June 2022 - Monthly Market Update

/Monthly Update || June 2022

“When you boil it all down, it’s the investor’s job to intelligently bear risk for profit. Doing it well is what separates the best from the rest.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our forty-fifth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that already has and will continue to fundamentally change the world – continuing to create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, May in some ways was the worst of times and the best of times. While Do Kwon’s Terra Luna algorithmic stablecoin experiment blew up in spectacular fashion – crashing the entire crypto market, vaporizing billions of dollars and eviscerating many crypto investors’ portfolios – Ikigai announced our first ever venture fund, raising $30mm from our existing hedge fund investors into a 10-year vehicle. In case you missed it, the press release is included below.

We launched Ikigai in December 2018 at the depths of the bear market, so perhaps it’s a good omen we’re launching our first venture fund now. The Trust Revolution Opportunities Fund is a notable departure from most of what we’ve done at Ikigai over the last few years. The primary way we’ve been deploying capital has been systematically trading Bitcoin to outperform holding Bitcoin on a risk-adjusted basis without much leverage. Pretty simply approach. We were good enough at it that it allowed us to scale up Ikigai and make sure we got to stay in the game. Which is important, because this asset class is going to outperform every other asset class over a 3/5/10-year horizon. I’m convicted of that. So we needed to make sure we were in the game. It was also easy for us to deploy that BTC trading strategy because we didn’t have to worry about publicly backing projects that would ultimately fail and cause regular people to lose a lot of money. That’s a topic we talk about a lot internally and a topic I’ve been discussing for years in these Monthly Updates.

We believe deeply in Bitcoin. That’s been true and remains true. It’s one of the most important innovations of the last 100 years, full stop. It has enormous potential to make the world a better place. It was an idea we could fully get behind. We are not BTC maximalists. We never have been. But over most of the last several years we just believed BTC’s value proposition was much more clearly defined than other cryptos. We no longer believe that, and we think other use cases in crypto can greatly benefit humanity too. If you’ve been following along for a while on these Monthly Updates, you’ve read about that progression we’ve had.

Through 2019/2020 we struggled to come up with compelling investment theses for most cryptos outside of BTC. Sure, names would pump to high heavens, but they often ended up crashing and producing limited/no lasting impact. We worried about publicly supporting that sort of thing. Many other funds have taken a different approach and that is totally fine. It might even be the more optimal approach. There is no innovation without failure and in crypto, innovation happens in a Cambrian explosion manner, with a high % of failure. Five different projects might provide slight incremental innovation but still ultimately fail just to get to the 6th project that provides the innovation that leads to a step-change in adoption. That’s just the nature of this ecosystem.

In the summer of 2021, we watched Axie Infinity change the world. That specific project may (or may not) prove to be a flash in the pan, but the innovation gave thousands of people in developing nations a living wage that might not otherwise have had it. That was a big deal for us. That was something we could get behind. That was objectively making a positive impact on humanity by leveraging technology. We started doing a lot of work on P2E, scholarships, guilds, et al and we were compelled by the long-term potential. We wanted to back these projects and others we strongly believed had the potential to make the world a better place. Those are multiyear commitments to projects, through thick and thin, and you need long-term capital for those sorts of investments.

We raised the venture fund from existing investors in the hedge fund because we liked the alignment. My business partner Anthony and I are the largest investors in the venture fund just like we’re the largest investors in the hedge fund. We like that alignment too. We figured our existing investors, through the relationship we have with them, would best understand how we think about risk, why we were making this move towards early stage and why now. $30mm is a rounding error compared to a lot of funds, but it’s a perfect place for us to start. We wanted alignment across our investor base and to be the best stewards of capital possible. We want to ensure we can tangibly support projects we believe in. We’re in this for decades. We want to set ourselves and the projects we partner with up for the highest chance of success.

Our mandate is broad within Web3. We expect to be spending a lot of time in metaverse, X-to-earn, gaming, gamefi, DAOs, NFTs and whatever else hasn’t been invented yet. We can be first money in or partner with projects further along in their lifecycle. We will back teams and projects that can make the world a better place. Projects that are leveraging technology to empower humanity rather than the other way around. We believe “X-to-earn” will redefine the concept of work in the coming decades. It’s the top of the 1st inning.

We will be wrong often - statistically wrong more often than we’re right. We will always do our best to clearly lay out the many risks associated with the early stage Web3 investments we’re making. Most will likely fail and we’re cognizant of that. We will do our very best to not dump on retail at their expense. This is important to us. Selling assets out of an investment fund is inevitable, but we are making multiyear commitments to projects we believe in. If our thesis changes, we will do our best to communicate that. We are asking for trust from this ecosystem that we love so dearly and believe in so strongly. And we know that is a big ask. We hope that we’ve earned trust so far through our words and actions, trust that we’ll do our best to do our little part in pushing this whole thing a couple steps in the direction of driving societal change for the good through decentralization. That’s why we named it Ikigai.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

May Highlights

Ikigai Enters Web3 VC - Raises $30mm Venture Fund from Existing Investors

Algorithmic Stablecoin Project Terra Luna Implodes in Spectacular Fashion, Vaporizing Billions of Dollars

Vitalik Buterin Says ETH Merge Will Happen August - October

A16Z Raises $4.5bn Crypto Fund

A16Z Raises $600mm Gaming Fund

Standard Crypto Raises $500mm VC Fund

Chainalysis Raises $170mm Series F at $8.6bn Valuation, Led by Singapore Sovereign Wealth Fund

NFT Blockchain Flow Launches $725mm Ecosystem Fund

KuCoin Announces $150mm Series B at $10bn Valuation

StarkWare Raises $100mm Series D at $8bn Valuation

Elliptic Raises $60mm Series C Led by JPMorgan

Facebook (Meta) Partners with Polygon on NFTs

Instagram to Support NFTs on Ethereum, Polygon, Solana and Flow

32 Central Banks and 12 Financial Authorities Meet in El Salvador to Discuss Financial Inclusion and Bitcoin

El Salvador Buys 500 BTC at $30,744

Federal Reserve Survey Finds 12% of US Adults Hold Crypto

Cloudflare To Begin Staking on Ethereum

FTX Expands into Stock Trading

FTX Proposes New Crypto Regulatory Framework for CFTC, Testifies Before Congress

Sam Bankman-Fried Buys 7.6% Stake in RobinHood

David Marcus, Former Head of Facebook’s Libra, Launches New Company Lightspark to Build Out Payment Functionality on Bitcoin

Coinbase Adds Bankruptcy Disclosure to 10Q, Spooking Customers

BitMEX Founders Fined $30mm, Avoid Jail Time

China Crypto Mining Reemerges Despite Government “Ban”

Terra Luna Founder Do Kwon Faces Inquiry, Prosecution Over Project Collapse

| Asset Class | May | Apr | Q1-22 | YTD | Q4-21 | Q3-21 | Q2-21 | Q1-21 | 2021 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -16% | -17% | -2% | -31% | 6% | 25% | -41% | 103% | 60% | 303% | BTC |

| NASDAQ | -2% | -14% | -9% | -23% | 11% | 1% | 11% | 2% | 27% | 48% | QQQ |

| S&P 500 | 0% | -9% | -5% | -13% | 11% | 0% | 8% | 6% | 27% | 16% | SPX |

| Total World Equities | 0% | -8% | -6% | -13% | 5% | -2% | 6% | 6% | 16% | 14% | VT |

| Emerging Market Equity | 1% | -6% | -8% | -13% | -3% | -9% | 3% | 4% | -5% | 15% | EEM |

| Gold | -3% | -2% | 6% | 0% | 4% | -1% | 3% | -10% | -4% | 25% | GLD |

| High Yield | 1% | -5% | -5% | -9% | -1% | -1% | 1% | 0% | 0% | -1% | HYG |

| Emerging Market Debt | 0% | -7% | -10% | -16% | -1% | -2% | 3% | -6% | -6% | 1% | EMB |

| Bank Debt | -2% | -1% | -1% | -5% | 0% | 0% | 0% | -1% | -1% | -2% | BKLN |

| Industrial Materials | -3% | -8% | 16% | 3% | 8% | 2% | 8% | 8% | 29% | 16% | DBB |

| USD | -1% | 5% | 3% | 6% | 1% | 2% |

-1% | 4% | 6% | -7% | DXY |

| Volatility Index | -21% | 64% | 19% | 53% | -26% | 46% |

-18% | -15% | -24% | 66% | VIX |

| Oil | 11% | 4% | 36% | 57% | 3% | 5% | 23% | 23% | 64% | -68% | USO |

Source: TradingView. As of 5/31/22.

Introductory Thoughts On Crypto Gaming

Guest Author: Ikigai Researcher Odette Wu

The Ikigai team has committed significant time and effort researching the crypto gaming vertical since summer 2021. We remain optimistic and bullish on this vertical, although it has cooled down a lot and many assets have dropped by more than 90% from their all-time high price. This monthly discusses why we remain bullish on crypto gaming, presents an industry map, and shares our mental model for in-game innovation.

Section 1: Why are we long-term bullish on crypto gaming?

Crypto Gaming Has A Potentially Huge TAM

In 2020, China was the largest gaming market in terms of annual revenue ($40.85B), followed by the United States ($36.92B) [Statista]. In 2021, the global gaming industry had an estimated annual revenue of $201B, and this number is predicted to reach $435B by 2028 [Zion Market Research]. If crypto gaming can take only 1% of the pie, this vertical can generate billions of revenue every year in the coming decades.

In 2021, there were an estimated 3.24B gamers globally. In Asia, the number is 1.48B, making it the largest video gaming market in terms of player count [Statista]. Asia was also the region with the largest number of online users – over 2.8 billion at the latest count [Statista]. Asia will remain fertile ground for crypto gaming to flourish. For example, crypto gaming has been offering a stream of income to residents in the SEA region, as evidenced by the rise of Play-to-Earn. These games may provide alternative employment opportunities for billions of people in the SEA regions and beyond.

Initial Success Story: Axie Infinity Proved That P2E Can Work

Axie Infinity is a digital pet (called “Axies”) battle game where anyone can Play-to-Earn through skilled gameplay, and it is the only game that has hit scale to date. The game, at its peak, had almost 125K unique monthly active wallets, with Day 30 and Day 90 retention rate fluctuating at the 40-60% range.

Tens of thousands of people in the Philippines were able to make a living or supplement their income through P2E [P2E Documentary]. We at Ikigai sponsored a first year college student to play various games, and this, we are happy to share, has provided him with a stream of income for food and essentials [Jihoz] [Dapp Radar]

Primary Market Interests

The past few quarters have witnessed very high primary market interests in the crypto gaming vertical. This deal type often ranks the highest in terms of number of deals funded, and consistently accounts for a high % funding allocated. [The Block Research]. In total, $4.51B has been allocated to the crypto gaming space this year alone [Dapp Radar].

Improving Infrastructure

Some crypto games are already built on high-throughput and low-transaction-cost blockchains, such as ImmutableX, Polygon, Binance Smart Chain, Wax, et al [Dapp Radar].

On the other hand, custodial platforms are being developed to streamline the user onboard process. A good example is Stardust, whose services include wallet/private key management and fiat onramps. Apart from third-party custodial providers, game developers with a Web2 background are also building their unique user-friendly onboarding processes.

Pushing Factor From Web2

Advertisement revenue - which has been a core revenue model for many Web2 mobile games - has dropped significantly since Apple changed its Identifier for Advertisers (IDFA) last year [Apple] [Venture Beat]. Abuses and predatory labour practices from the Web2 gaming industry have become a global phenomenon. There have been allegations of sexual assaults, inhumane working hours and unjustified firing/layoff [SCMP] [Washington Post] [Wired].

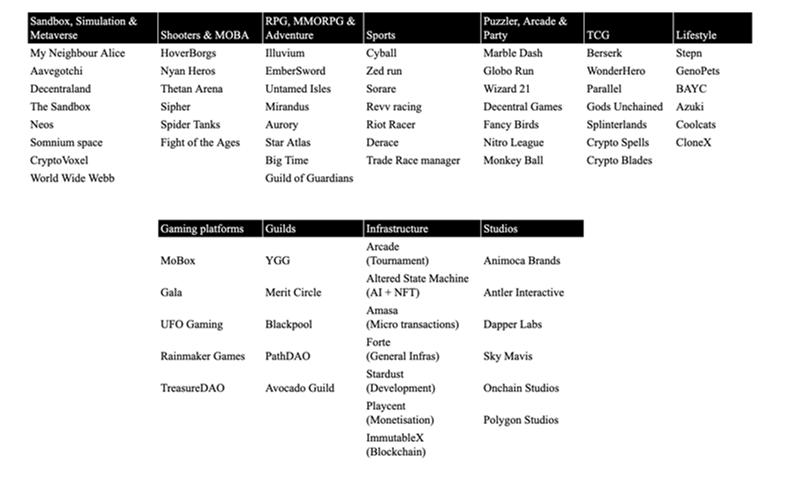

Section 2: Crypto Gaming Industry Map

This industry map has two parts. In the upper part, we categorise games by genre - citing popular web2 gaming genres. We didn’t divide the game by the blockchain on which it was built, because many games are now multi-chain - e.g. having NFTs on Polygon or Arbitrum, and having token staking on the mainnet. The lower part are gaming platforms, guilds, infrastructure and studios.

Below is a definition and discussion of one example for each category/genre.

Sandbox, Simulation & Metaverse

This genre features an open-ended mode. It’s often associated with player choice, open environments, and nonlinear, open-ended gameplay. Players often have less concrete goals or narrative pathways to pursue, and this encourages discoveries and experimentations, drawing players into immersive experiences. The Sandbox is a virtual world where players can build, own, and monetize their gaming experiences powered by digital asset NFTs.

Shooters and MOBA (Multiplayer Online Battle Arena)

In this genre, you often have a factional alignment and typically control a single character to compete in a multiplayer setting against other human players and pursue a set of victory conditions. Thetan Arena is a skill-based esport game MOBA, and Nyan Heros is an immersive NFT-based shooter game.

RPG, MMORPG, Adventure

In an RPG, you control a character which you can then level up through experience points in various open-world or sandbox adventures. Ember Sword is a F2P MMORPG with a player-driven economy, a classless combat system, and scarce, tradable cosmetic NFT collectibles.

Sports and Fantasy Sports

This genre is self-explanatory. Sorare is a fantasy soccer game, where players act as soccer managers and compose virtual teams. Teams are ranked according to the performance of their players on the real-world soccer pitch.

Puzzlers and Party Games

These games often include multiplayer elements, and puzzles and different themes are built into the adventure narrative and setting, making them a key game mechanic. Fancy Birds is an example party game where you control a bird and fly as far as you can.

TCG

Trading Card Game (TCG) is a card game that combines strategic deck building with features of trading cards. Gods Unchained is an online P2E TCG.

Lifestyle Games

Some video games double as lifestyle platforms. Developers update, expand, and improve the gaming contents over time that gives you an experience related to real life, such as exercise, fitness, beauty, diet, etc. Stepn is a move-to-earn game with socialfi and gamefi elements, where players, equipped with shoe NFTs, can make token incomes by walking, jogging or running outdoors in real life.

Section 3: Mental Model for In-game Innovations

The downfall of Axie Infinity we witnessed is due to a persistent oversupply of farmed tokens and its built-in reflexivity in all moving parts of the in-game economy. This highlights the need for careful in-game economic designs. In this section we share a mental model for thinking about innovations in game.

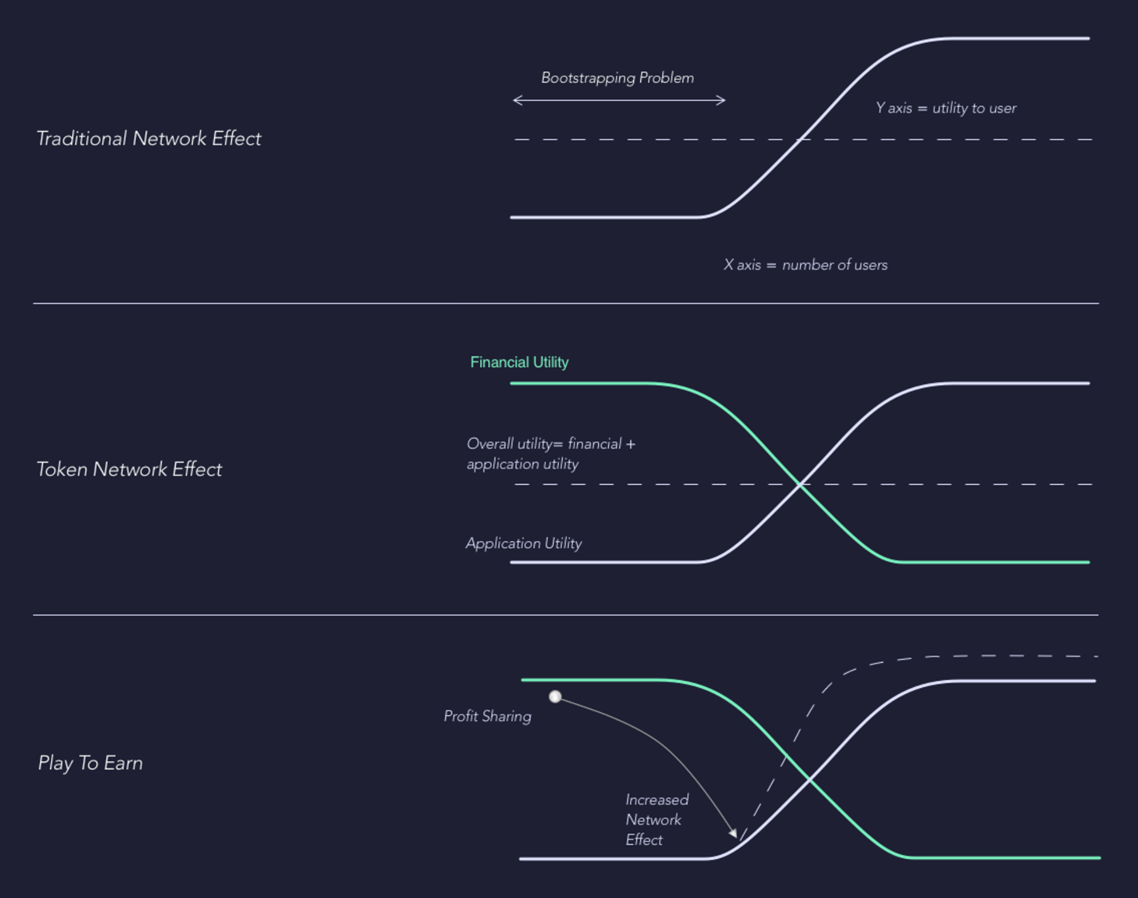

The graphic above, initially presented in the Ikigai Trust Revolution Opportunities Fund pitch deck, illustrates what a step change the P2E revolution can be. Applying this model to economic innovations in crypto gaming, we can categorise innovations into two types with different goals.

These two types of innovations are compatible with each other and stress different utilities of in-game assets. Generally speaking, it is easier to pump (short-term) financial utility. But only by strengthening the application utility can an in-game economy be sustainable and serve the long-term interests of all stakeholders.

The path from financial innovation to gameplay innovation is crucial and can be a “Great Filter” differentiating successful games from failed ones. It is important for projects to work on adding real utilities and integrations to their in-game assets, in a manner that is tied to the game mechanics. It is very dangerous for the team and investors and other stakeholders to stay complacent when the token price is high.

A good economic design is not a silver bullet, and a strong in-game economy is in service of the fun part. The economy alone is not the main goal of the game. The game itself must be fun to play, such that there are real for-fun players that generate sustainable & organic demand for native assets. Projects whose application utility cannot pick up will die, and its financial utility will converge with its real utility at zero.

Market Update – Liquid Crypto Asset Investing

Guest Author: Asher Montague-Warr

| Symbol | May | Apr | Q1-22 | YTD | Q4-21 | Q3-21 | Q2-21 | Q1-21 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -16% | -17% | -2% | -31% | 6% | 25% | -41% | 103% | 60% | 303% |

| ETH | -29% | -17% | -11% | -47% | 23% | 32% | 19% | 160% | 399% | 469% |

| XRP | -28% | -28% | -2% | -49% | -10% | 31% | 23% | 161% | 278% | 14% |

| BCH* | -26% | -27% | -13% | -53% | -13% | -6% | -11% | 45% | 6% | 71% |

| EOS | -32% | -28% | -7% | -55% | -23% | -5% | -14% | 85% | 17% | 1% |

| BNB | -15% | -12% | -16% | -37% | 32% | 28% | 0% | 708% | 1269% | 172% |

| XTZ | -17% | -32% | -14% | -52% | -28% | 100% | -37% | 142% | 116% | 49% |

| XLM | -11% | -26% | -15% | -44% | -4% | -1% | -31% | 220% | 108% | 184% |

| LTC | -29% | -22% | -16% | -53% | -4% | 6% | -27% | 58% | 17% | 202% |

| TRX | 34% | -15% | -2% | 12% | -16% | 31% | -26% | 244% | 181% | 101% |

| Aggregate Mkt Cap | -23% | -19% | -5% | -40% | 13% | 33% | -23% | 146% | 186% | 301% |

| Aggregate DeFi* | -51% | -23% | -8% | -65% | 29% | 64% | -27% | 339% | 581% | 1177% |

| Aggr Alts Mkt Cap | -28% | -20% | -7% | -46% | 19% | 40% | 1% | 246% | 479% | 274% |

Source: CoinMarketCap. As of 5/31/22. BCH includes SV. Aggregate DeFi from Coingecko.

Bitcoin is in consolidation after the longest reigning consecutive red weekly candles in Bitcoin history! The old adage among wall-street folks of “sell in May and walk away” was more relevant this year than any other year in recent memory. May was a brutal month for most participants, and the general sentiment among the crypto sphere has become strongly pessimistic. At the moment, BTC finds itself in a sideways market, in a potential range between $25,350 and $33,000. The big question on everyone's mind is, have we bottomed or are we just gearing up for a bear market rally with lower levels to come? Let’s dive into the technicals and see!

Key Points

Bitcoin is yet to complete a full 5 wave structure and is probably at the end of its wave 4 with another wave down to come

Bitcoin made an equal measured move from the bear flag down to 26k

Fear and greed index shows highest levels of fear since the covid crash

Aggregate funding for all coins showed some bullish signs but is quickly turning neutral

Open interest aggregate hit a key support level but is ramping fast for this move

Possible deviation pattern happening on bitcoin

DXY is a possible distribution schematic, but we need to closely monitor the development to gather a better understanding on the schematic and its validity

SPX is in a channel and is bouncing off of the lows

Source: Tradingview. As of 5/31/22.

Above we can see our equal measured move, as stated in last month’s newsletter, is now complete. We are currently hitting an important demand zone, but one thing that is missing is a final 5th wave down. I think that will likely materialize in the coming weeks and I have marked out the potential wave structure on the chart above. My expectation is we at least see a double bottom at some point or an extended 5th wave that would lead us to lower prices. BTC is often described as a coiled spring and when you’ve had this long of a down trend, it’s usually getting ready to expand in the opposite direction, but this could still take time.

Source: Tradingview. As of 5/31/22.

In the chart above I have marked out the deviation at the top and at the bottom of the range. The orange pattern is a replication of the top deviation pattern except in reverse. Bitcoin often repeats patterns so we could see something like this happen where we raid the range highs at ~$30k-$33k then come all the way down to make a double bottom.

The Fear and Greed Index shown below is supporting the thesis that a bottom is close. Historically these are great moments to be leaning in and paying attention to the market, whilst a lot of fearful and weak hands are leaving.

Source: Alternative.me. As of 5/31/22.

Aggregate funding rate for all coins, shown below, looks to be presenting a setup for a bottom here. We can see sentiment has turned very bearish and the market has been aggressively shorting. One caveat is that aggregate funding rates are currently turning from extreme negative to neutral, which isn't typically what you want to see for a sustained price rally.

Source: Coinalyze. As of 5/31/22.

Source: Coinalyze. As of 5/31/22.

Shown above is Aggregate Stablecoin-margined Open Interest. The six-month price decline took OI from a record $11bn down to $5bn at the lows, including a sharp $3bn OI decline during the crash in May. These are the types of “OI wipes” that can often be indicative of a capitulatory bottom. There just one problem - we have already bounced back to $7bn with BTC only bouncing ~25% from the lows. When comparing this to prior bounces after price crashes, it appears traders may be a bit too enthusiastic here. Whenever that happens, a price rally may prove unsustainable. This adds to my thesis that we could be due for yet another move down to curb some of that enthusiasm.

Source: Tradingview. As of 5/31/22.

As mentioned last month, we have been keeping a keen eye on the DXY as a key indicator for BTC’s direction. Shown above, it appears we could be in a decade-long distribution schematic. It’s a very big timeframe call to make and it’s currently only partially through the potential structure. If this schematic does indeed play out, we are currently sitting at the highest levels of the DXY for the next several years, before making one more higher high in the back part of this decade. If we are currently witnessing an Upthrust (UT), the DXY is poised to pullback meaningfully from here. This would likely be an ideal backdrop for BTC and crypto broadly to move much higher in coming years. We will be watching closely to see how this potential distribution schematic develops.

The SPX is off to a historically poor start of the year, one of the worst ever in fact. If history holds, we are likely to see higher prices than current at YE-22, and potentially much higher.

Source: Tradingview. As of 5/31/22.

Shown above, the SPX seems to be in a downward channel and has bounced off of the bottom of this channel in the last week. We are currently sitting just above the middle point of the channel at the 0.382 fib where we are likely to see a pull-back before potentially heading up again to the top of the channel. The correlation between BTC and equities is still really strong, so it would make sense to see a near-term pullback and then further upside in June. It’s too early to call what might happen if and when SPX gets back to the top of downward channel.

Summary

While there are some positive developments in terms of price action, it doesn’t seem like we’re completely out of the woods yet. We’re going to have to wait and see how inflation and economic growth indicators materialize in the coming weeks/months and how the Fed reacts to that data. A lot of bulls are basing their bullish thesis on a presumed backdrop of poor economic data and the hope of the Fed making a pivot towards less tightening. For the moment, that scenario is not clean, and we are playing the charts level by level. We believe in the current scenario patience will pay off in the long term. The safest option would be to wait for a clear bottom and accumulation range to reveal itself. The good news is that we could see some relief after the final 5th wave down - that would be the moment to lean in and pay close attention.

Closing Remarks

May was a rough month for our beloved ecosystem as the 6th largest crypto asset and the 3rd largest stablecoin evaporated over a matter of days. Bitcoin is 55% off its highs from six months ago and the same price it was in December 2020. The aggregate crypto market cap declined 23% in May is now down 40% YTD. DeFi in particular was eviscerated, with the Coingecko DeFi sector down 51% in May and down 65% YTD. The mood of the ecosystem, if Crypto Twitter is any gauge, has turned deeply sour with bitter infighting, accusations (both warranted and unwarranted), and name-calling.

There’s no way we’ll ever know what the exact price action would have been around the Luna implosion if the macro backdrop was one of the Fed cutting interest rates and juicing QE, rather than raising interest rates and beginning QT. But it’s safe to say the crypto market reaction would have likely been much less draconian. So at the moment we’re experiencing a tough macro backdrop and a legitimately nasty micro event. It’s no wonder the collective mood is so bad!

At times like these, reflection and contemplation are worthwhile, even more so than usual. Individual reflection and contemplation roll up to the collective, and some sort of change is often the result - hopefully for the better. So what sorts of collective reflection and contemplation might we have right now, in light of this tough month?

Do Kwon’s attitude and communication towards the market is worth thinking about. Is that how we want leaders of major projects to act? Is that in the best interest of the ecosystem? There’s a fine line between a visionary and a psychopath. Steve Jobs and Ted Kaczynski. We need boldness in this ecosystem, but at what price?

“Ponzinomics” are worth thinking about. What, if any, place do they have in our ecosystem? Has any good come from any projects that have had any aspect of Ponzinomics? Can Ponzinomics be innovated upon and eventually lead to a step-change in adoption while making the world a better place? Is there a way to better protect everyday investors from the inevitable implosions of failed experiments?

What is the actual point of DeFi is worth thinking about. What does DeFi have to show for itself at this point? Where is the innovation that’s occurred thus far heading? Will governments actually allow a decentralized, KYC-free financial system to exist and flourish? Can governments stop it even if they wanted to?

The frequency and mindspace of meritless projects are worth thinking about.

The incentive structures in place to produce meaningful innovation versus get-rich-quick pump-and-dumps are worth thinking about.

What do you need decentralization for and how decentralized is decentralized enough are worth thinking about.

Things that at first glance look like gimmicks, scams or worthless projects but actually lead to incremental innovation that leads to eventual step-change innovation are worth thinking about.

Retail investors losing so much they get turned off to the ecosystem forever is worth thinking about.

“Community” being touted as the only thing that really matters while the largest, most sophisticated investors constantly win at the expense of said community is worth thinking about.

Innovating on human coordination to empower humanity is worth thinking about.

All of these topics and more have been particularly top of mind for us as Ikigai enters Web3 venture investing for the first time. I won’t pretend to have all the answers or even any answers, but we’re definitely doing our own reflecting and contemplating as we wade into the wild world of early stage crypto. We want to do right by our investors and do right by this ecosystem and do right by humanity, simultaneously. I doubt that will prove to be an easy task to accomplish all the time, but we’re here for it.

“The mouth is the source of disaster.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS