Stablecoins - The Good, The Bad, and the Terra UST

/Stablecoins, why do they exist? What purpose do they serve? Are they a necessary evil? How do they work? Let’s explore!

Back in 2018, I wrote a scathing article about the stablecoin Tether entitled “The Tether Death Spiral.” At this time, the entire market capitalization of ALL stablecoins was a mere $2b; which seems laughable by today’s standards. Tether had claimed to be fully backed by US Dollars, and yet a series of shenanigans had made it seem more and more likely that the entire project was a Ponzi Scheme set to explode like a ticking time bomb. Perhaps the most alarming revelation was that the price of Bitcoin on Tether-Only exchanges traded $500-$1,000 higher than exchanges where you could move in US Dollars. And then this happened

Of course we know now that Tether did not die (or at least it hasn’t yet), and in fact has grown by orders of magnitude over the last four years. But back then, nobody really understood what to do with a stablecoin. Let me start with my first realization, when my thinking started to evolve.

Let’s say you notice that BTC is trading for $29,000 on one exchange (exchange A), and $30,000 on another exchange (exchange B). How could you profit from this? Well you would first move some money onto exchange A, with the lower price. But that involves transferring cash from your bank. So you move in $29,000 USD and if you’re lucky, that happens quickly and you can buy a Bitcoin at the lower price. But now what? Next you’ve got to move that BTC to the exchange with the higher price and sell it. Let’s say you do that and everything works out like you planned. You just made $1,000. But now you want to do it again. But that’s when you realize there’s a problem. You can’t move USD from exchange B to exchange A because they don’t support that, or if they do the process takes a week or more. You could withdraw to your bank, and then move those funds back to exchange A but that’s two transactions that have to be cleared and God forbid it’s the weekend. By the time you get the money back to exchange A, your window of opportunity has closed.

Now enter stablecoins. If you could move USD (or something like it) between exchanges without having to go through the traditional banking system you could have your money in minutes or perhaps an hour. That’s a pretty important difference when there’s $1,000 on the table for each time you transact. It could add up quickly, and $1,000 differences in the price of coins, even BTC, didn’t used to be that rare. This arbitrage function is one of the ways that crypto has started to mature, even if the instruments themselves have been rickety or downright unstable at times.

Since 2018 a lot has changed. These days stablecoins have found use cases ranging from esoteric, like flash loans and complex multi chain staking/swapping mechanisms, to the good old fashioned use cases like circumventing capital flow controls from countries without freely traded national currencies. And the results of these use cases have ranged from incredible, to criminal, and off into places I’m still trying to understand.

And just look at ‘em go! From a total market cap of only $1m USD in 2016 to over $150b just six years later. That’s 150,000x growth in six years (chart in log scale).

Source: https://charts.coinmetrics.io/

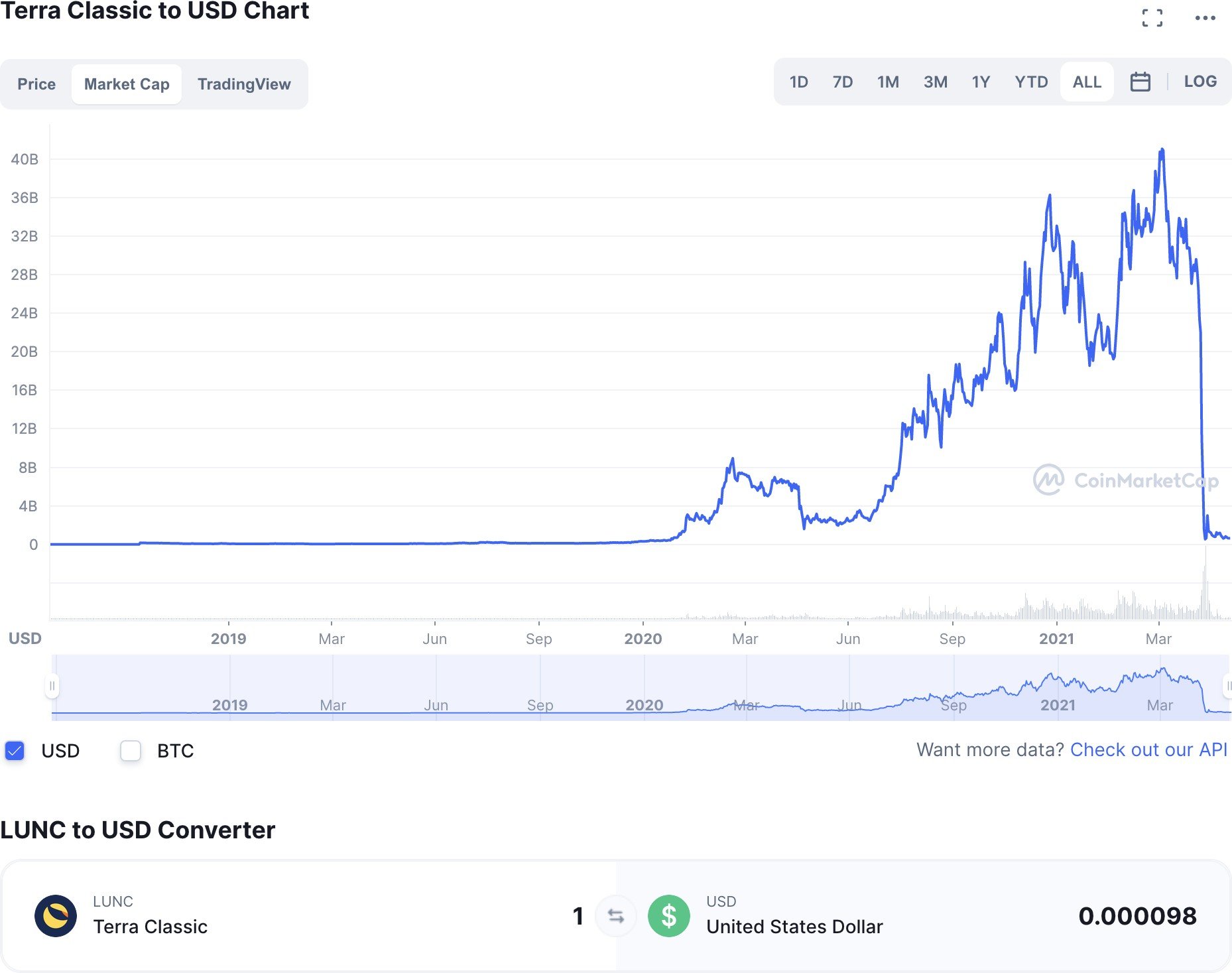

Most of you are probably aware that in the month of May, one of the largest stablecoins did in fact implode, taking with it another popular token that was meant to help maintain its peg. These two tokens are of course TERRA/LUNA and UST. The scale of this implosion dwarfed anything that I had dreamed in 2018, and yet all told - the ecosystem has taken this in stride.

All in all that’s nearly $60b that just vanished overnight.

Luckily for the crypto ecosystem as a whole, there are many stablecoins out there with a variety of mechanisms to keep them pegged to their $1 target. Luna was not the largest, even though it was on pace to battle for the crown before all hell broke loose. Today Tether is still the top dog with over $72b in market cap, but USDC and BUSD both garner respectable sums of $6-$7b.

The details of what exactly went wrong with UST are too in-depth for this short conversation, but the bottom line was that the pegging mechanism was too complex and people figured out how to exploit it at a time when the market was already on pins and needles. The rest is history.

So where do we go from here? Probably the biggest development on the stablecoin front was that the TERRA/LUNA/UST collapse drew the attention of none other than Janet Yellen, former head of the Federal Reserve and now Treasury.

There has been mention of stablecoins from Jerome Powel, and several other officials as well. But these comments have been centered around the need to research, understand, and possibly implement some kind of government-backed digital dollar.

We really shouldn’t be surprised by these developments, because the government is not capable of innovation on its own. But it still amazes me how far the crypto space has come from a bunch of scrappy coders and a few scoundrels to the mainstream with such incredible velocity. Not only has crypto already started to reshape the global economy and markets, but I believe the majority of the impact is still to be felt. We all have a part to play. And that’s what drives me to keep digging deeper into understanding what’s really under the hood, and what’s around the next corner.

Thank you,