December 2025 - Monthly Market Update

/Monthly Update || December 2025

“Everyone hopes a buyer will come along who’s willing to overpay for what they have for sale.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our eighty-seventh Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, November was a bit choppy in traditional markets and very choppy in crypto markets. The government shutdown, tightening liquidity conditions and fears of the Fed not cutting in December were the main culprits for the choppy price action. But SPX was down <1%. QQQ was only down 2.5%. BTC on the other hand was down 17% in November, for it’s second worst month of the year and its second worst month since June 2022. ETH was -22%. SOL -28%.

So it’s fair to say crypto took a much rougher gut punch in November than the rest of the markets. And that is representative for how crypto has traded all year – quite crappy relative to other assets.

Below is a chart that shows relative YTD performance for Gold, QQQ, BTC, ETH, SOL, Total3 and OTHERS -

Source: TradingView. As of 11/30/25.

Yeah… So that is just much worse performance than what most anyone was expecting out of crypto this year. Some might say I’m cherry picking the date there. Let’s pull it back to right before the election, so you get all the election gains –

Source: TradingView. As of 11/30/25.

So again, even including the Trump pump, that is still meaningfully worse than expectations, all things considered.

The outperformance of QQQ can be explained with two letters – AI. The AI narrative fully encompassed dozens of stocks in 2025 and drove several trillion of aggregate market cap gains. Additionally, Emerging Tech sectors like quantum, space, data centers and semis exploded higher in 2025, with many tickers up hundreds of percent YTD. There was indeed an Alt Szn in 2025 – it was just in Emerging Tech stocks.

And so, crypto is wrapping up the year in the tough position of being an “inferior casino”.

November Highlights

BTC ETFs See $3.5bn of Outflows

ETH ETFs See $1.4bn of Outflows

US Treasury and IRS Issue New Guidance To Allow Staking for Crypto ETFs

Ripple Raises $500mm At $40bn Valuation From Fortress, Citadel Securities, et al

Kraken Raises $200mm At $20bn Valuation From Citadel Securities

Kalshi Raises $1bn At $11bn Valuation Led By Sequoia

Coinbase Launches New ICO Platform with Monad; Monad Trades Poorly Upon Launch

A Democrat and Republican Senator Jointly Unveil Draft Crypto Bill Granting CFTC Oversight Power For Crypto

State of Texas Establishes Bitcoin Strategic Reserve with $5mm IBIT Purchase

Polymarket Receives CFTC Approval, Enabling US Market Access

RobinHood To Launch Prediction Markets

“Buy Now Pay Later” Company Klarna to Launch KlarnaUSD Stablecoin on Stripe’s Tempo Blockchain

El Salvador Buys $100mm of BTC

Coinbase Backs Out Of Previously Announced $2bn Acquisition of Stablecoin Startup BVNK

Google To Begin Showing Polymarket and Kalshi Prediction Market Data in Search Results

| Asset Class | Nov | Oct | Q3-25 | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -17% | -4% | 6% | 30% | -12% | -3% | 121% | 48% | 1% | -12% | 69% | 155% | -64% | BTC |

| NASDAQ | -2% | 5% | 9% | 18% | -8% | 21% | 25% | 5% | 2% | 8% | 8% | 54% | -33% | QQQ |

| S&P 500 | 0% | 2% | 8% | 11% | -5% | 16% | 23% | 2% | 6% | 4% | 10% | 24% | -19% | SPX |

| Total World Equities | 0% | 2% | 8% | 10% | -1% | 20% | 14% | -2% | 6% | 2% | 7% | 19% | -20% | VT |

| Emerging Market Equity | -2% | 4% | 11% | 10% | 4% | 30% | 4% | -9% | 8% | 4% | 2% | 6% | -22% | EEM |

| Gold | 5% | 4% | 16% | 6% | 19% | 60% | 27% | 0% | 13% | 5% | 8% | 13% | -1% | GLD |

| High Yield | 0% | 0% | 0% | 3% | 0% | 3% | 2% | -2% | 4% | -1% | 0% | 5% | -15% | HYG |

| Emerging Market Debt | 0% | 2% | 3% | 2% | 2% | 9% | 0% | -5% | 6% | -1% | 1% | 5% | -22% | EMB |

| Bank Debt | 0% | 0% | 0% | 1% | -2% | -1% | -1% | 0% | 0% | 0% | 0% | 3% | -7% | BKLN |

| Industrial Metals | 0% | 7% | 4% | 3% | 2% | 17% | 3% | -9% | 3% | 12% | -2% | -6% | -13% | DBB |

| USD | 0% | 2% | 1% | -7% | -4% | -8% | 7% | 8% | -5% | 1% | 3% | -2% | 8% | DXY |

| Volatility Index | -6% | 7% | -4% | -24% | 28% | -6% | 39% | 4% | 34% | -4% | 4% | -43% | 26% | VIX |

| Oil | -2% | -2% | 1% | -5% | 2% | -6% | 13% | 10% | -13% | 1% | 18% | -5% | 29% | USO |

SOURCE: TRADING VIEW. AS OF 11/30/25.

The Inferior Casino

As I was saying, finds itself in the tough position of being the inferior casino. That’s very true for Alts, but to some extent it is true for BTC as well. BTC has not performed as well as most would have expected relative to QQQ and relative to Gold.

Below is BTC/QQQ –

Source: TradingView. As of 11/30/25.

One share of QQQ will buy you more BTC today than it did in 1H-24 or most of 2021. Not what people were expecting given the circumstances.

Below is BTC/Gold –

Source: TradingView. As of 11/30/25.

One ounce of Gold will buy you more BTC today than it did for most of the last 4 ½ years. Not what people were expecting given the circumstances.

What explains this relative underperformance of BTC vs QQQ and Gold, considering all the good things that have happened to BTC (eg, ETFs, Trump win)? In my opinion the #1 reason for this underperformance is the proliferation of cash-settled BTC derivatives. These instruments remove the inherent scarcity in spot BTC, and that scarcity is a huge driver of BTC’s reflexivity. The “paper” Bitcoin extinguishes this upward reflexivity. In particular, covered call writers are harvesting upside volatility. I think this impact has been particularly noticeable around new ATH breakouts this year, which have been consistently faded, likely through the aggressive selling of covered calls.

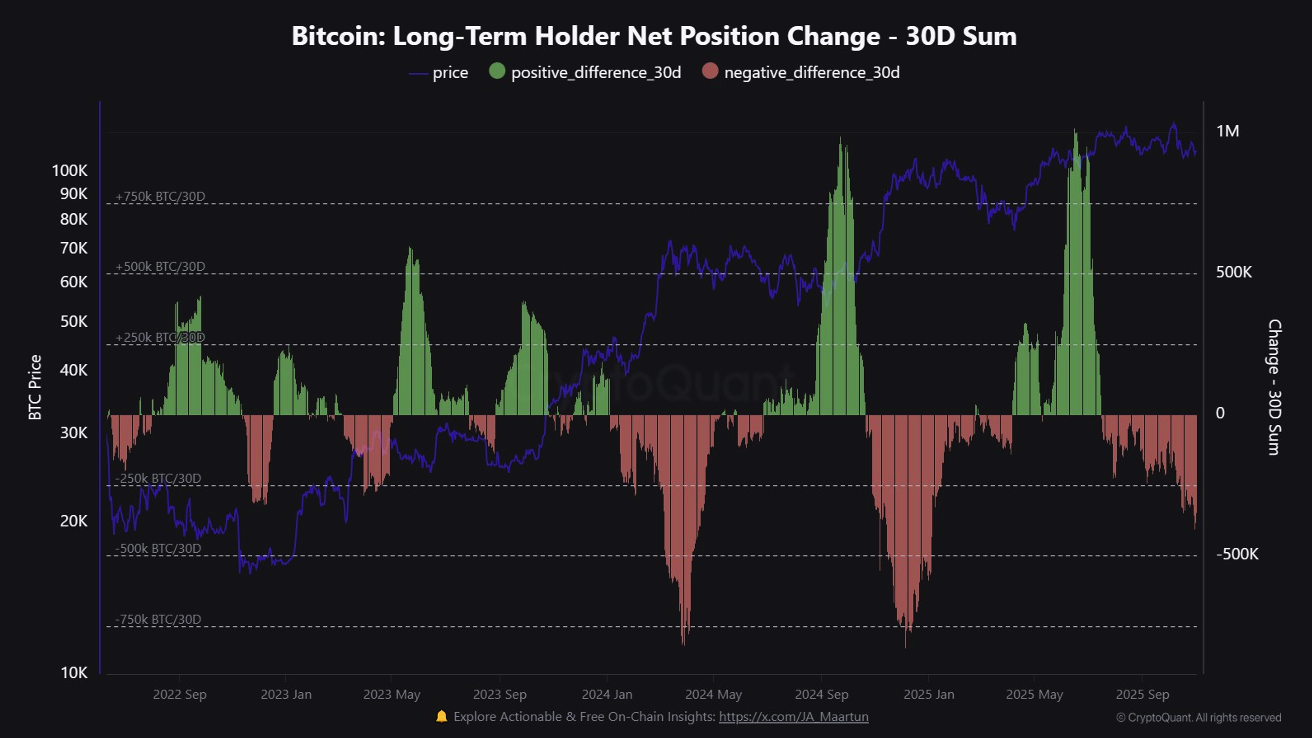

BTC has also dragged this year because OG whales have been selling a lot of Bitcoin –

Source: CryptoQuant. As of 11/3/25.

If I put myself in the shoes of an OG BTC whale, I understand how the current environment could feel like the end of the trade. BTC has effectively won. It’s $100k. We have ETFs. They’re huge. The US government is insanely supportive of BTC. The president shills it nonstop. They established a BTC strategic reserve. Michael Saylor shoved 650k coins into a small tech company. Dozens of companies tried and mostly failed to copy him. Yeah, I get why an OG BTC whale would feel like this is a good time to cash out and sail off into the sunset. So that dragged on BTC some this year.

I also think the quantum fear put at least some damper on BTC’s price performance this year. I will save a full analysis of the quantum risk for another time but suffice it to say I think this is now firmly on people’s radar. And I don’t think BTC will be able to move a lot higher (say $175k+) until this risk gets alleviated or the market gets VERY comfortable that the quantum risk is a decade or more away. So that dragged on BTC some this year.

BTC is also just huge. $2.5tn market cap at the highs ($1.8tn currently). At the YTD highs, BTC had added about a trillion of market cap since before the election. So all the good that happened for BTC since right before the election added up to taking a $1.5tn asset to a $2.5tn asset. That’s a huge market cap – only a handful of companies and one element on the periodic table are worth more. We’ve only seen a $1.5tn asset quickly rocket much higher a couple times – NVDA and GOOG and MSFT and that’s basically it. So what tells me, is that if you want to REALLY move a $1.5tn asset, you need the kind of tailwinds that NVDA, GOOG and MSFT have – which is to say, insanely hot tailwinds. I don’t think BTC has insanely hot tailwinds at the moment.

All of that adds up to 2025 being a year where BTC acted in a way it’s never acted before, as it relates to the “3 Up 1 Down” cycle. This is shown most clearly in the table below –

This table sorts all asset classes in descending order of YTD performance (through 11/21/25). You see BTC there at the very bottom. The only negative in the whole column. Worst performing asset class in the world in 2025. This is a total shattering of the “3 Up 1 Down” cycle. Going back to 2011, BTC was the best performing asset class on Earth for three years in a row, then it was the worst performing asset class (by a lot) in the fourth year, and then the cycle restarted. As of 2025, that is now over (unless BTC does something really crazy in December).

Looking into 2026, I struggle to see how BTC isn’t going to drag its beta to QQQ again next year. That would be my base case. There is a path where global liquidity conditions tighten in 2026 and that would likely weigh on all risk assets, and you could see QQQ down 10-20% next year. In that event, I would expect BTC to be down at least as much as QQQ and likely more. There is also a path where global liquidity conditions loosen in 2026 and that is supportive for all risk assets, and you could see QQQ up 20%+ next year. In that event, I would not expect BTC to materially outperform QQQ. In short, most of the reasons I think BTC dragged QQQ in 2025 still seem in place for 2026.

Looking at Alts, I think they are in a worse position than BTC heading into 2026. Alts very badly dragged BTC in 2025 with few exceptions. I don’t want to beat a dead horse in explaining the reasons for this very bad performance. If you’ve been reading, you know why. Alts lack product-market-fit.

I went back and read my letter from a year ago – 12/1/24, the first letter I wrote after the election. I said this about Alts –

“I’ve spoken about this many times here, but just to reiterate – Alts broadly have a “core utility” problem. There are some who would argue that an adversarial US regulatory backdrop has been A, and perhaps THE main driver of this “core utility” problem. And now that we’re going to clean up all those regulatory issues and have a nice clean backdrop for crypto, this “core utility” problem is going to magically vanish as numerous compelling use cases that gain significant mass adoption finally just appear. I would be wary of that view. A good regulatory backdrop is going to be helpful, without a doubt. But Alts broadly have a bigger issue than that. Outside of Bitcoin and stablecoins, the overwhelming majority of crypto projects are somewhere between solutions looking for problems and vaporware grift. I don’t think that fact magically changes with supportive regulations. But it’s certainly a great start.“

OK. So you fast forward a year and Alts are down ~40% since I wrote that and that was during a year that was insanely supportive of crypto and a risk-on macro year and also “supposed” to be the part of the cycle where Alts go gangbusters.

But the market figured it out this time around. Alts don’t do anything. There is no significant real-world adoption of crypto outside of BTC and stablecoins. And the value accrual that the market assigns to the L1 that is shuttling the stablecoins is not clear. Or said differently, ETH at $400bn may not be a very attractive price tag for a stablecoin shuttler. Solana at $100bn might be more attractive, but Tron moves more stables than anyone and it’s completely centralized via Justin Sun and it’s worth $30bn. So what’s the right price tag for a stablecoin shuttler?

Along the way, you have utterly cannibalized a user base. Absolute max extraction wherever you look. Memecoin punters got annihilated on Pump Fun. Every VC token launched this cycle was a failure. No new adoption. Large net migration OUT of crypto entirely. Zero additional proven use cases. DePIN tokens trade atrociously despite legit traction. Can’t hire top talent – they’d never come work in crypto when they can go to AI. Dreadful reputation. President of the United States running a multifaceted unfettered grift to fleece anyone and everyone.

That is what crypto faces heading into 2026. I do not see compelling reasons to think this situation will get meaningfully better in the coming year. There are not new use cases on the horizon that will drive significant increased adoption. There are also no longer additional market participants to rope into this PvP game of musical chairs with 10 bodies and 1 chair. The curtain has been pulled back. Crypto is the inferior casino.

The perceived attractiveness of crypto as a vehicle for speculation is a crucial part of its value proposition. For the vast majority of Alts, it is the ONLY value proposition. There was a period when crypto was the horse track and it was a good horse track with fun, interesting, opportunities to make money and people liked betting at that horse track. People don’t want to bet at the horse track of Alts anymore. Everyone that has been doing that got destroyed and people don’t want to do it anymore. The price performance over the last 12+ months has driven this home.

Crypto is the inferior casino. Emerging Tech stocks are the new, better casino. Quantum. Space. Biotech. Data centers. Rare earths/critical minerals. Drones. Specialized AI software. Smart Infra. Semis. The list goes on. Dozens of names. And they’re up hundreds of percent this year and in many cases, the year before that too. It’s like what we imagined the Alt landscape would be like in 2017 when we were daydreaming about mass adoption in the far-off year of 2025. Some of the names are huge – a hundred billion of market cap or more. Huge revenues. Huge backlogs. Compelling, scalable product-market-fit. Some of the names are essentially “Listed VC”. <$5bn market cap. Pre-revenue. Huge product risk. A whole spectrum of emerging technologies – some that are rapidly changing the world in real time, some that are just selling hopium.

But it’s an actual functioning landscape of companies and ideas. You can look at these companies and they actually do stuff or are purporting to start doing stuff in the near future. Companies with actual PMF. Without the insanely toxic market structure of Alts. Without crippling VC overhang. Without totally fugazi user metrics. Without founders that made generational wealth before doing a single thing of note. Emerging tech stocks are the superior casino.

And so, that’s the hand that crypto is dealt going into 2026. And it’s probably going to sting again in 2026 just like it stung in 2025. And the market will continue to take notice and to the extent that speculative capital is tied up in crypto, that capital will continue to exit and it will make for a bunch of ugly charts, just like the charts we got in 2025.

What we may be watching unfold is a path that I’ve been contemplating for three years. This is the path where you essentially starve crypto for years until the ecosystem does an actual reset. The opportunities to make attractive risk-adjusted returns get so inferior, that the large majority of people just stop paying attention. Even the scammers leave because there’s no one left to scam. Crypto Twitter activity declines another 90% from its already sunken state. Alts get cut in half and then cut in half again. Stablecoin market cap grows while L1 market cap shrinks. Most crypto VC’s either shut down or pivot.

Aggregate Alt market cap is a completely fake number, so don’t read too much into the actual number. But aggregate Alt market cap is currently $1.3tn, down from a cycle-high $2tn in early October. That $1.3tn could be $130bn and Alts still wouldn’t be cheap in any traditionally accepted sort of way. But if aggregate Alt market cap went down 90% from here, you would def get rid of a lot of riff raff. And you might actually get a real shot at getting a reset that could drive better long-term fundamentals.

I don’t think Alts are about to go down 90%. They could easily go down another 50% though. And the viral memetic idea of crypto as the inferior casino could continue to propagate and that just keeps starving the whole ecosystem, until eventually something gives, and things start getting better and crypto becomes more investable again.

Market Update— Liquid Crypto Asset Investing

| Nov | Oct | Q3-25 | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -17% | -4% | 6% | 30% | -12% | -3% | 121% | 48% | 1% | -12% | 69% | 155% | -64% |

| ETH | -22% | -7% | 67% | 36% | -45% | -10% | 46% | 28% | -24% | -6% | 60% | 91% | -67% |

| XRP | -14% | -12% | 27% | 7% | 0% | 4% | 238% | 240% | 29% | -24% | 2% | 81% | -59% |

| BCH* | 1% | -4% | 10% | 59% | -31% | 16% | 36% | 25% | -12% | -44% | 121% | 157% | -75% |

| EOS | -26% | -32% | -31% | -8% | -20% | -75% | -8% | 50% | -11% | -48% | 30% | -2% | -72% |

| BNB | -19% | 8% | 53% | 9% | -14% | 25% | 124% | 24% | -3% | -4% | 94% | 27% | -52% |

| XTZ | -16% | -13% | 24% | -18% | -49% | -62% | 28% | 82% | -11% | -43% | 40% | 39% | -84% |

| XLM | -18% | -15% | 51% | -10% | -20% | -25% | 157% | 237% | 8% | -35% | 9% | 81% | -73% |

| LTC | -14% | -11% | 24% | 4% | -19% | -20% | 42% | 54% | -11% | -28% | 44% | 4% | -52% |

| TRX | -5% | -11% | 19% | 17% | -6% | 11% | 136% | 63% | 25% | 1% | 14% | 98% | -28% |

| Aggregate Mkt Cap | -16% | -5% | 16% | 24% | -19% | -7% | 96% | 46% | -4% | -14% | 63% | 119% | -64% |

| Aggregate DeFi* | -25% | -6% | 40% | 20% | -19% | -5% | 50% | 52% | -15% | -21% | 47% | 132% | -77% |

| Aggr Alts Mkt Cap | -9% | -15% | 34% | 25% | -34% | -14% | 72% | 47% | -13% | -15% | 58% | 90% | -64% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 11/30/25. BCH INCLUDES SV.

BTC was -17% in November and most other cryptos fared worse. There was significant technical damage done to the BTC chart. And that has the market quite nervous about further price declines coming in the near future.

Shown below, you can see the crucial support level around $100k (white box) was broken, and price quickly accelerated downward, before find the next clear support level in the low $80s (yellow) –

Source: TradingView. As of 11/30/25.

Zooming in, I’ve circled that low-$80s to mid-$90s range (purple) –

Source: TradingView. As of 11/30/25.

You see that price has very rapidly moved through that purple area three times now – twice on the way down and once on the way up. So there’s some “green grass” in that area immediately overhead that could be reclaimed quickly. Overall, I think we’ve established a new “sub-$100k” range here in the low $80s up to $100k. It’s not my base case we will see new lows in BTC in the next couple months, or at least not by much. And in terms of further upside, I think we’ll just have to see how price acts around that $100k range when we get there again. My guess is we’ll get a look at those levels in December or January.

The chart below shows the 50-week MA in blue –

Source: TradingView. As of 11/30/25.

This is a level that has understandably made market participants quite nervous. It has worked as a “line in the sand” for over five years at this point. And that level was very firmly broken in November. The last time this level broke as support was December 2021, and price went down 67% thereafter.

ETH failed at prior ATHs and has now declined ~40% in a straight line in less than two months. ETH now sits at the midpoint of a broad range of the last 4 ½ years –

Source: TradingView. As of 11/30/25.

ETH’s narrative was taking a ride on a multiyear strugglebus until this summer when Tom Lee showed up with BMNR and bought 3.6mm ETH totaling >$10bn. All that buying drove ETH to the top of the range but was not sufficient to drive ETH to new highs, and now price has fallen back to the $3k level. Tom Lee is still buying ETH. He bought >$1bn in November. But that wasn’t enough to keep ETH’s price from falling 22% in the month. So whatever sort of buying BMNR was doing in November, there was a lot more selling. ETH’s narrative is a struggle right now. There is definitely a path where ETH’s price revisits the bottom of this range in 2026.

ETHBTC got a big pump this summer off the DAT catalyst, but it’s been fading ever since. ETH needs a new catalyst if this half a trillion-dollar asset wants to be a trillion-dollar asset –

Source: TradingView. As of 11/30/25.

Solana had a bad year, down 35% YTD. My guess is the overwhelming driver of SOL’s price action was the selling of all that locked SOL that was bought out of the FTX estate. Those buyers made a lot of money and were more than happy to get out of the trade as it unlocked. On top of that, the Pump Fun protocol hammered upwards of a $1bn in SOL sells from platform fees. This combined selling pushed price down all year.

SOL is currently sitting at 18-month support –

Source: TradingView. As of 12/1/25.

The price action above the white line looks clearly distributive to me, and it matches up with all that FTX and Pump Fun selling I just mentioned. Like ETH, SOL needs a new narrative.

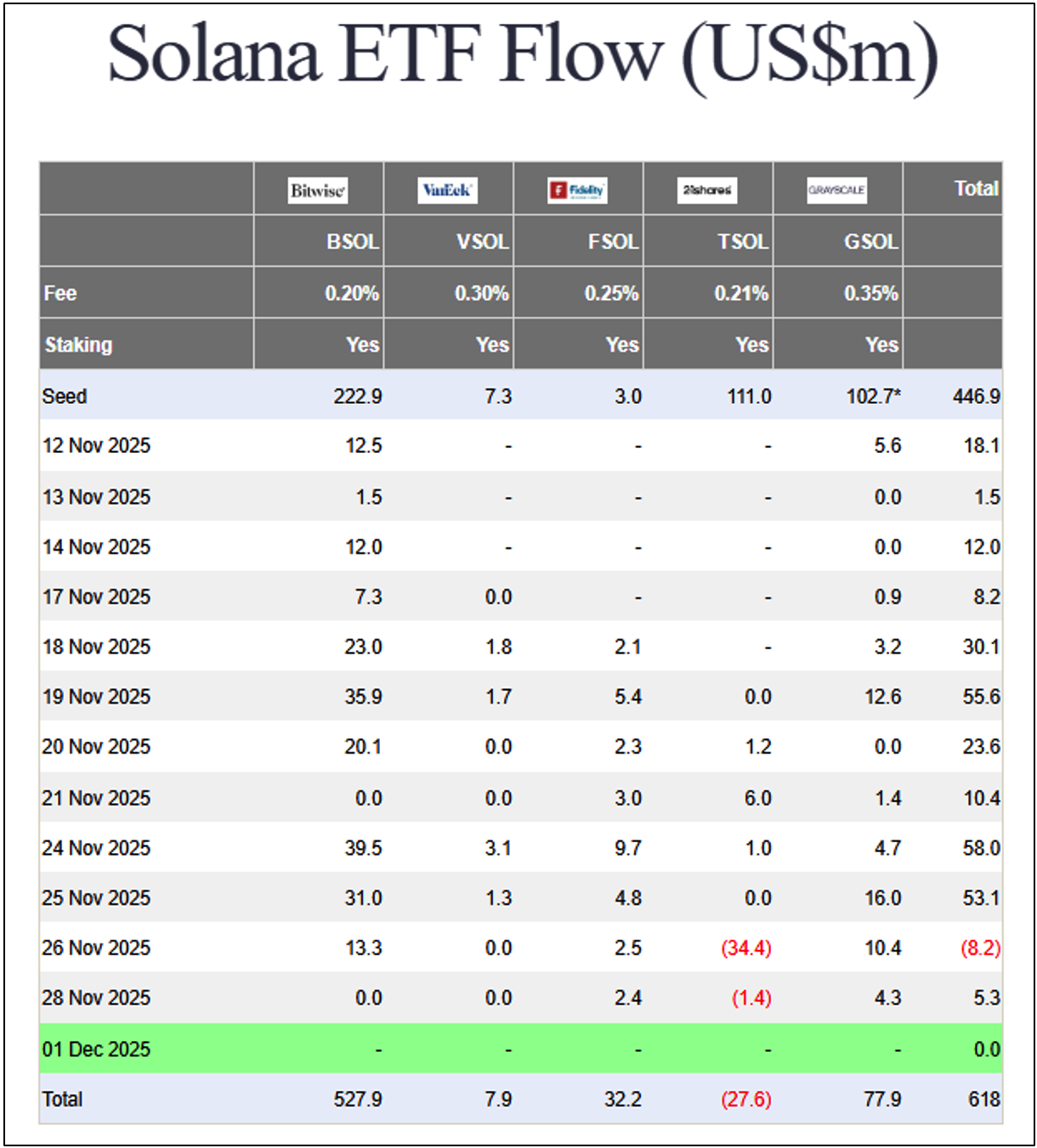

The SOL ETF inflows have been pretty decent. BSOL will be one the strongest ETFs launched in 2025. But it wasn’t enough to keep SOL’s price from getting smoked –

Source: Farside.co.uk. As of 12/1/25.

OTHERS (aggregate market cap outside of top 10) looks a lot like the SOL chart above -

Source: tradingview. As of 12/1/25.

The yellow line shows where price failed at prior ATH immediately after the election a year ago. Price is now down 55% since that Trump pump and is sitting at the bottom of an 18-month range (white box). As previously mentioned, this OTHERS market cap number is pretty fake because the market caps of the constituents are quite fake. OTHERS is currently worth ~$200bn. If it declined 90% to $20bn, it still wouldn’t be cheap in any traditionally accepted sort of way. I don’t think OTHERS is about to decline 90%, but it could certainly go down 50% next year. It would be a good thing for the space, to my point earlier about starving crypto to force structural change.

SUI was a name that had a fair amount of hype around it in 23/24 -

Source: TradingView. As of 12/1/25.

SUI price had support around ~$2 (white box), but once that level was lost, you saw aggressive acceleration to the downside. Price is now -64% in the last two months. The actual SUI ecosystem was fledgling and has not produced a noteworthy project, so I don’t get the sense there is some strong fundamental story to SUI that would prevent it from going down further. And that’s also just a pretty bad looking chart.

As we look back on the last three years of crypto since the FTX bottom, we can say confidently that Pump Fun was one of the worst things to happen to crypto this cycle. The scale of the extraction ($844mm of SOL in fees paid, the SOL was sold for cash by Pump mgmt) and the lopsidedness of the scams (>99% of profits likely accrued to a few hundred entities) puts Pump Fun in a league of its own in terms of being cancerous to crypto. Pump Fun was ground zero for the hyper-gambling, financial nihilism risk taking that ended up as a defining feature for this crypto cycle. I called Pump Fun a poison back in February, and that turned out to be correct.

But that didn’t stop them from raising $500mm in an ICO from retail investors –

Source: TradingView. As of 12/1/25.

The Pump Fun token traded above ICO price for a bit but is now sitting at the lows and 32% below ICO price. This price action generally matches the trading volume on Pump Fun, which is sitting near the lows –

Source: defi llama. As of 12/1/25.

Pump Fun began a token buyback program this summer. At the beginning of September, they changed the buyback to equal 100% of net revenues generated by the platform. This has led to $194mm of buybacks – 60% of which are burned and 40% are distributed as staking rewards for PUMP holders. So that’s certainly better than nothing. But the entire platform is terribly parasitic and enables the worst of crypto and if the whole thing just fades away from here, the world will be better off. Decent chance that’s what happens.

Closing Remarks

I feel like this month’s letter was a bit of a downer. I assure you that was not my intention when I sat down to write it. I didn’t know what I was going to write about and then this one just shook out the way that it did. Although to be fair, from what I can tell from what’s left of Crypto Twitter and Telegram chats, my dour assessment of the state of crypto is felt by many others. Also, it’s just the end of the calendar year and this is a natural period for retrospection. And it’s just a fact that crypto in 2025 was disappointing relative to expectations when we were sitting here a year ago.

Crypto has always been in a state of flux. Every year since I got into this in 2017 (and certainly the years before that as well) crypto has sloshed around in a state of flux. There have been all manner of positive and negative events for crypto over those years. We’ve seen the rise and fall of a slew of characters, projects and companies. Market caps have ballooned and collapsed and ballooned again only to collapse again so they can then boom again… phew. Only this time, they didn’t really balloon to the extent people were expecting. And that is telling about the type of flux that crypto finds itself in today.

It goes back to that “core utility” problem I mentioned earlier. Crypto is being forced to look at its core utility problem square in the eyes. And just like when any of us look at a problem we have in our own lives square in the eyes, this process is forcing crypto to grow up. That growing up process includes cutting away the vines of vaporware that have been choking the life out of crypto. As you’ve probably noticed, crypto’s desire to shill vaporware has not gone quietly into the night. The industry’s scammers and grifters are fighting to remain a part of this ecosystem, but they’re getting starved. They were pretty starved in 2025. The opportunities to scam and grift were thinner than they’d been in years past. The healthiest possible thing for this ecosystem would be for 2026 to be another year where scammers and grifters are starved for opportunities. Not sure what they’ll do with all their free time, though. Maybe run for office?

“The skilled hawk hides its talons.”

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS