November 2025 - Monthly Market Update

/Monthly Update || November 2025

“Great investing requires both generating returns and controlling risk.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our eighty-sixth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, October was a busy month for crypto, both positive and negative. We got long-awaited additional spot ETFs for SOL, HBAR and LTC. The SOL ETF is the first ETF to include staking. The SOL ETF received meaningful inflows – totaling $197mm in the first four days of trading. SOL price did not respond much at all in either direction to the ETF launch. HBAR and LTC ETFs were effectively duds.

Trump nominated a knowledgeable and competent crypto supporter to CFTC chair with Mike Selig. With the government shutdown ongoing, it looks pretty unlikely that congress will pass a crypto market structure bill into law in 2025. But I don’t think that’s cause for much concern. The stablecoin bill has already passed and it’s brought a slew of stablecoin interest from all sorts of companies. And the SEC and CFTC have remained exceedingly accommodating to crypto, so a market structure bill isn’t immediately necessary. If we don’t get it in 2025, we’re highly likely to get it in 2026.

There were a lot of capital raises and acquisitions announced in October. There were new product, new integrations and new company launches. I’ve listed some of the biggest ones below.

On the flipside, crypto experienced a flash crash on October 10th that generated the largest nominal liquidation event in crypto history. We will discuss that in more detail below. Additionally, as of October we are now starting to see the ugly side of DATs. Two DAT’s sold portions of their crypto holdings to start buying back their stocks, which have traded very poorly. This was a risk that has been discussed for months, and it has the potential to spook the market. So far, the dollar amounts of DAT crypto selling have been relatively small. But if more broken DATs trading <1 mNAV join in the selling, it could have a negative impact on price. The DAT trend always seemed pretty ill-advised to me. I’ve said as much in previous letters earlier this year. It didn’t take long to see how true that ended up being.

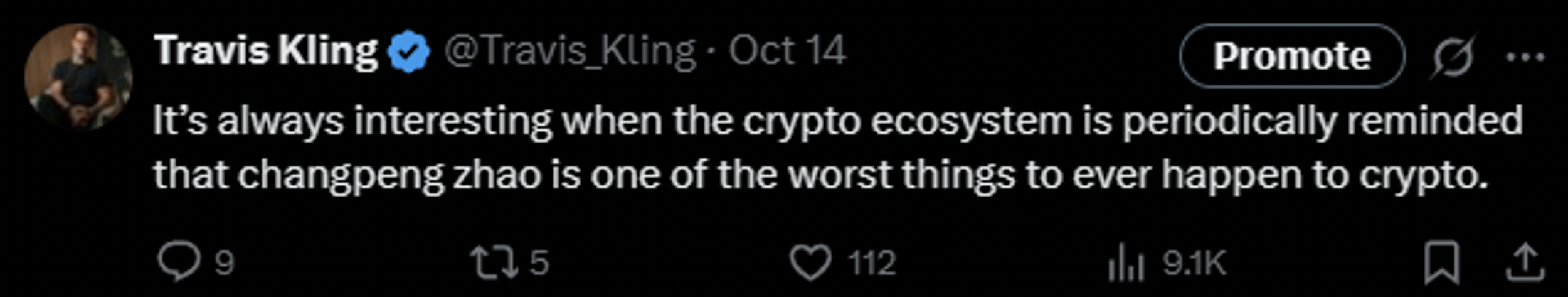

Finally, Trump pardoned Binance founder Changpeng Zhao. There is every indication to believe that Changpeng effectively bribed his way into a pardon. Early this year Changpeng hired “lobbyist” Ches McDowell, who is hunting buddies with Don Jr., to try and get a pardon out of Trump. Then, in May, when Binance accepted a $2bn investment from Abu Dhabi’s sovereign wealth fund, that investment was funded entirely in USD1, the stablecoin of the Trump family’s crypto project World Liberty Financial. Abu Dhabi had to fund dollars into World Liberty to create those $2bn of USD1 stablecoins. World Liberty then in turn would take those dollars and invest them in Treasuries yielding ~3.75%. 3.75% of $2bn is $75mm. $75mm/year in interest income to Trump’s World Liberty on the $2bn they got so Abu Dhabi could fund their investment in Binance. Five months later, Changpeng was pardoned.

So, yeah. That shit is gross. But if you’re looking at the pattern of behavior from the Trump family, it is certainly not surprising.

October Highlights

Crypto Market Experiences Flash Crash, Largest Single Day Crypto Liquidation Ever

Trump Nominates Chief Legal Counsel For SEC Crypto Task Force Mike Selig As CFTC Chair

Bitwise Solana ETF BSOL Receives Approval, Starts Trading, Sees $70mm First Day Inflows

HBAR and LTC ETFs Receive Approval, Start Trading, See Minimal Inflows

Broken DAT “ETHZ” Sells $40mm ETH to Buy Back Shares

Broken DAT “SQNS” Moves $112mm BTC to Coinbase, Presumably to Sell, But No Official Announcement From Company

Trump Pardons Binance Founder Changpeng Zhao

Visa To Incorporate Stablecoin Payments on Four Blockchains

Western Union To Launch Stablecoin on Solana

NYSE Owner ICE Makes $2bn Investment In Polymarket at $9bn Valuation

Kalshi Raises $300mm at $5bn Valuation, Led By Sequoia, A16Z

Stripe-backed Payments Blockchain “Tempo” Raises $500mm, Led By Thrive, Greenoaks

Token Launching Platform Securitize Goes Public Via SPAC at $1.25bn Valuation

Galaxy Raises $460mm From $3tn AUM Asset Manager “Capital Group”

Coinbase Acquires Crypto Fundraising Platform Echo, Founded by Crypto Veteran Cobie, for $375mm

Ripple Acquires Treasury Management Company “GTreasury” For $1bn

FalconX Acquires ETF Manager 21Shares

US Regulators Approve Launch of Cryptobank “Erebor” Backed By Palmer Luckey and Peter Thiel

JPMorgan To Allow BTC and ETH As Collateral

Crypto Media Company Blockworks Shutters Its News Division

CME To Launch 24/7 Trading of Crypto Products

Celsius Bankruptcy Wins $300mm Settlement from Tether

Roger Ver Reaches Settlement with DOJ, Agrees to Pay $48mm Penalty

| Asset Class | Oct | Q3-25 | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -4% | 6% | 30% | -12% | 17% | 121% | 48% | 1% | -12% | 69% | 155% | -64% | BTC |

| NASDAQ | 5% | 9% | 18% | -8% | 23% | 25% | 5% | 2% | 8% | 8% | 54% | -33% | QQQ |

| S&P 500 | 2% | 8% | 11% | -5% | 16% | 23% | 2% | 6% | 4% | 10% | 24% | -19% | SPX |

| Total World Equities | 2% | 8% | 10% | -1% | 20% | 14% | -2% | 6% | 2% | 7% | 19% | -20% | VT |

| Emerging Market Equity | 4% | 11% | 10% | 4% | 32% | 4% | -9% | 8% | 4% | 2% | 6% | -22% | EEM |

| Gold | 4% | 16% | 6% | 19% | 52% | 27% | 0% | 13% | 5% | 8% | 13% | -1% | GLD |

| High Yield | 0% | 0% | 3% | 0% | 3% | 2% | -2% | 4% | -1% | 0% | 5% | -15% | HYG |

| Emerging Market Debt | 2% | 3% | 2% | 2% | 9% | 0% | -5% | 6% | -1% | 1% | 5% | -22% | EMB |

| Bank Debt | 0% | 0% | 1% | -2% | -1% | -1% | 0% | 0% | 0% | 0% | 3% | -7% | BKLN |

| Industrial Metals | 7% | 4% | 3% | 2% | 16% | 3% | -9% | 3% | 12% | -2% | -6% | -13% | DBB |

| USD | 2% | 1% | -7% | -4% | -8% | 7% | 8% | -5% | 1% | 3% | -2% | 8% | DXY |

| Volatility Index | 7% | -4% | -24% | 28% | 1% | 39% | 4% | 34% | -4% | 4% | -43% | 26% | VIX |

| Oil | -2% | 1% | -5% | 2% | -4% | 13% | 10% | -13% | 1% | 18% | -5% | 29% | USO |

SOURCE: TRADING VIEW. AS OF 10/31/25.

Crypto Black Friday

On October 10th, the crypto market had a short-lived but extremely violent crash. On October 9th, China announced they were imposing approval requirements for the export of rare Earth metals, including to the US. The next day on the afternoon of the 10th, Trump tweeted he would be increasing tariffs on China to 100% starting November 1st in response to China’s rare earth restrictions. This caused a crash in all assets – with the SPX declining 3% in a few hours.

The first weird thing about this event as it relates to crypto is that a newly created account on Hyperliquid placed a $700mm BTC short and a $350mm ETH short 30 minutes before Trump’s tweet. The market crashed hard immediately thereafter, and the account closed the shorts at the bottom of the crash, realizing $192mm in profit in a couple hours. Coincidence? Ehh, maybe. Maybe not. I doubt we’ll ever find out.

At the peak of the mania, BTC and ETH both crashed ~10% in 10 minutes. Alts faired far worse. Aggregate crypto market cap excluding BTC and ETH declined 25% in 45 minutes.

Source: TradingView. As of 10/30/25.

Aggregate crypto market cap excluding the top 10 declined 45% in 45 minutes.

Source: TradingView. As of 10/30/25.

LINK declined 62% in 45 minutes.

Source: TradingView. As of 10/30/25.

ENA declined 74% in 45 minutes.

Source: TradingView. As of 10/30/25.

ATOM went to zero on Binance. Like actually zero.

Source: TradingView. As of 10/30/25.

So yeah. Carnage. Short-lived but intense carnage. The move had a huge impact on Open Interest, as many, many leveraged traders were liquidated.

BTC aggregate OI declined 35% in a day.

Source: TRDR. As of 10/30/25.

ETH aggregate OI declined 42% in a day.

Source: TRDR. As of 10/30/25.

SOL aggregate OI declined 57% in a day.

Source: TRDR. As of 10/30/25.

There were reports of $19bn total liquidations, but that number likely drastically underestimates the real number because Binance and Bybit do not accurately report liquidations (they only report one liquidation per second and during times of extreme price volatility there is much more than one liquidation per second). It was certainly the largest nominal liquidation event in crypto history, we just don’t know by exactly how much.

Because of the torrent of longs being liquidated, many traders with short positions experienced “ADL” – Auto Deleveraging. ADL happens during extreme price volatility when an exchange liquidates a leveraged account due to losses in the account, but doesn’t close the positions in time before the account’s equity goes negative. So the exchange ends up with “bad debt” due to the negative equity of the liquidated account. When a bunch of these stack up together, the bad debt can get big and potentially put the solvency of the exchange at risk. In order to fill the hole caused by all this bad debt, the exchange automatically closes profitable positions in other accounts. So basically, if you were short on any exchange and printing on your short, the exchange probably closed your short for you, whether you wanted to close it or not.

ADL happened en masse across nearly every derivatives exchange, both CEX and DEX. Hyperliquid reported 35,000 ADL events across 20,000 accounts. For portfolios that were running long/short strategies or basis trades, this meant that you thought you were hedged – a long against a short, except the exchange automatically closed the short for you and you were left with a naked long, which may or may not have been immediately subsequently liquidated as prices continued to fall and you weren’t hedged. Ouch.

As you can probably imagine, this was an absolute shitshow on Crypto Twitter. There were many reports of platform outages at exchanges, and in particular Binance seemed to have performed especially poorly in terms of traders actually being able to execute any trades. The inability to execute trades on the platform greatly exacerbated the liquidations and caused additional negative knock-on effects.

The most significant exacerbation was the depeging of Ethena’s stablecoin USDe on Binance.

Source: TradingView. As of 10/30/25.

USDe briefly traded as low as 65c. Binance was not using any external oracles to mark the price of their customers’ USDe. The depeg couldn’t be arbed away because no one could get orders through. Because USDe was being used as collateral for leveraged positions on Binance, this depeg caused a wave of liquidations.

It appears rather likely that the USDe depeg was intentional. The external oracle issue was a known problem. In fact, Binance had announced the week before that they would be changing that pricing mechanism to include external oracles starting October 14th. As the market began trading off due to the tariff escalation, it appears that $60-90mm of USDe was market sold on Binance, potentially with the intention to cause the depeg and the knock-on cascading liquidations. I doubt we’ll ever know exactly what happened here, but it smells like an exploit.

As the result of all this, Crypto Twitter was majorly pissed off at Binance. As a result of that backlash, Binance issued $283mm in vouchers to some of the effected accounts (there were various qualifying factors in order to get a voucher). This only served to piss off Crypto Twitter further still, as the total liquidations were in the billions.

If you weren’t trading with any leverage in either direction, you were basically unaffected by the crash. Sure, if you were holdings Alts they went down a lot temporarily, but they bounced quickly (although most are still down 10-20% MTD). But if you were long Alts and running even just a turn or two of leverage. Or if you were running a 5-10x levered long/short book. Or if you were running 0x levered Alt funding arbs or basis trades. All those buckets of market participants. You probably got wiped on the October 10th move for whatever you had in your account.

Market Update— Liquid Crypto Asset Investing

| Oct | Q3-25 | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -4% | 6% | 30% | -12% | 17% | 121% | 48% | 1% | -12% | 69% | 155% | -64% |

| ETH | -7% | 67% | 36% | -45% | 15% | 46% | 28% | -24% | -6% | 60% | 91% | -67% |

| XRP | -12% | 27% | 7% | 0% | 21% | 238% | 240% | 29% | -24% | 2% | 81% | -59% |

| BCH* | -4% | 10% | 59% | -31% | 15% | 36% | 25% | -12% | -44% | 121% | 157% | -75% |

| EOS | -32% | -31% | -8% | -20% | -66% | -8% | 50% | -11% | -48% | 30% | -2% | -72% |

| BNB | 8% | 53% | 9% | -14% | 55% | 124% | 24% | -3% | -4% | 94% | 27% | -52% |

| XTZ | -13% | 24% | -18% | -49% | -55% | 28% | 82% | -11% | -43% | 40% | 39% | -84% |

| XLM | -15% | 51% | -10% | -20% | -8% | 157% | 237% | 8% | -35% | 9% | 81% | -73% |

| LTC | -11% | 24% | 4% | -19% | -7% | 42% | 54% | -11% | -28% | 44% | 4% | -52% |

| TRX | -11% | 19% | 17% | -6% | 17% | 136% | 63% | 25% | 1% | 14% | 98% | -28% |

| Aggregate Mkt Cap | -5% | 16% | 24% | -19% | 11% | 96% | 46% | -4% | -14% | 63% | 119% | -64% |

| Aggregate DeFi* | -6% | 40% | 20% | -19% | 27% | 50% | 52% | -15% | -21% | 47% | 132% | -77% |

| Aggr Alts Mkt Cap | -15% | 34% | 25% | -34% | -5% | 72% | 47% | -13% | -15% | 58% | 90% | -64% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 10/31/25. BCH INCLUDES SV.

BTC was -4% in October and most every Alt faired worse, many significantly worse. ETH was -7%. SOL -10%.

The broad crypto market bounced significantly in the immediate days after the 10/10 crash, but then chopped the rest of the month towards the bottom of the range established from the 10/10 crash-

Source: TradingView. As of 10/31/25.

BTC has now been trading in this blue channel for three years, since the collapse of FTX. Price is up about 600% since those FTX lows-

Source: TradingView. As of 10/31/25.

Looking at BTC over the last year -

Source: TradingView. As of 10/31/25.

You can see this significant point of control at the white box around $110k. That level has been a battle of support and resistance all year. In the yellow circles, you see the big round number of the $100k level that’s been defended 5 consecutive times. BTC has not traded below $100k since it rebroke that level in early May. Finally, you’ll see in purple that BTC has struggled to spend much time at all above $120k. Supply seems to overwhelm demand around that level.

Many BTC bulls have been frustrated at BTC’s performance relative to Gold, which is +52% YTD vs BTC +17%. Below is the five-year chart of BTC/Gold-

Source: TradingView. As of 10/31/25.

You’ll see that BTC/Gold ran into resistance twice in 2025 at the same level as the peak of the last cycle. You can buy more Bitcoin with one ounce of gold today than you could at the peak of the last cycle. That’s actually kinda crazy when you think about how much good stuff has happened to BTC since then.

After a big bounce this summer driven by ETH DATs, ETHBTC has now sold off ~20% from the late-August highs, more or less in a straight line-

Source: TradingView. As of 10/31/25.

As mentioned earlier, it looks like the DAT trade is mostly dead for everyone except BMNR (who still bought an impressive $2.7bn of ETH in October) and to some extent MSTR (whose pace of buying has slowed drastically - $849mm in Sept, $89mm in Oct).

I cannot really articulate a compelling reason why ETHBTC would outperform from here. The fundamentals of ETH are not particularly good. BMNR bought billions of dollars of ETH over the last two months, and the ETH price was down 20%. So apparently billions of dollars a month of buying from BMNR hasn’t been enough to keep price heading higher or even flat. I suppose there’s a path where BMNR keeps buying billions every month and at some point, whoever is in the mood to sell ETH above $4k runs out of ETH to sell, and price can head higher. But I don’t think that’s the most likely setup.

You can see the struggle around $4k shown in the white box –

Source: TradingView. As of 10/31/25.

SOL is another name that has struggled with a big round number, $200 –

Source: TradingView. As of 10/31/25.

SOL got a proper ETF this month with Bitwise’s BSOL, and with staking to boot. Additionally, Grayscale’s closed-end SOL trust successfully converted to an ETF in October. BSOL put up solid numbers out of the gate. It is the most successful ETF launch of 2025.

Source: farside.co.uk. As of 10/31/25.

If the BSOL ETF inflows stay this good in the coming weeks, I would guess that will be pretty supportive of SOL’s price into year end. As a reminder, SOL’s market cap is 22% of ETH’s market cap. So a billion a month of inflows into BSOL should have a larger impact on SOL’s price than a billion a month into ETH ETFs. That said, I wouldn’t expect SOL to rocket to new ATHs and beyond in the near term, all else equal. I think SOL needs a new narrative. I’m not sure where that would come from at the moment. But if risk appetite stays buoyant, SOL should perform well just off the beta.

Aggregate crypto market cap excluding the top 10 (ticker “OTHERS”) is currently ~50% lower than it was at the peak of the last cycle –

Source: TradingView. As of 10/31/25.

OTHERS never quite made a new ATH this cycle. And the large majority of the constituent names in this index that were around last cycle badly underperformed, partially offset by new entrant names that performed better. At the current value of $250bn, OTHERS is significantly overvalued relative to the value being delivered by the projects that make up that $250bn. That $250bn could be cut in half and it still wouldn’t be cheap in any traditional sense. So I don’t see much to get excited about out of OTHERS.

Zcash was up more than 600% in October –

Source: TradingView. As of 10/31/25.

I wish I could tell you I had a logical fundamental explanation for this. But I don’t. I doubt it keeps going. I think you would probably be surprised by how little actual dollars buying ZEC it takes to pump the price that much.

HYPE, likely the hottest project of this cycle, has been struggling at the $50 level in 2H-25 –

Source: TradingView. As of 10/31/25.

24% of HYPE’s total supply is unlocking in November. My guess is we’ve seen the highs for HYPE.

SPX6900 was one of the “marquee” memecoins this summer. It’s down 60% from the highs and looking like a pretty challenged chart-

Source: TradingView. As of 10/31/25.

I’ll leave you with this table, which shows all cryptos listed on Binance with a market cap >$300mm. The table is sorted in descending order of YTD performance –

Source: TradingView. As of 10/31/25.

As you can see, there are very few names that outperformed BTC YTD and only a handful that are positive on the year. By the time you get to 20th best performing name YTD, it’s down 30% on the year.

So yeah. That’s not really what anyone thought they were signing up for in 2025.

Closing Remarks

The Black Friday crash was a gut punch to an already quite downtrodden crypto community. It’s not hard to understand why the mood is as sour as it is.

Source: TradingView. As of 10/31/25.

This is just not what anyone thought they were signing up for in 2025 with crypto. You could have just bought QQQ and gone to the beach all year and you would have done better, and in many cases, done much better. Unless you accurately bought dips and sold rips or you full ported HYPE, you’re probably flat-to-down on the year in crypto. That’s a tough pill to swallow in a year that’s supposed to be THE year for outsized crypto gains.

To make things worse, you now have a market full of anxiety due to the potential of “3 up 1 down” still being in play. This is a topic we’ve discussed multiple times here earlier this year. If crypto is still doing “3 up 1 down”, then it’s essentially already over right now. You should have sold a month ago. If you didn’t, you should sell right now.

As I have discussed here previously, I am not an outright believer of the “3 up 1 down” crypto cycle. It’s macro that mattered last cycle and it’s macro that will matter again this cycle. The Fed just cut interest rates another 25bps and announced the end of QT as of December 1st. The labor market is slowing while economic growth and inflation are hanging in reasonably well. But if you believe the work of global liquidity analyst CrossBorder Capital, it appears we are getting to the tail end of the global liquidity cycle, and liquidity conditions are actually set to tighten in 2026 –

Source: CrossBorder Capital. As of 10/27/25.

If global liquidity conditions do indeed tighten in 2026 and it pushes stock prices down from their currently highly elevated levels, you could see some version of “3 up 1 down” come to fruition for crypto in 2026. But once again, it would be a macro cycle disguised as a crypto cycle. Perhaps that’s why the coins have traded so crappy lately?

"Seeing once is better than hearing a hundred times.”

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS