June 2020 - Monthly Market Update

/Monthly Update || June 2020

“A riot is the language of the unheard.”

Opening Remarks

Greetings from inside Ikigai Asset Management¹ headquarters in Marina del Rey, CA. We welcome the opportunity to bring to you our twenty-first Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

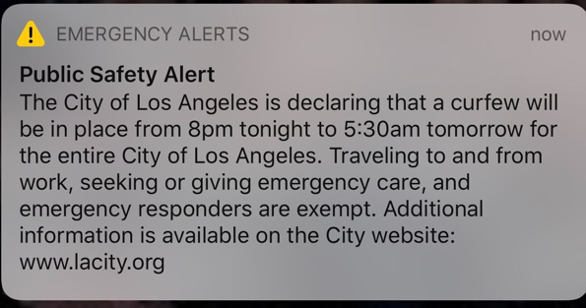

To that end, I sit here writing this in Venice, CA as helicopters roar overhead. Sirens, explosions, and gunshots have been coming at a steady pace for hours. Santa Monica and Venice both experienced significant looting today. A police officer was shot in the leg a few miles from me. The National Guard set up shop a few miles further. I took my gun out of its hiding place today and put it within arm’s reach. I’ve never done anything like that in my life.

To be frank, I’m having trouble finding the words to write this Monthly Update. It’s not that I don’t have anything to say about Bitcoin or crypto or macro. I’ve got plenty. They’re top of mind for me constantly. But it feels inappropriate to talk about that right now as our nation faces the weight of such profound and widespread anger. My heart hurts for these Americans who have been moved to protest. Tonight, the night of May 31st, significant rioting is occurring in more than twenty major cities across the United States. These riots are the offshoots of primarily peaceful Black Lives Matter protests that were launched nationwide in response to the George Floyd murder by police officers in Minneapolis.

The protests are occurring for good reason. The murder of Georgy Floyd was brutal and added to the long list of African Americans who have tragically lost their lives to unnecessary and criminal police force since Eric Garner was murdered in 2014. America is supposed to be the greatest country in the world. Why can’t we do any better than this?

George Floyd was a match thrown on an already fully built bonfire and that bonfire was built of more than just racial injustice. The rioting that metastasized from the Black Lives Matter protests appears to have almost exclusively been led by antifa and other radical groups. These groups proved to be stunningly well-organized and effective. They appear to have recognized an opportunity to inflict enormous havoc and seized on it. These radical groups appear to care little about the Black Lives Matter movement outside of using it as a vehicle to cause chaos. Antifa and other anarchist leaning groups are angry about something related to Black Lives Matter, but only broadly. I also have no doubt there were thousands of Americans that participated in rioting this weekend that never previously identified as antifa or anarchist. They were just flat out angry.

That broad anger. That is part of the Trust Revolution. Our society is losing faith in its institutions. That lost faith has happened at other points in our country’s history, but this time around is quickly growing to a severity not seen in decades.

It would be a fair question to ask – “did Corona contribute to the protests and riots, and if so, how?” Was it simply because people have been cooped up and are on edge? Is it 40 million unemployed? Is it financial market bailouts while small businesses are systematically disadvantaged? Is it the government’s response to Coronavirus? It’s all that and more. People are angry because, for an increasingly wide swath of Americans, the system is not working. For a significant portion of the United States, the ends were not really meeting before anyone ever said Coronavirus. Many of these Americans have become disenfranchised with how things are going in this country and Coronavirus was the tipping point. Significant change may very well be demanded from the people.

May Highlights

Paul Tudor Jones Takes Significant Bitcoin Position, Publishes Thesis

JPMorgan Extends Banking Services to Coinbase and Gemini Trust

Square’s Cash App Bitcoin Q/Q Volume Grows To $306mm from $178mm

Genesis Acquires Custodian To Launch Prime Brokerage Business

Genesis Loan Book Increases $2bn in Q1

BitGo Launches Prime Brokerage Business

Coinbase Acquires Tagomi for $70-$100mm

Coinbase Custody Begins Accepting Tether

ErisX Launches First CFTC Regulated ETH Future

FTX Launches US Exchange

Facebook Rebrands Libra Wallet from Calibra To Novi

Telegram ICO Cancels Project & Returns Funds to Investors

| Symbol | May | April | Q1-20 | YTD | Q4-19 | Q3-19 | Q2-19 | Q1-19 | 2019 | % ATH |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 9% | 34% | -11% | 32% | -13% | -23% | 164% | 10% | 92% | -53% |

| ETH | 11% | 55% | 3% | 78% | -28% | -38% | 105% | 6% | -3% | -84% |

| XRP | -5% | 22% | -10% | 5% | -25% | -35% | 28% | -12% | -45% | -95% |

| BCH* | -5% | 19% | 26% | 41% | -3% | -47% | 154% | -1% | 30% | -90% |

| EOS | -6% | 27% | -14% | 3% | -13% | -49% | 38% | 63% | 0% | -88% |

| BNB | 0% | 35% | -8% | 24% | -13% | -51% | 86% | 182% | 123% | -31% |

| XTZ | 1% | 70% | 20% | 107% | 49% | -3% | -12% | 129% | 192% | -28% |

| XLM | 4% | 66% | -10% | 56% | -26% | -41% | -3% | -5% | -60% | -92% |

| LTC | -2% | 19% | -5% | 10% | -26% | -54% | 101% | 99% | 36% | -88% |

| TRX | 4% | 31% | -13% | 19% | -8% | -55% | 36% | 25% | -29% | -94% |

| Aggregate Mkt Cap | 9% | 34% | -5% | 39% | -14% | -29% | 117% | 14% | 51% | -68% |

| Aggr Alts Mkt Cap | 2% | 42% | 4% | 52% | -16% | -40% | 68% | 18% | -1% | -83% |

Source: CoinMarketCap. As of 5/31/20. BCH includes SV.

| Asset Class | May | April | March | YTD | Instrument |

|---|---|---|---|---|---|

| Bitcoin | 9% | 34% | -25% | 32% | BTC |

| NASDAQ | 7% | 15% | -7% | 10% | QQQ |

| S&P 500 | 5% | 13% | -13% | -6% | SPX |

| Total World Equities | 5% | 10% | -15% | -10% | VT |

| Emerging Market Equity | 3% | 7% | -16% | -16% | EEM |

| Gold | 3% | 7% | 0% | 14% | GLD |

| High Yield | 2% | 4% | -10% | -6% | HYG |

| Emerging Market Debt | 6% | 4% | -15% | -7% | EMB |

| Bank Debt | 2% | 3% | -7% | -6% | BKLN |

| Industrial Metals | 4% | 1% | -10% | -13% | DBB |

| USD | -1% | 0% | 1% | 2% | DXY |

| Volatility Index | -19% | -36% | 33% | 100% | VIX |

| Oil | 35% | -43% | -55% | -75% | USO |

Source: TradingView. As of 5/31/20.

Closing Remarks

I’m not going to talk about Bitcoin, crypto or macro this month. I can’t bring myself to do it. I thought about not writing a Monthly Update for June or pushing it back a week. But I wanted to at least pay a small tribute to the magnitude of the pain being felt in America right now, even if its just in a little newsletter that maybe a thousand folks read.

There is a big question to be answered – “what long term changes are going to come about from Coronavirus?” There are many layers and vectors to that answer. I discussed some of them in detail on Pomp’s podcast May 22nd. That discussion focused on changes that may occur with regards to QE, MMT, UBI, strong dollar, inflation, China, generational divide, and politics. I believe courses of action have been set in place in the last three months on these various factors that will play out in the years and decades to come and will be some of the absolutely most important factors to shape our lives. Once these factors get moving in a direction, they become difficult or impossible to walk back.

There is now an equally big question to be answered – “what long term changes are going to come about from the protesting and rioting?” This is a more difficult question to answer. Partially because it is much newer than Coronavirus at this moment. We need to see how much longer the protests and riots go on to have a better sense of whether they will successfully affect large scale change in America. One complicating factor in assessing whether change will come about from the protests is that the powers in control of America right now are by and large strongly against much of the change these protestors are fighting for. The system currently in place that so many Americans are so deeply disenfranchised by is the system those in control created and will fight to maintain. Today in America, the Fed will purchase billions of dollars of Treasuries because the elites that run this country want their asset prices high. Today in America, those same elites will roll the National Guard out to confront the thousands of Americans begging for Black Lives to Matter. That is an untenable juxtaposition.

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2020 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS