan Loeb’s Third Point Files as a Coinbase Custody Customer

Biden Administration Said to Be in The Early Stages of Developing Crypto Regulatory Framework

Congress Passes “the Eliminate Barriers to Innovation Act” to Establish SEC/CFTC Working Group on Digital Assets

Coinbase To Devote 10% of Resources to Innovation Bets

Gemini Now Supports Apple Pay and Google Pay

Tether Trading Pairs to Launch on Coinbase

Binance Launches Zero-Commission Tokenized Stock Trading

Coinbase Executes Direct Listing on NASDAQ, Trades Poorly

Turkey’s Central Bank Bans Citizens from Using Crypto for Purchases

62 Arrested In $2bn Fraud at Major Turkish Crypto Exchange Thodex

| Asset Class | April | Mar | Feb | Jan | YTD | Q4-20 | Q3-20 | Q2-20 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -2% | 31% | 36% | 14% | 103% | 169% | 18% | 42% | 303% | BTC |

| NASDAQ | 6% | 2% | 0% | 0% | 2% | 13% | 12% | 30% | 48% | QQQ |

| S&P 500 | 5% | 4% | 3% | -1% | 6% | 12% | 8% | 20% | 16% | SPX |

| Total World Equities | 3% | 3% | 3% | 0% | 5% | 15% | 8% | 19% | 14% | VT |

| Emerging Market Equity | 1% | 0% | 1% | 3% | 3% | 17% | 10% | 17% | 15% | EEM |

| Gold | 3% | -1% | -6% | -3% | -10% | 1% | 6% | 13% | 25% | GLD |

| High Yield | 1% | 1% | -1% | 0% | 0% | 4% | 3% | 6% | -1% | HYG |

| Emerging Market Debt | 2% | -1% | -3% | -2% | -6% | 5% | 2% | 13% | 1% | EMB |

| Bank Debt | 0% | 0% | 0% | 0% | -1% | 2% | 2% | 4% | -2% | BKLN |

| Industrial Materials | 8% | 0% | 11% | -2% | 8% | 14% | 11% | 10% | 16% | DBB |

| USD | -2% |

3% | 0% | 1% | 4% | -4% | -4% | -2% | -7% | DXY |

| Volatility Index | -4% |

-31% | -15% | 45% | -15% | -14% | -13% | -43% | 66% | VIX |

| Oil | 7% | -2% | 17% | 7% | 23% | 17% | 1% | -17% | -68% | USO |

Source: TradingView. As of 4/30/21.

Is The Biggest Risk Really That Big?

The question is constantly posed, “what are the biggest risks to crypto?” I get asked this all the time. It’s a question worth pondering. Many of us have a totally outsized bet in our portfolio on crypto. Maybe that bet wasn’t so outsized 6 or 12 months ago but now all of a sudden it really matters cause the value is exploding higher.

So if you’re trying to understand how that big bet might not work out in your favor, you spend time contemplating the likelihood of various negative scenarios playing out. I spend a lot of time thinking about these risks. As a result of that process, you end up ranking risks by thinking about expected downside price performance multiplied by the likelihood you think that risk might come to fruition. If a risk has a high likelihood of occurring but a small expected negative effect on price, you treat that differently than a risk that may have a low likelihood of occurring but a very bad outcome. The former you can recover from, the latter you might not.

The most-often talked about “tail” risk is “the US government will regulate or tax crypto into oblivion or even outright ban it.” An age-old risk to crypto. Present since the days of the Secret Service investigating Mt Gox. It makes sense why this scenario gets brought up so often because at some point Bitcoin gets big enough to challenge the US dollar hegemony and that’s the sort of thing the US government takes very seriously. The US government has previously put people in jail for creating non-sovereign digital money. If you pull the timeline back further, governments globally have been killing people and throwing people in jail over money for thousands of years. So, what WILL the US government do as crypto broadly and Bitcoin specifically continues to gain adoption and grow in market value? What CAN they do?

The Wolves

First, let’s establish crypto is already regulated. So it’s in no way a blank slate currently. Admittedly those regulations are somewhat piecemeal and leave holes and inconsistencies, but they’re in place. Yes, the US government could in theory take an aggressive step out from existing regulations – enacting such heavy-handed legal requirements to hold and use crypto so as to negate the use cases and value propositions of crypto entirely. The US government actually tried to take a step in this general direction in December 2020. There were rumors of a draft proposal for regulating self-hosted wallets that had onerous requirements in it. The pushback from the crypto industry and pro-innovation politicians was so forceful that the actual proposal that went public had most of the teeth taken out of it, and even THAT didn’t pass under the Trump administration. At time of writing, the FinCEN proposal is still in the review/comment period, and a number of organizations are pushing back against it. Even if this current proposal is enacted, it’s far from a death blow to crypto. In fact, it would likely make Bitcoin MORE ownable by institutions, not less - by clearing up any uncertainties about KYC/AML requirements and removing the risk that something much more heavy-handed would eventually be enacted.

If the US government is having trouble regulating crypto into oblivion, perhaps they could try to tax it into oblivion instead? Again, let’s establish that we’re in no way starting from a blank slate – there are existing rules in place for the US taxation of crypto. That said, we know the Biden administration is currently gearing up to try and increase taxes, although that proposal contains nothing specific to crypto taxes. Even then, Democrats control the Senate by the narrowest possible margin – a 50/50 tie with Vice President Harris as the tie breaker. So if a single Democrat doesn’t vote for any sort of tax increase, it won’t pass. At the moment, there are already heavy doubts that the current tax hike proposal will be passed. Judging by the recent performance of equities, the market doesn’t appear to be too worried about potential tax hikes either.

Source: TradingView. As of 5/1/21.

Let’s suppose the current slate of proposed tax increases is eventually passed, which would increase capital gains on the wealthiest Americans from 20% to 39.6%. This might have an outsized impact on crypto holders, as the recent massive bull run has created significant capital gains for many investors making over $1mm. But let’s think about that more deeply. Would this *actually* force holders of crypto to sell? If they sell now, those gains will be taxed at 20% instead of 39.6%. But if they ever buy again, they’ll be exposed to that higher tax regime. There currently exists a robust borrow/lending ecosystem to provide cash loans collateralized by crypto. Doesn’t it make more sense that many crypto holders sitting on large capital gains would just never realize those gains and instead borrow against the value of those assets? That is an undoubtedly a much more tax efficient approach.

There is an overarching theme present in the above scenario of Bitcoin as pristine collateral. Yes, the realized volatility of Bitcoin’s price is currently higher than many other assets. But over almost any medium-term timeframe, that volatility has been decidedly upward. And while the rates to borrow cash against Bitcoin may seem high in dollar-terms, they’re actually cheap in Bitcoin terms given the historical and expected appreciation of Bitcoin. In a world shifting its view on fiat currency and trending toward a non-sovereign store of value, 1) holding the hard asset; 2) borrowing against it to satisfy fiat needs; and 3) paying interest in fiat which is inherently getting inflated away anyway is a playbook that makes a ton of sense. Especially since that interest will get cheaper through time; even more so as we venture down the full-blow MMT route; which coincidently likely also leads to higher values in fiat terms of the hard asset you’re borrowing against… You see the point, right?

The current state of politics in the US lends serious doubts to the ability for politicians to enact ANY sort of tax increase, much less something specifically heavy-handed towards crypto. But what would that actually look like anyway? The most heavy-handed tax ruling against crypto that I’ve heard theorized, which is completely unfounded in any fact pattern, is the following – “the US government makes a ruling where every year all gains, whether realized or unrealized, are automatically taxed at ordinary income rates”. This represents a true black swan “tax this thing into oblivion” event. That feels nearly impossible to actually put in place, but if the whole of the US government decided to gang up on Bitcoin, perhaps that outcome could occur. What could shield us from such an unlikely but very bad outcome occurring?

The Shepherds

In America, the people with the power and the money makes the rules. You can hate that or love that, but that is the state of things here at the moment. The elected and appointed officials that run our country are humans. They have career histories. They have allegiances. They have personal networks. They go to country clubs. They have kids that go to school with kids of other parents. All of that makes up the web of influence that drives lawmaking and regulation. That’s literally how lobbying works. So to the extent the individuals with power and money also hold Bitcoin, that acts as a buffer against heavy-handed regulatory or taxation action. Shepherds, if you will.

Who might some of those shepherds be? Elon Musk. Stanley Druckenmiller. Paul Tudor Jones. Howard Marks. The Winklevoss Twins. Mike Novogratz. Bill Miller. Anthony Scaramucci. Jack Dorsey. Cathie Wood. Chamath Palihapitiya.

Those are just a sample of some well-known public proponents of Bitcoin. But let’s be honest. Take a look at this list. How many of these individuals do you think hold Bitcoin?

Source: Wikipedia.

There are 614 billionaires in America. Honestly, what percent own Bitcoin? 10%? 20%? A third? Half? Remember – billionaires mostly make the rules around here.

What about institutions? Institutions swing just as much if not more of a stick than ultrawealthy individuals. Banks. Asset management firms. Endowments. Pension funds. Big venture capital. Big tech. Insurance companies. Payments companies. These institutions make up the backbone of the American economy and American-held wealth. So what have then been up to crypto? Let’s talk a brief walk down memory lane-

October 2020

PayPal & Venmo Introduce Cryptocurrency Buying, Selling & Shopping

JPMorgan Launches Digital Asset Business Unit, Rumored to Buy Custodian

November 2020

Citigroup Research Publishes YE 2021 BTC Price Target as High as $318k

BTIG Research Publishes YE 2021 BTC Price Target of $50k

AllianceBernstein Recommends Allocation to Crypto

December 2020

MassMutual Buys $100mm of Bitcoin and Minority Stake in NYDIG

Guggenheim CIO Scott Minerd Says Bitcoin Fundamental Value Is $400,000

JPMorgan Says Gold Will Suffer for Years Because of Bitcoin

Fidelity Digital to Hold Bitcoin as Collateral for Cash Loans

Jefferies Head of Global Equity Strategy Cuts Gold Exposure for Bitcoin

SkyBridge Capital Registers Fund to Buy Bitcoin and Buys $182mm

January 2021

$7.8tn AUM BlackRock Files to Invest in Bitcoin Futures for Two Funds

Publicly-Traded Marathon Patent Group Purchases $150mm of Bitcoin on Balance Sheet

Osprey Funds Launches Trading on GBTC Competitor BTC Fund

February 2021

TSLA Buys $1.5bn of Bitcoin on Balance Sheet

BNY Melon to Custody Crypto

MasterCard to Enable Crypto Purchases for All Merchants

Deutsche Bank to Offer Crypto Custody and Prime Brokerage

BlackRock Begins Buying Bitcoin

March 2021

$4tn AUM Morgan Stanley Private Wealth Management to Offer NYDIG and Galaxy BTC Funds to Clients

NYDIG Raises $200mm From Morgan Stanley, New York Life, MassMutual, Soros

Visa to Enable Bitcoin Purchases at 70mm Merchants

Fireblocks Raises $133mm Series C from Coatue, Ribbit, BNY Mellon

Fidelity, Goldman, SkyBridge, NYDIG, VanEck, Valkyrie, WisdomTree and Bitwise All Have Current Bitcoin ETF Applications Pending

Visa Launches Pilot with Crypto.com to Settle USDC on Visa Network

PayPal Acquires Crypto Custodian Curve, Launches “Checkout with Crypto”

April 2021

2nd Oldest U.S. Bank State Street with $3.2tn AUM to Start Trading Crypto

Goldman Prepares to Offer Crypto to Private Wealth Management Clients

Morgan Stanley Files to Add Bitcoin Exposure to a Dozen Institutional Funds

$230bn AUM CI Global Asset Management Launches CI Bitcoin Fund

US Bank to Launch Crypto Custody

Wealthfront To Enable Crypto Purchases Later This Year

NYDIG Raises $100mm (After Raising $200mm Last Month) From Liberty Mutual Insurance, Starr Insurance and Others

Consensys Raises $65mm From JPMorgan, Mastercard, UBS, Others

A little stunning when you look at it all together like that, right? Keep in mind that was SEVEN months. We’ve come THAT far in THAT little amount of time.

Even if a few elected and appointed officials are enemies of crypto and would prefer to see it shut down, they must overcome their colleagues that are actual supporters of crypto. And if heavy-handed regulatory or taxation rulings were about to be enacted, wouldn’t those likely be preceded by incrementally negative rulings, not incrementally positive? So let’s take another walk down memory lane-

July 2020

Office of the Comptroller of the Currency Allowing Banks to Custody Crypto

August 2020

SEC Confirms “Crypto Mom” Hester Peirce As Commissioner Through 2025

September 2020

US State Bank Regulators Agree to Blanket Set of Rules for Money Transmitter Licenses

Kraken Wins Bank Charter in Wyoming, First Ever for Crypto Company

October 2020

CFTC Chairman Makes Highly Positive Public Remarks About Ethereum

US Attorney General Releases Cryptocurrency Enforcement Framework

US National Security Council Names DLT As One of Twenty Focus Areas

November 2020

Wyoming Elects Bitcoin Bull Cynthia Lummis As US Senator

Jay Clayton Steps Down as SEC Chairman

Alameda Research & FTX Founder Sam Bankman-Fried Donates $5mm To Biden Campaign

OCC’s Brian Brooks Testifies to Senate on Importance of Crypto

December 2020

Warren Davidson and Three Other Congressmen Write Public Letter to Mnuchin in Protest of Heavy-Handed Legislation

January 2021

Highly Crypto-Experienced Gary Gensler Named Chairman of the SEC

Crypto Custodian Anchorage Given First-Ever Federal Bank Charter

OCC Releases Guidance Allowing US Banks to Use Public Blockchains As Settlement Infrastructure

February 2021

Tether Settles Longstanding Case with NYAG for $18.5mm; Does Not Admit Wrongdoing; Agrees to Future Quarterly Audits of Reserves

Bitcoiner Cynthia Lummis Named to Senate Banking Committee

Miami Mayor Activates Bitcoin Across the City, Including Treasury, Employees, Taxes & Fees

March 2021

One River Adds Former SEC Chair Jay Clayton as Advisor

Jerome Powell Says Bitcoin Is More Like Gold Than the Dollar

Binance Adds Former US Senator and Ambassador to China Max Baucus as Advisor

CFTC Fines Coinbase $6.5mm for 2015-2018 False Reporting and Wash Trading

FATF Release Draft 2021 Crypto Guidance

April 2021

Former OCC Head Brian Brooks Named CEO of Binance US

Former CFTC Chair Chris Giancarlo Joins BlockFi’s Board of Directors

FinCEN Appoints Former Chainalysis CTO Michael Mosier As Director

Former Acting Director of CIA Michael Morell Publishes Independent Paper Strongly Supportive of Crypto

Paxos Receives Federal Bank Charter From OCC

Again, a little stunning when you look at it all together, right?

US Retail Investors

The US government knows it has a major wealth inequality problem on its hands. The wealthiest slice of Americans have been gaining increasingly more share of the pie for decades, and that has accelerated even more post-Covid. Crypto is the one area of investment where the little guy actually showed up before the institutions. The stats are clear. Coinbase has 56 million registered users. Coinbase traded $32 billion of retail volume in Q4-20, growing 78% from Q3-20. Coinbase had 6.1 million active users in Q1-21. RobinHood had 9.5mm active crypto users in Q1-21, up from 1.7mm in Q4-20. The Cash App had three million people make bitcoin transactions in 2020, and nearly one million people made their first bitcoin transactions in January 2021. Gemini commissioned a study showing 21.2mm Americans or 14% of the population own crypto.

This asset class has rapidly become an integral part of many millions of Americans’ portfolios, wealth and financial stability. What is the US government REALLY going to do? Torch all the rich people, the institutions and the little guy by somehow running over the politicians that would vehemently oppose those actions and overturning the existing regulatory and taxation framework? What’s the likelihood of that happening?

Regulatory Arbitrage

This factor has been an unsung hero in the battle against “the US government will somehow shut down crypto”. Many countries around the world come to crypto with open arms. Some are small countries with extremely friendly “investment passport” rules like Vanuatu, Malta, Georgia and Estonia. Others are larger countries that have enacted favorable crypto-specific tax rules and regulations including Portugal and financial powerhouse Singapore. Japan, while cautious, has been a long supporter of crypto and the Japanese are heavy crypto investors. A number of other developed nations – Sweden, Denmark, South Korea, Australia and New Zealand, to name a few, have outwardly positive stances toward crypto that are at least as friendly as the US if not more.

If the US government takes an adversarial stance towards crypto, will all that innovative human capital and hungry financial capital just give up and call it quits? How much of that capital will be willing to take action towards domiciling, legally or physically, in any number of more crypto friendly jurisdictions. How damaging would that be to the United States if and when crypto becomes ubiquitous?

Game Theory vs China

The final factor worth mentioning is how crypto broadly and BTC specifically fit into US-China relations. The two most dominant global superpowers by leaps and bounds, that relationship has been under increasingly more strain for years. Asia broadly and China specifically have been dominant in crypto for the majority of Bitcoin’s history. They own more. They trade more. They mine more. They drive market price fluctuations more.

For most of Bitcoin’s history including 2017, 2018 and 2019, it was mostly Asia’s world and America was just living in it. The United States has taken back control of Bitcoin in a major way over the last year. The significance of this shift cannot be overstated. There’s plenty of quantitative evidence of it occurring. Also, after the halving in May 2020, miners by definition have less influence over Bitcoin’s price because they hold less Bitcoin. That is to the detriment of China, where a majority of hash power resides.

A deep discussion of US-China relations is outside the scope of this Monthly Update and outside of my area of expertise but suffice it to say crypto broadly and Bitcoin specifically are at the heart of the matter. I believe this setup is a classical prisoner’s dilemma type of scenario. Both the United States and China would be better off if Bitcoin wasn’t a big deal. The dollar and the renminbi could just duke it out over the coming decades. But if Bitcoin becomes a big deal and your opponent has all of it and you have none of it, that’s a bad outcome for you. So it would seem the Schelling point would be for the two countries to compete for Bitcoin. To be clear, this is a very favorable outcome for Bitcoin. My assessment of the current landscape is that’s exactly what is happening. It certainly bears paying close attention.

The Risk-Adjusted Approach

Overall, I believe the situation is clearly one of declining, not accelerating, risk, even as Bitcoin’s threat towards the US dollar grows with its market cap. An investor of ours recently posed the question – “on a scale of 1 to 100, with 100 being Bitcoin is fully embraced as a store of value and reserve asset and the Fed holds it on its balance sheet and 1 being Bitcoin will imminently be made completely illegal or too onerous to own because of regulations or taxes…where were we a year ago and where are we today?” It’s a great question and in my opinion the right way to frame the situation. I think we’ve gone from 33% to 67% in a year. I just laid out the case for why I think that. I know plenty others who would say I’m being too conservative with 67% and it’s actually higher than that. Maybe they’re right. I tend to err on the side of caution.

Regardless, however you want to weigh the current likelihood of a heavy-handed regulatory or taxation ruling from the US government, you must weigh it meaningfully lower than you did a year ago. The body of evidence demands it. And that must make your target price for Bitcoin increase meaningfully. After all, if there were not any risks whatsoever this non-sovereign, hardcapped supply, global, immutable decentralized, digital store of value would be trade well over $1mm a coin. Don’t get spooked out of owning it now though. The fact pattern warrants the opposite.

Market Update – Liquid Crypto Asset Investing

| Symbol | April | March | February | January | YTD | Q4-20 | Q3-20 | Q2-20 | Q1-20 | 2020 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -2% | 31% | 36% | 14% | 99% | 169% | 18% | 42% | -11% | 303% | 92% |

| ETH | 45% | 36% | 8% | 78% | 276% | 105% | 59% | 69% | 3% | 469% | -3% |

| XRP | 177% | 39% | -16% | 124% | 623% | -9% | 38% | 1% | -10% | 14% | -45% |

| BCH* | 73% | 19% | 11% | 10% | 152% | 31% | 5% | -1% | 26% | 71% | 30% |

| EOS | 34% | 39% | 19% | 12% | 148% | 1% | 9% | 6% | -14% | 1% | 0% |

| BNB | 107% | 45% | 373% | 18% | 1570% | 27% | 90% | 22% | -8% | 172% | 123% |

| XTZ | 15% | 43% | 20% | 41% | 179% | -9% | -7% | 46% | 20% | 49% | 192% |

| XLM | 29% | 2% | 33% | 138% | 312% | 71% | 12% | 64% | -10% | 184% | -60% |

| LTC | 37% | 20% | 27% | 4% | 117% | 169% | 12% | 6% | -5% | 202% | 36% |

| TRX | 43% | 97% | 44% | 18% | 393% | 2% | 61% | 41% | -13% | 101% | -29% |

| Aggregate Mkt Cap | 17% | 36% | 39% | 29% | 188% | 122% | 32% | 44% | -5% | 301% | 51% |

| Aggregate DeFi* | 34% | 43% | 44% | 113% | 487% | 41% | 164% | 217% | 9% | 1177% | 77% |

| Aggr Alts Mkt Cap | 43% | 44% | 45% | 65% | 396% | 56% | 58% | 45% | 4% | 274% | -1% |

Source: CoinMarketCap. As of 4/30/21. BCH includes SV. Aggregate DeFi from Coingecko.

Pay close attention to that April column – most of the rest of this discussion is going to center around that situation.

ETH is on a real heater. Off the cyclical bottom in December 2018, ETH and BTC stayed somewhat close together for years, and just this month ETH took a big leap forward.

Source: TradingView. As of 5/1/21.

The ETHBTC chart is a different way to examine this.

Source: TradingView. As of 5/1/21.

I’ll spare the details but from a purely TA perspective this chart is bullish three different ways – 1) a breakout of the multiyear accumulation zone; 2) A Bump and Run Reversal (a crypto bull market Hall of Famer); and 3) A Livermore cylinder. That’s a potent combo. The most bullish TA scenario would be the following-

Source: TradingView. As of 5/1/21.

That would send ETHBTC to a new ATH and honestly would be the type of setup that would precede an eventual flipping. But TA is just lines on page right so who knows?

What would be the fundamental backdrop for such a bullish advance on ETHBTC? That should be clear by this point. We discussed it in last month’s letter. It’s incessantly talked about on Twitter, podcasts and crypto news coverage. EIP-1559. ETH is going deflationary! And less fees! And Layer 2 scaling! When it transitions to ETH 2.0 Proof of Stake it will be ESG friendly! DeFi forever!

Those are the narratives right now. They’re highly digestible narratives. Check the chart – the narratives are being digested extremely well. Crypto LOVES a good narrative. And Bitcoin has that pesky problem of being “too expensive” and everyone has “missed the trade”. It is my belief that ETH is currently attracting significant institutional capital that is purchasing crypto for the first time. I also believe ETH is pulling capital out of BTC that has never previously owned ETH. I believe this overall situation has more room to run, as does the chart. It remains to be seen whether the market’s enthusiasm for these improvements will outpace the implementation of said improvements. History would tell you that is likely to be the case, but “this time might be different”.

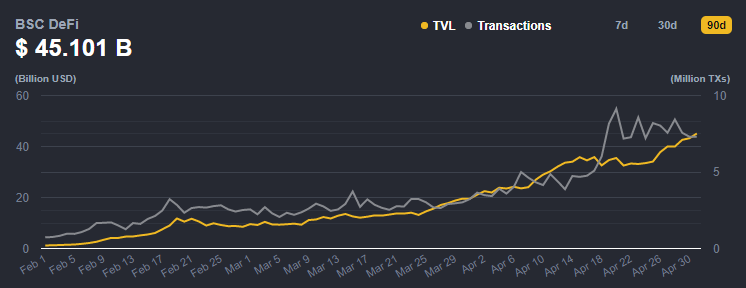

In any case, ETH has legitimate competition on its heels. Binance forked Ethereum and made Binance Smart Chain (BSC) which has 21 validator nodes and is generally viewed as being more or less a centralized database. BSC has grown it’s TVL from $1bn to $45bn in 90 days. Let that sink in.

Source: TradingView. As of 5/1/21.

ETH active wallets vs BSC active wallets looks like this.

Source: Twitter.com/Rewkang. As of 4/25/21.

Which has led to a BNB chart that looks like this-

Source: TradingView. As of 5/1/21.

BNB has *destroyed* BTC and ETH price performance YTD. Yet there remain questions about the legitimacy and quality of BSC DeFi activity. The Ponzi-nomics are out in full force there and the ape-ing is as strong as anything we saw in 2017. There are doubts about BSC scalability. There are naysayers who point out the highly centralized nature of BSC. Which brings up two of the most important questions when evaluating use cases of blockchain – What do you need decentralization for and how decentralized is decentralized enough? We’re seeing an experiment to answer those questions play out in real time.

The other primary entrant to this experiment is Solana. And SOL? Well it’s been the fastest horse of them all YTD.

Source: TradingView. As of 5/1/21.

Solana is a highly performant Proof of Stake blockchain. It takes a fundamentally different approach to verifying transactions than Ethereum. This allows it to process 50k transactions per second while still presenting a credible case for being “sufficiently decentralized” over time. Solana had 62 validator nodes as of April 2021 but has a credible path to scale to 150 and eventually thousands. That term “sufficiently decentralized” was in quotes because the market is still deciding what that means. While the Solana blockchain still has kinks to work out on tech side, those appear to be solvable. Running a Solana node is a $100k upfront cost. That ain’t exactly a Raspberry Pi but again, “what do you need decentralization for and how decentralized is decentralized enough”? TBD.

SOL cannot be evaluated without discussion of the #1 reason behind its success-

Source: Glassnode. As of 3/31/21.

This is Sam Bankman-Fried and he is a generational talent. I don’t know him personally, but I’ve been paying close attention for two years. What strikes me as most special about Sam is his unique combination of 1) work ethic; 2) intellectual horsepower; 3) understanding of market microstructure; and 4) relationship with risk. These four traits combine together in way that makes SBF a truly rare human. The work ethic of a ditchdigger. The intellectual horsepower of an Ivy League professor. The market microstructure knowledge of a Wall St savant quant. The relationship with risk of a very successful riverboat gambler.

SBF is at the helm of the Solana ecosystem as CZ is at the helm of the BSC ecosystem. They’re different people with different tech and different approaches. If you’re betting on one vs the other, there are different market values to consider.

Source: Coingecko. As of 5/1/21.

Source: Coingecko. As of 5/1/21.

$13bn vs $96bn. The best executor in the space vs the former best executor in the space. More decentralized tech vs less. West vs East. It will be fascinating to watch it play out, and we plan on doing so closely.

Both BSC and SOL are pulling capital out of ETH. There is institutional capital flowing into BNB and SOL that has previously only owned BTC and ETH. This setup of 1) ETH with clear catalysts and an ability to attract a significant flow of institutional capital, while 2) BSC and SOL fight to compete to pull DeFi off of ETH and onto their chains promises to be one of the most significant and value-shifting situations for the rest of this year and likely into next.

As part of that situation analysis, it is necessary to evaluate Bitcoin’s cycle. I’ve said it before here, but Bitcoin is giving *permission* for the market to run away with the valuations of Layer 1’s and the DeFi protocols built on top. Bitcoin is giving *permission* for NFTs to go gong show. Bitcoin is giving *permission* for DOGE to be worth 50 BILLION DOLLARS. This is still Bitcoin’s world and when it gets in the mood to vaporize 40% of the market cap in these science experiments that don’t work very well and hardly anyone is using, it will do so at will. Bitcoin actually works for what its supposed to do. The tech works to be the hardest money in human history. Maybe some day other crypto assets will deliver on their use case as fully and convincingly as Bitcoin does, but today ain’t that day. We’ll be watching.

Closing Remarks

This is a raging bull market. All the signs are there. Your least responsible and least grounded friends investing in crypto will make the most money in the coming months. At the moment I see nothing that would indicate we are close to the cyclical top - neither in price nor in time. Bitcoin took a breather in April while more speculative names, with varying degrees of legitimacy, ran hard. This is classic bull market activity.

It remains to be seen whether Bitcoin will do a cyclical top in the coming quarters or whether this time is different. If BTC were to make a cyclical top, it remains to be seen whether the various DeFi ecosystems built on various L1’s can bring enough compelling products to market and lock in enough users so as to separate their collective price performance from BTC. DeFi CAN improve on and make obsolete existing CeFi analogues, but it is frankly doing very little of that currently. It’s mostly speculation fueled by Ponzi-nomics with a side of tech innovation and a serving of brilliant mechanism design. It remains to be seen what the lasting impacts will be, and over what timeframe.

The risks to investing in this asset class are decreasing in real time while the use cases are simultaneously starting to firm up, all while the monetary and fiscal policy backdrop is exceedingly accommodative. Crypto is poised to make a legitimate run to fundamentally change the way the world works. Like the internet did. Except hopefully with an improved outcome.

When the internet was built the first time around, it was built in a centralized manner so as to scale quickly and bring the wonders of the internet to as many people possible as quickly as possible. From the very beginning of the internet, there was a small cohort of a couple hundred cypherpunks who strongly opposed the centralized development of the internet. They worked in obscurity to build a decentralized alternative. Much of that work centered around a decentralized internet money. The Bitcoin whitepaper was birthed as a culmination of that work and the world was never the same. When Web 2.0 came around, social media platforms and mega tech were there to further centralization still such that by the time we arrived at today, the centralization of the internet is causing serious disruptions and discontent from the users that were supposed to benefit. The people are starting to demand change. This ecosystem is the technological solution to drive that change. That’s what we’re all working on here. It’s worth working on.

“To succeed in life, you need two things: ignorance and confidence.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS