November 2018 - Market Update

/Monthly Update || November 2018

“You can’t predict. You can prepare.”

OPENING REMARKS

Greetings from inside Ikigai Asset Management1 headquarters in Marina Del Rey, CA. We welcome the opportunity to bring to you our second Monthly Update and hope these are helpful in better understanding what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process. We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, we are heads down building a world-class crypto asset management firm and the results are showing. Our team of 17 in LA and two working remote are making daily progress on multiple fronts – news flow synthesis; qualitative framework architecting; narrative tracking and assessment; new valuation framework creation; quantitative analysis; sentiment analysis; trading tools construction; venture deal origination and diligence; Internal Ventures origination, execution and management; partnership exploration; exchange and OTC onboarding; driving operational excellence; hiring team members; speaking at conferences; and meeting with investors. We are making great strides and we are proud of that.

While building an outstanding organization is never a finished job, much of the heavy lifting has been completed. The slab has been poured and the framing has been erected. We are ready to drive superior risk-adjusted returns on a repeatable basis and we believe our timing is ideal. Put simply, we are ready.

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Timothy Lewis, Anthony Emtman, and their team.

OCTOBER HIGHLIGHTS

• Yale endowment invests in crypto fund

• TD Ameritrade invests in institutional crypto exchange ErisX

• Circle acquires SeedInvest

• Ric Edelman invests in Bitwise

• Fidelity to offer crypto custody in early 2019

• ICE-backed Bakkt exchange sets December 12 launch date

• Binance receives investment from Singapore Govt-owned Vertex Ventures

• Coinbase obtains license from NY State to operate as a Qualified Custodian

• VanEck makes significant progress with regulators on a BTC ETF

• Coinbases raises $300mm at an $8bn valuation

TETHER

This is a saga that you’ve likely heard about for well over a year and has recently reared its head again. The details are vague and I could certainly be missing some things or getting some things wrong, but the story goes something like this - Noble Bank, the bank of Tether (USDT) had been trying to raise money at the operating level for months. Lots of folks took a look and there were no bidders, presumably due, at least in part, to the inability to get comfort around the co-mingling of funds between USDT and Bitfinex, which are essentially controlled by the same people, and who were customers at Noble, as was Jump (who is also an investor in Noble). About 8 weeks ago, Noble kicked USDT out as a client. Shortly thereafter, Bitfinex either quit or was fired by Noble. Bitfinex quickly got a new bank account at HSBC under a shell company, but was kicked out after about 2 weeks when HSBC found out who it was. Bitfinex has been kicked out of 5 banks in 8 months. Meanwhile, USDT got a shady bank in the Bahamas called Deltec to handle the impending redemptions. Noble may have found a buyer but the future is unclear there.

All of this came to head the night of 10/14 as there was a crisis of confidence in USDT. USDT prices plunged and prices of more trustworthy competitors like TUSD, USDC and PAX soared. Crypto asset prices became distorted as many are shown relative to USDT. As USDT price dropped, crypto asset prices appeared to rise, albeit artificially. This divergence is apparent when comparing fiat-onramps to USDT dominated exchanges. (see yellow line denoting Coinbase prices in bottom chart).

Source: TradingView. As of 10/30/18.

Source: TradingView. As of 10/30/18.

Source: TradingView. As of 10/30/18.

At the time, on Sunday night, it looked like we might be witnessing the real-time collapse of USDT, which has grown to systemic importance in the crypto ecosystem. With hindsight, as shown on the charts above, that Sunday night was peak USDT stress and well-informed market participants stepped in to close the arb by redeeming USDT for USD out of Deltec in the days thereafter. This was a very profitable, low-risk trade for individuals who knew the amount of USD collateral Tether had and could access that USD when redeeming USDT.

In total, $1,040mm USDT was “redeemed” out of circulation and into the USDT Treasury. Of that $1,040mm, $500mm was “destroyed”. We believe this is a meaningful market occurrence.

Source: Omniexplorer. As of 10/30/18.

In the meantime, the market caps of TUSD, USDC and PAX soared.

Source: CoinMarketCap. As of 10/30/18.

In aggregate, TUSD, USDC and PAX market cap has grown >$300mm recently. It is clear that fiat currencies are leaving USDT en masse and at least part of that has flowed into other, more trustworthy Stablecoins. Looking solely at the delta between the decline in USDT in circulation and the increase in competing Stablecoins’ market cap, it would appear that >$700mm moved into either fiat or other crypto assets. This large apparent shift has occured in the context of incredibly stable BTC prices. We struggle to make sense of this, and we may be missing something; or it may just be evidence of highly manipulated crypto prices. Where did all that USD go?

Source: TradingView. As of 10/30/18.

Going forward, it’s hard to say for sure but it appears the confidence in USDT may be permanently impaired and the ecosystem is quickly moving towards regulated, safer alternatives. USDT utilization was pervasive across the space, so it will take time to rejigger the system to use other Stablecoins. If what we’ve already seen was the max pain relative to USDT worries and now it’s importance to the ecosystem will fade, that was a GREAT outcome for the space, as it removes uncertainty. We will continue to closely monitor this situation.

MARKET UPDATE – VENTURE CRYPTO ASSET INVESTING

Over the last month, our venture crypto asset investing business has been in full swing, averaging about a deal a day being assessed, and that pace is increasing. Our intake, assessment, diligencing and execution processes are in place and operating effectively. We pass on many projects within the first hour of diligence, as they do not possess the characteristics of a compelling investment opportunity. For others, the project may have compelling investment characteristics, but the valuation is too high. Currently, we are seeing this often. Many crypto funds have significant AUM tied up in illiquid investments that they don’t want to be publicly listed because of the imminent, immediate price decline relative to where these funds have these investments marked, which is at cost or in some cases even higher. Still, many of the top tier crypto funds that do have deployable capital appear to be willing to club up and invest in highly-valued venture crypto deals, justifying the prices being paid because “this is the next Ethereum” or “other smart investors are in”. In many cases, these funds are still playing a game of greater fool, with the expectation that returns will be insulated by a future fundraising round at much higher valuations than their investment, and that eventually the project will be listed publicly, and early investors will be able to unload on retail buyers. We find these justifications to be inadequate and the risk-adjusted return propositions to be broadly unattractive. This aspect of current market structure feels like it has another shoe waiting to drop. We believe venture crypto asset investing may have simply risen too far, too fast. Values of unused networks have been irrational. The ecosystem needs to build and deploy secure infrastructure before attracting network participation. This process is ongoing.

That being said, venture deal structures are evolving. Many raises are now leading with equity rather than a token. These equity raises may have SAFT’s attached to them, or in some cases the equity may convert into Utility Tokens at a later time. In other instances, we’re seeing capital raises via Security Token with a totally separate token distribution model for a Utility Token at a later date. In each case, there is acknowledgement, explicitly or otherwise, that the ecosystem does not currently know how to create a token structure for most types of Utility Tokens that will accrue value over the long term. As such, the strategy is to raise equity capital now and sort out the token structure later when the ecosystem’s understanding as a whole evolves further. We believe this is a step in the right direction from where we were in 2017 and early 2018, when the vast majority of ICOs had token structures that were fundamentally flawed in their ability to accrue value over the long term.

While we remain patient, the current venture crypto asset landscape is not entirely devoid of compelling investment opportunities. We are finding smaller deals, some under $15mm, that possess many characteristics of a compelling investment opportunity. In other cases, valuations may be >$50mm but the technology is fully functional, patent-protected, with a clear revenue model and a strong go-to-market strategy. We may be in a position to execute on several of these transactions before year-end.

Overall, we practice patience. We are planning on running Ikigai for the next 20 years. We believe we could miss 100 good venture deals and still produce outstanding returns for our investors, because there will be that many bites at the apple. In the current environment with so much uncertainty present in every corner of the market, our hurdle to make an investmentwhich, in many cases, we will be locked into for 12-18 months, is quite high. We believe this is the prudent approach to generating attractive risk-adjusted returns on a repeatable basis.

MARKET UPDATE – LIQUID DIGITAL ASSET INVESTING

Source: CoinMarketCap. As of 10/31/18.

October crypto markets were characterized by USDT fears and meaningful declines in trading volume, with the backdrop of significant stress in traditional asset classes.

Volume has gone from bad to worse. It is currently a small percentage of the volume from earlier this year. The volume shown below doesn’t even tell the entire story. A meaningful portion of this volume, perhaps well over half, is actually wash trading on unregulated exchanges. The depth of order books is very shallow. Despite about ~$5mm of daily volume on paper and a ~$150mm market cap, one could easily depress the price 20% or more attempting to sell $1mm of an asset outside the top 30, over a several day period on-exchange. This puts the market in a precarious position.

Source: TradingView. As of 10/30/18.

Dominance has stayed approximately flat in the low 50’s, while the Bottom 99 is leaking lower- currently 20% off the ATL.

Source: CoinMarketCap. As of 10/31/18.

Source: CoinMarketCap. As of 10/31/18.

Last month, we talked about a Bottom 99 that could trough as low as $40-50bn if not lower. We still think that could happen. However, we acknowledge the inherent flaws in this framework, like all crypto asset valuation frameworks taken in isolation. One of those flaws is the reliance on “paper” market cap, rife with wash trading, that is a distorted representation of actual capital deployed, the motivations of that capital, and the cost basis of that capital might be. Another potential flaw is the assumption that this current market is comparable to historical crypto asset markets. While we are acutely wary of the risks in assuming “this time is different”, we also acknowledge the drastically different market participants, structure, awareness and investor capital “in-play” at the current juncture relative to just one year ago.

Instead of relying solely on this Bottom 99 framework, we have constructed a set of scenario analyses based on what the next 1-6 months might look like. For each of the many scenarios, we have identified key, defining characteristics of each regime, which will be used to identify the specific regime as it unfolds in real-time. Different portfolio constructions will be applied depending on the specific regime observed.

Cross-Coin Correlations have generally increased over the last month from already-elevated levels.

Source: www.sifrdata.com. As of 10/31/18.

Volatility continues to collapse to new ATL’s. Even the USDT stress, which was a major event for the asset class, could do nothing more than slightly spike vol for a day before collapsing again. Volatility continues to make lower highs and lower lows into declining volume.

Source: TradingView. As of 10/31/18.

Richard Wyckoff was a stock market analyst and author in early 1900’s. We believe his widely-regarded research still holds relevancy in today’s markets, and even more so in crypto asset markets. According to Wyckoff, what we’re currently witnessing in the BTC market may be a classic Wyckoff hinge - supply comes to meet support until neither side cares anymore. This hinge is characterized by the decreasing volume into steady price support that we currently see. At this point, a regime change is needed to shake one side out of its apathy.

Wyckoff’s analysis focuses on the accumulation and distribution patterns of a "Composite Operator" heuristic. This hypothetical Composite Operator is a sophisticated, well-capitalized, asymmetrical information-having, whale who bends market activities to his advantage. We believe this is an accurate heuristic to characterize the current BTC market. The Composite Operator is happy to buy whatever comes her way in the low $6,000’s and high $5,000’s. The Composite Operator is squeezing all the sellers out in these price ranges, to the point of seller exhaustion. However, the Composite Operator is not currently interested in buying at higher prices. This stance can be confirmed by OTC desks, who say there is plenty of supply in the high $6's low $7's, but in the low $6’s a steady base of demand. That demand appears to have control over price right now. If that demand wants to take prices higher, it may likely be able to. However, we believe it is unclear BTC prices would not make new lows without continual significant buy support to defend the cyclical low.

Is this one massive accumulation of BTC by sophisticated, well-capitalized, asymmetrical information-having, colluding whales?

Source: TradingView. As of 10/31/18.

Source: TradingView. As of 10/31/18.

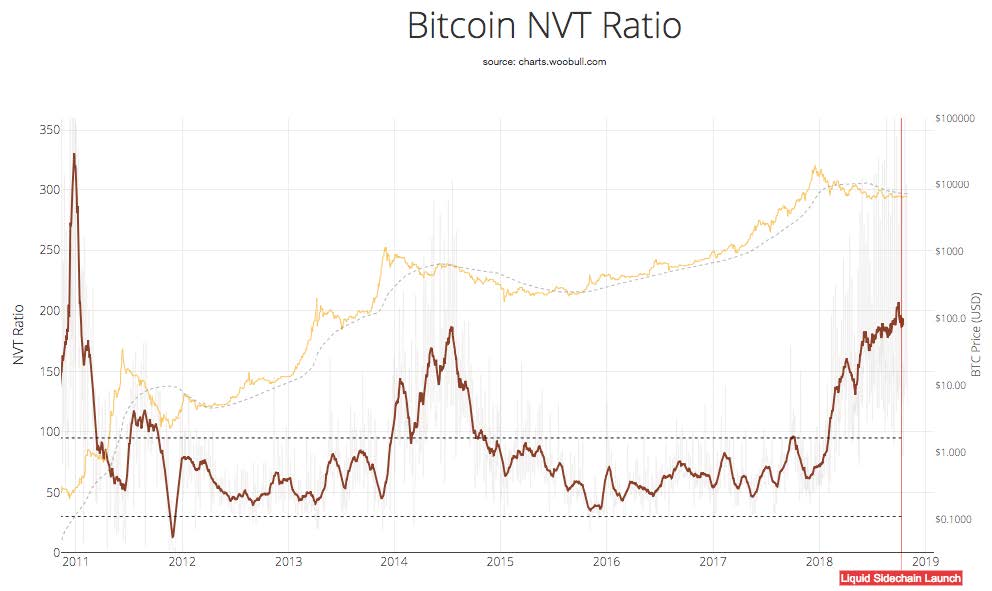

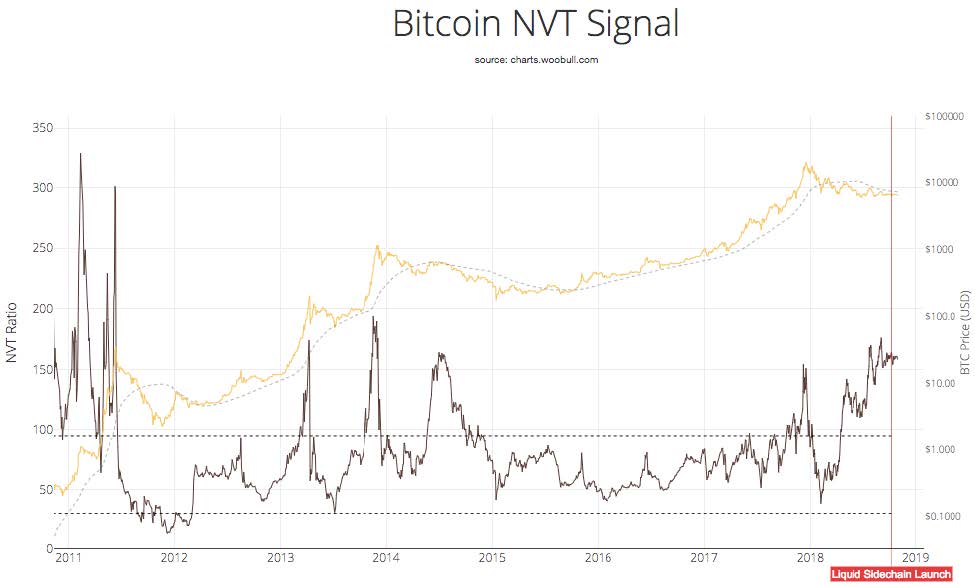

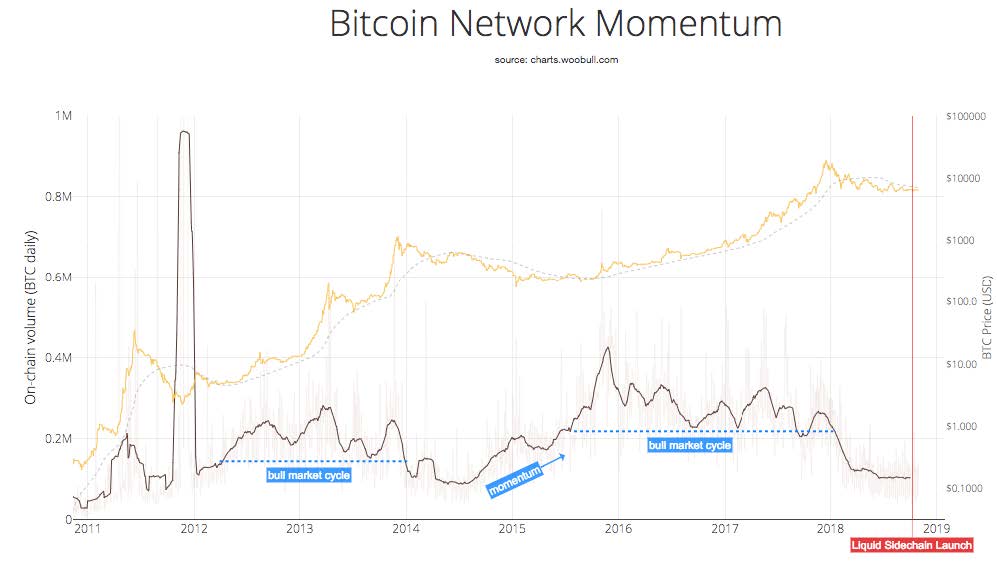

We pay close attention to on-chain metrics and network activity-implied valuations. These indicators suggest either prices need to decline considerably, or network activity needs to increase significantly. These valuation methodologies cannot be taken in isolation, but they are important.

Source: Willy Woo. As of 10/31/18.

Source: Willy Woo. As of 10/31/18.

Source: Willy Woo. As of 10/31/18.

Source: Willy Woo. As of 10/31/18.

Source: Murad Mahmudov and David Puell. As of 10/1/18.

Last month, we made the analogy of Emerging Markets being a horse track, and BTC acting like a horse track as well. We also addressed the stress showing up in traditional asset classes, acutely in Emerging Markets. That stress meaningfully increased in October, although has abated some over the last couple days. What is clear, is that BTC was able to separate itself from performance of these other horse tracks. We believe this is evidence of the Wyckoff scenario proposed above, and bears close monitoring.

Source: TradingView. As of 10/31/18.

The VIX is stressed and USD strength (shown inverted below) is having ripple effects.

Source: TradingView. As of 10/31/18.

Source: TradingView. As of 10/31/18.

Frankly, we have been surprised by the strength exhibited by BTC in the face of this traditional asset class stress. One potential interpretation of this dislocation has been explained above. We can’t be sure of exactly what is happening, but we are closely monitoring dozens of signals and making investment decisions accordingly.

Finally, this chart still, almost comically, remains intact. The adherence to this descending triangle leads us to believe BTC prices may be controlled by a tight group of market participants.

Source: TradingView. As of 10/31/18.

By the end of November, we will have broken out of this 7+ month pattern. Based on current market dynamics, this may not occur with the fireworks we were preparing for a month ago. Apathy appears to be at new cyclical highs. A number of positive news items occurred over the last month and they were met with complete indifference. While this current apathy makes us wary of being too aggressive at the moment, we believe investor sentiment can turn incredibly quickly and with it, prices. We remain vigilant of signs of this turn.

There are various aspects of the current market environment that lead us to believe the bottom may not be in for this market. Conviction of this view is highest in crypto assets down market cap from BTC, as BTC appears to be trading with a different set of parameters from other names. We expect BTC may hold in better than other names, but a new low could very well still be in play. If Top 100 aggregate market cap continues to linger in the current range or move lower, in December and January we could see a “crypto fund redemption forced selling” narrative take hold, which could drive prices significantly lower. On the other hand, the planned launch of Bakkt in mid-December may generate some advanced excitement, which could lead to an increase in crypto prices, specifically BTC, between now and Christmas.

CLOSING REMARKS

Generating attractive risk-adjusted returns on a repeatable basis in crypto asset investing requires the observation of the religious while remaining secular. This is a dynamic not present in any other asset class and offers unique challenges and opportunities. Broadly, directionally, we are highly convicted in our bullishness. Specifically, and on short timeframes, we are uncertain as we believe the exact nature of how this asset class buildout will unfold is currently unknowable. We believe the current market environment has both bullish and bearish characteristics, and either could overtake the other at any time and drive significant price movement in either direction. We believe this plays in our favor, as our frameworks, processes, tools and team position us to have a significant competitive advantage in this environment. We believe we will know it when we see it, we will see it early, and we will deploy capital accordingly.

As always, we are available to answer questions or more fully unpack what we are seeing as we execute on our mandate. We thank you for your interest in what we are building here and we look forward to growing together with you.

“When you have completed 95 percent of your journey, you are only halfway there.”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S. Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2019 Ikigai Asset Management, LLC. All Rights Reserved.

CONFIDENTIAL – NOT FOR FURTHER DISTRIBUTION

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS