May 2025 - Monthly Market Update

/Monthly Update || May 2025

“The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our eightieth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, April was another macro-dominated month and a month that ended MUCH better than it began. April can be summarized with one word and one word only – tariffs. Tariffs have been the headline issue for a while now – we talked about them in Feb and then in more detail in March. But that was just the leadup to the actual tariff event – April 2nd, dubbed “Liberation Day” by Trump. He got up to the podium in the Rose Garden at the White House and dropped this zinger –

The reciprocal tariffs imposed on ~90 countries were MUCH higher than pretty much anyone was expecting, and the market REALLY didn’t like that. The market had already been trading risk-off in advance of Liberation Day, but things got quite pukey immediately after the announcement. NASDAQ traded off 17% at the lows in the first three sessions after Liberation Day. VIX went from 21 to 60 in those same three sessions. Treasury market volatility picked up meaningfully. Yields were tighter in the first couple days but then started eerily widening. The US10Y yield went from 3.9% to 4.2% in a single session on Monday April 7th.

This one-week period of time, from April 2 to April 9, was probably the most stress we’ve seen in the market since Covid. Certainly right up there with SVB collapse contagion and Yen carry trade unwind. Trump managed to instantaneously introduce a pretty stunning level of uncertainty into the market. For a handful of days. the market really had no sense of how to think about these tariffs – would there be exceptions? How long would they last? How would the tariffed countries respond? Powell was mostly silent on the matter, stating that the tariffs were larger than expected, could drive increased inflation, and that it was too soon to say what the monetary policy response might be. To make matters worse, China issued retaliatory tariffs equal to Trump’s imposed tariffs just two days after Liberation Day. Canada, Mexico and the EU also announced reciprocal retaliatory tariffs in the immediate wake of Liberation Day. It was a full-on tariff war.

By Monday April 7th, amidst peak fear, Bessent got on Fox News and said “50, 60 maybe almost 70 countries” had reached out to negotiate terms of a tariff reduction. He specifically said it’s “going to be a very busy April, May, maybe even into June”. This was the first time (to my knowledge) that the Trump admin had given the market SOME sort of timeline with how to think about this tariff situation. Bessent said negotiations had already started with Japan.

On the morning of April 9th, Trump dropped this (in hindsight totally insane) tweet

Just a few hours later, we got this bombshell-

And the market did a monstrous inverted nuke. The VIX was -35% - the largest single day decline in the VIX ever. The NASDAQ had its second largest daily increase ever. The SPX had its third largest daily increase ever. You can’t really overstate the magnitude of the sigh of relief collectively breathed by the market in that moment. After being down as much as 14% on the month, the NASDAQ closed April up 1%. After being as high as 60, the VIX closed April at 25.

As of April 30th, no official trade deals have been announced with any countries, but the US is said to be in active negotiations with at least 15 countries, including India, Japan, South Korea, Canada and Mexico. EU has been somewhat more reluctant, but there seems to be progress being made there as well.

China continues to be the sole major outlier in this ordeal. The US and China have both announced tariff exemptions for certain goods, somewhat alleviating near-term concerns. There appears to be at least some amount of discussion occurring between the US and China, but even that is contested.

There was no shortage of opinions from pundits on this whole situation as it unfolded. There is disagreement about the underlying drivers of how the events unfolded in early April. Like so many things, the opinions are mostly divided over people’s opinions of Trump himself -

If you have Trump Derangement Syndrome, you were apoplectic over the stress in the market. You viewed the Liberation Day tariffs as an utterly foolish blunder and an incredibly risky misstep that crashed the market and was going to crash the market further had Trump not announced the reciprocal tariff relief. You viewed the Treasury market as being days away from imploding, and Trump being forced to walk back his tariffs only a week after their announcement, to avoid complete catastrophe in the markets. You view his administration as being in shambles – divided and incompetent. You view him as historically unpopular at the current time and you are certain Republicans are going to get smoked in the mid-terms and this whole Trump experiment, including the disastrous tariffs, will be looked upon by history as a tremendous mistake.

If you have a more constructive or at least hopeful view of Trump and his administration, you view the tariff saga as being in line with what he said he was going to do, and in line with what he has often done previously. Trump employs confusion and chaos as a negotiating tactic – classic Art of The Deal type stuff. Trump moves one side of the goalposts way out so that the eventual compromise in the middle gets moved to his side – classic Art of The Deal type stuff. Admittedly, for various reasons, Trump’s communication style can be difficult to glean insight from. Bessent’s communication style is MUCH easier to actually glean insight from. He is a lifelong markets guy and talks like a markets guy - so listen to what he says. If you are TDS-free, you might look at the current situation and say, “it kinda looks like every country on planet Earth that matters has already come to the table, other than China. And now China is isolated in its negotiation position.” You might say, “there was near-term stress, but the whole thing bounced hard and the markets look fine from here.” You might say, “what Trump is trying to accomplish is tremendously difficult to pull off and also tremendously necessary for the betterment of America, and thus requires highly strategic and even daring action to achieve the end goals.”

Exact same situation. Two polar opposite takes, depending on being TDS-afflicted or TDS-free. Funny how things work like that sometime.

The last thing I’ll say on the matter is this. The whole thing felt like obvious theater to me. Kabuki theater. A public display of pretend actions that mask the actual workings underneath the surface. I’ll point out a couple things to prove my point -

Trump announces the high reciprocal tariffs on April 2nd. Huge uproar. A bunch of countries are pissed. Within days, you have rumors that Japan has already reached out to negotiate. Five days after Liberation Day, Bessent says 50-60-70 countries have reached out. By the time Trump puts a pause on the higher tariffs on April 9th, Bessent says they’re just soooo overwhelmed by countries wanting to deal. Bessent is shocked at how completely inundated he is - 75+ countries coming hat in hand to negotiate. And it’s just soooo much, that they need to pause the tariffs for 90 days to get these deals worked out….

That is fake. That characterization makes zero sense. Trump talked about tariffs for a YEAR before he got into office. After he won the election, the tariff rhetoric was ratcheted up, and after the inauguration it was ratcheted up further still. About 2/3 of the countries on planet Earth do WHATEVER America says. We say jump, they say how high. This is the way of the world with a US hegemony. We have diplomats in every country on Earth except North Korea, Iran, Bhutan and Syria. With our major trading counterparts, our dialogues are constant. Of course they knew this was coming! Maybe they didn’t know the exact details, but they knew tariffs were coming and they knew that there would be room for dealmaking immediately thereafter. This was true for every single country, even for China.

The China aspect of this deal has always been the elephant in the room. Much tougher negotiating counterpart. Much more leverage against the US. They’re a Communist country so they can play by very different rules. And saving face is more important for Xi than any other world leader involved in these tariff negotiations. But Trump has bragged about the strength of his relationship with Xi. Bessent has also bragged about Trump’s relationship with Xi. On top of that, China’s economy is in the worst shape it’s been in decades. The idea that these tariffs blindsided China makes zero sense. And the rapidly escalating retaliatory tariff increases we saw China and the US go back and forth with in April? That was theater. China knew this was coming. Trump and Xi have talked about this before. And a meeting of some sort will take place, and my guess is the market is going to LOVE that. I’ll put the other/under at July 4th.

Remember, the same guy that said this -

Also said this. Act accordingly.

April Highlights

BTC ETF Inflows Resume, Totaling $3bn

MSTR Buys $2.3bn of BTC in Three Tranches

Cantor Fitzgerald, Tether, Softbank and Bitfinex Announce “Twenty One”, Backed By 42,000 BTC, To Issue Equity and Debt and Buy BTC, MSTR-style; Merges with Publicly-Traded Cantor Equity Partners; Jack Mallers Named CEO

Trump Signs Executive Order to Roll Back “Broker Rule” Impacting DeFi

DoJ Dissolves Its Crypto Unit

US Federal Reserve Withdraws Guidance for Banks on Crypto and Stablecoins

SEC Approves Options on Spot ETH ETFs

CME To Launch XRP Futures May 19th

Helium Partners with AT&T to Provide 5G Coverage

Fidelity Launches Direct Crypto Investing in IRAs

Justin Sun Publicly Accuses FDUSD, Binance’s Primary Stablecoin, of Being Insolvent

Crypto Exchange OKX Relaunches in US, Two Months After Settling with DoJ for $500mm

Ripple Acquires Crypto Prime Broker Hidden Road for $1.25bn

Circle Files for IPO

Galaxy Receives SEC Approval for US Listing

Visa Joins Stablecoin Consortium with Paxos, RobinHood

Bitwise Launches Three Active Option Income Strategy ETFs for MSTR, COIN and MARA

CryptoPunk Whale Pleads Guilty to Hiding $13mm in Profits from IRS

Securitize Acquires MG Stover’s Crypto Fund Administration Business

| Asset Class | Apr | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 14% | -12% | 1% | 121% | 48% | 1% | -12% | 69% | 155% | -64% | BTC |

| NASDAQ | 1% | -8% | -7% | 25% | 5% | 2% | 8% | 8% | 54% | -33% | QQQ |

| S&P 500 | -1% | -5% | -5% | 23% | 2% | 6% | 4% | 10% | 24% | -19% | SPX |

| Total World Equities | 0% | -1% | -1% | 14% | -2% | 6% | 2% | 7% | 19% | -20% | VT |

| Emerging Market Equity | 0% | 4% | 5% | 4% | -9% | 8% | 4% | 2% | 6% | -22% | EEM |

| Gold | 5% | 19% | 25% | 27% | 0% | 13% | 5% | 8% | 13% | -1% | GLD |

| High Yield | 0% | 0% | 0% | 2% | -2% | 4% | -1% | 0% | 5% | -15% | HYG |

| Emerging Market Debt | -1% | 2% | 1% | 0% | -5% | 6% | -1% | 1% | 5% | -22% | EMB |

| Bank Debt | 0% | -2% | -2% | -1% | 0% | 0% | 0% | 0% | 3% | -7% | BKLN |

| Industrial Metals | -7% | 2% | -6% | 3% | -9% | 3% | 12% | -2% | -6% | -13% | DBB |

| USD | -4% | -4% | -8% | 7% | 8% | -5% | 1% | 3% | -2% | 8% | DXY |

| Volatility Index | 11% | 28% | 42% | 39% | 4% | 34% | -4% | 4% | -43% | 26% | VIX |

| Oil | -18% | 2% | -16% | 13% | 10% | -13% | 1% | 18% | -5% | 29% | USO |

SOURCE: TRADING VIEW. AS OF 4/30/25.

Macro Chart Smorgasbord

As we just discussed, LOTS happened in macro in April. So here’s a bunch of charts that help contextualize the situation.

This was the best chart I saw on tariff overviews. It’s basically out of date at this point because China was ratcheted up and other countries were put on pause at 10%, but maybe still helpful-

Source: Goldman Sachs. As of 4/3/25.

SPX was -10.7% over 3 trading days ending 4/7/25. That’s 11th largest 3-day decline since 1950. Very bullish signal over 1/3/5-year timeframes -

As of 4/7/25.

This shows how historic the volatility was in April –

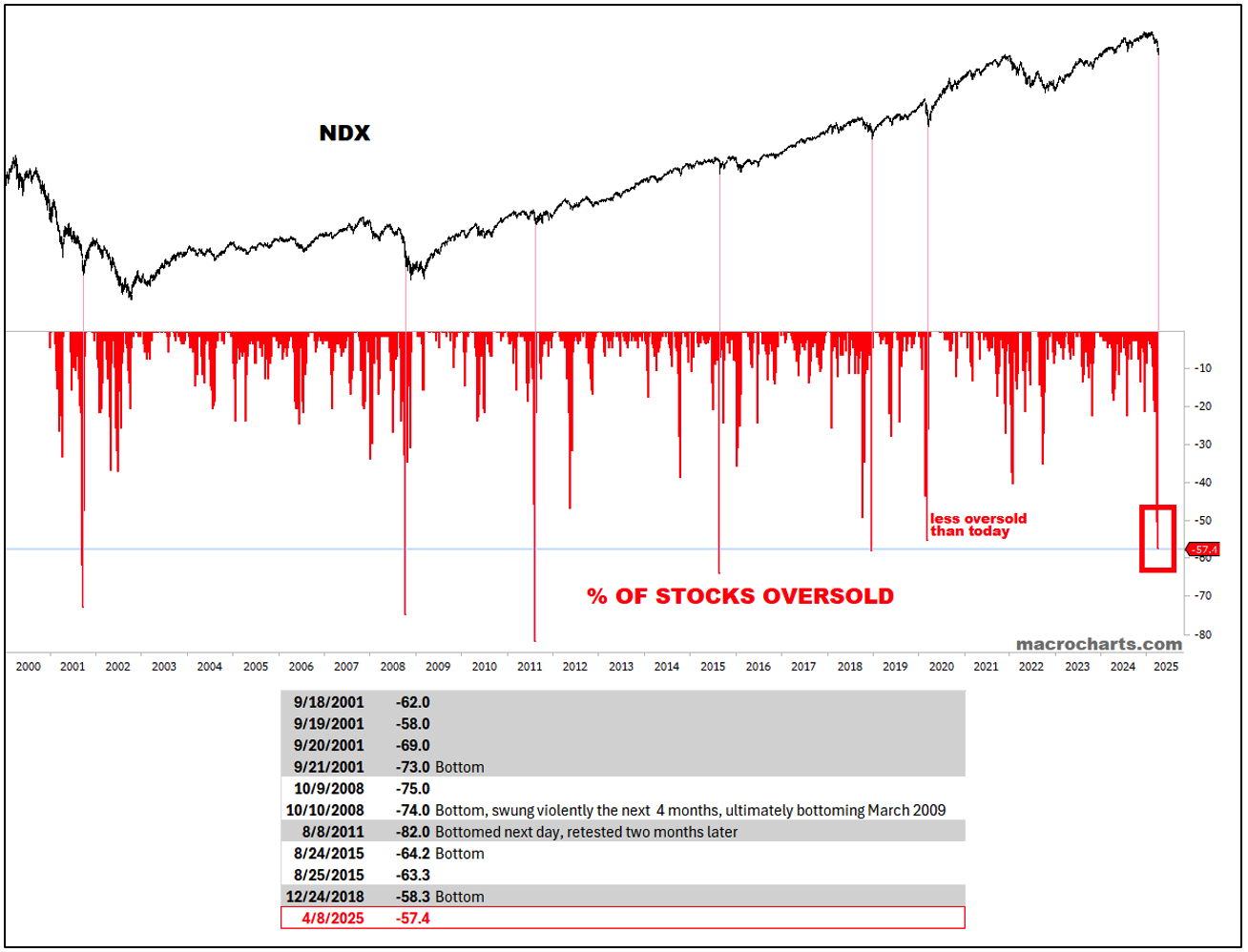

4/8/25 was the 11th most oversold day in NASDAQ history. You’ll never guess what happened next -

As of 4/8/25.

When the SPX has a huge up day like it did on 4/9, the 1/3/5-year returns are historically very strongly positive-

As of 4/9/25.

Below shows the historic volatility of the 5-day period ending 4/9, using a well-known technical indicator called Average True Range. The SPX 5D AVT spiked above 6% for the fourth time since 1962. The others were Black Monday, the Global Financial Crisis, and Covid shutdowns –

Source: @sentimentrader. As of 4/10/25.

At the peak of the Treasury market volatility, there were fears that China was dumping Treasuries. The chart below shows that likely didn’t happen in much size, and that other countries were likely selling more aggressively –

Source: @humblestudent. As of 4/10/25.

Inflation legged lower in April –

Consumer sentiment reached historic lows amidst the tariff wars –

Chart below from April 15th. Move in VIX above 50 and then below 30. “The Bear Killer” –

Source: @jasongoepfert. As of 4/15/25.

Bottoms happen from people puking out of stocks into money market funds –

As of 4/18/25.

Below is a VIX term structure chart from 4/18. Front-month VIX futures spiked more than 20% above 3rd-month futures. Previous instances were mostly buys-

Source: @jasongoepfert. As of 4/18/25.

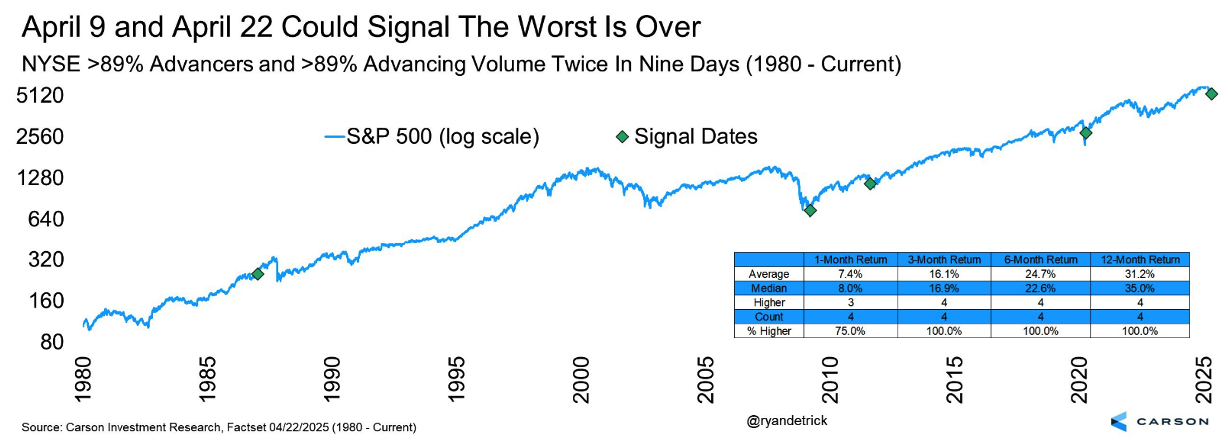

From 4/22. Shows very strong breadth to the increase in stock prices on that day. Has historically been a solid buy signal –

There is a relatively well-known technical indicator called a “Zweig Thrust” that measures market breadth that triggered a buy on the bounce in April, and it has a strong track record. There is a less-known derivation called the SuperZweig. It has an even stronger track record –

Source: @jasongoepfert. As of 4/24/25.

This was a table showing price increases for random items on Shein –

A reminder about the Treasury market –

“The whole secret lies in confusing the enemy, so that he cannot fathom our real intent.” - Sun Tzu, The Art of War

Source: @jasongoepfert. As of 4/17/25.

So What?

Kinda looks like a bottom, right? Now granted, Trump is a true wild card. There are plenty of paths were stocks chop around for months. But my base case is we’ll get headlines of trade deals with various countries in May and June and that should be supportive. To the extent Trump has to play hard ball and spook trade partners, the market will not like that. It would not be my base case stocks make a lower low, but I don’t think they necessarily rocket to new ATHs from here either. China will likely be the deciding factor. I think Trump gets them to deal. Not sure which month that will be in.

Market Update - Liquid Crypto Asset Investing

| Apr | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 14% | -12% | 1% | 121% | 48% | 1% | -12% | 69% | 155% | -64% |

| ETH | -2% | -45% | -46% | 46% | 28% | -24% | -6% | 60% | 91% | -67% |

| XRP | 5% | 0% | 5% | 238% | 240% | 29% | -24% | 2% | 81% | -59% |

| BCH* | 21% | -31% | -17% | 36% | 25% | -12% | -44% | 121% | 157% | -75% |

| EOS | 9% | -20% | -13% | -8% | 50% | -11% | -48% | 30% | -2% | -72% |

| BNB | -1% | -14% | -14% | 124% | 24% | -3% | -4% | 94% | 27% | -52% |

| XTZ | -15% | -49% | -57% | 28% | 82% | -11% | -43% | 40% | 39% | -84% |

| XLM | 3% | -20% | -18% | 157% | 237% | 8% | -35% | 9% | 81% | -73% |

| LTC | 1% | -19% | -19% | 42% | 54% | -11% | -28% | 44% | 4% | -52% |

| TRX | 3% | -6% | -3% | 136% | 63% | 25% | 1% | 14% | 98% | -28% |

| Aggregate Mkt Cap | 10% | -19% | -11% | 96% | 46% | -4% | -14% | 63% | 119% | -64% |

| Aggregate DeFi* | -1% | -19% | -20% | 50% | 52% | -15% | -21% | 47% | 132% | -77% |

| Aggr Alts Mkt Cap | 14% | -34% | -24% | 72% | 47% | -13% | -15% | 58% | 90% | -64% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 4/30/25. BCH INCLUDES SV.

BTC was down 10% MTD in April at the lows before Trump announced the tariff pause that ripped the entire market. It is noteworthy that at those lows, QQQ was -14% MTD. At those early April lows both QQQ and BTC were -20% YTD. So folks were pointing to this as outperformance for BTC and I do think that’s valid. If you told me Q’s would puke 14% in the first 7 days of April and then ask me how BTC would be trading, I would have said down more than 14% for sure. Then once everything bounced. BTC bounced harder than tradfi. BTC ended April +14% with QQQ +1% - traded better on the way down and on the way up.

If I were to explain that, I would point to Gold having another very strong month, +5%, on top of a very strong year, +25% YTD. I would point to the DXY, -4% in April and -8% YTD. I would characterize the tariff wars as directionally destabilizing for global dollar hegemony, and that has the potential to increase the perceived attractiveness of an alternative emerging store of value like Bitcoin. Finally I would point to Saylor buying – he got off $2.3bn of BTC buys in three tranches in April. So I think overall that explains BTC vs macro.

Technically, BTC looks MUCH better right here than it did a month ago. A month ago, BTC was trading under its 50/100/200DMA’s, with downward sloping 50D and 100DMA’s. BTC had fallen out of its range, retested prior support as resistance and failed at that resistance –

Source: TradingView. As of 5/1/25.

Fast forward a month, and really most all of that damage has been repaired. BTC reclaimed all three MA’s and just as of May 1st, appears to have firmly reclaimed the prior range. It’s easier to see on weekly candles, shown below-

Source: TradingView. As of 5/1/25.

Shown above, price fell decidedly out of the range, made a couple lower low sweeps and then rocketed back up. At time of writing, BTC is trading $97,330 and it is worth noting that BTC price has only closed higher than here 52 days ever. So we’re in pretty rare air up here. But this is certainly the range that was established from late November to late Feb and is now attempting to reestablish itself again. You can basically call this “The Battle for $100k”. We’ve had 28 days ever close over $100k. Three days ever close over $105k.

On Nov 25th, I said this –

And I still think we’re in some version of this setup, albeit with some significant macro stress that’s shown up over the last few months. The capital markets have stayed open for Saylor since the election, but at much lower levels than the incredible showing he had in Nov and Dec. YTD his monthly buys have actually been remarkably steady at $2.5bn/mo –

Source: saylortracker.com. As of 5/1/25.

Overall, my guess is BTC punches $100K in May, and if we get a couple trade deal headlines coming through, we should probably close the month over $100k.

How this strong BTC performance trickles down to Alts I think is a much harder call to make. What we can certainly say is that ETH continues to trade absolutely terribly.

ETHBTC is now -65% since July 2024, and has give back it’s ENTIRE outperformance from last cycle - all of the DeFi/NFT outperformance, has now been walked back. ETHBTC is currently sitting at late 2019 levels –

Source: TradingView. As of 5/1/25.

It’s a crazy chart. And the fundamentals of ETH match the chart. ETH’s narrative is lost at sea and I don’t see anything on the near-term horizon that would shift that. It’s certainly worth paying attention to, because the chart is crazy oversold, sentiment is atrocious, and things change fast in crypto. But I don’t see them changing yet for ETH.

SOL’s chart is certainly better looking than ETH. I would characterize SOL as having a year-long trading range of ~$125-$200, with two relatively short-lived pops above $200 that got sold pretty aggressively, and one deviation below the range that was bought pretty quickly -

Source: TradingView. As of 5/1/25.

Currently, SOL is sitting right in the middle of that yearlong range. If BTC goes and retests ATH in over the next two months, which I think there’s a good chance it will, SOL prob heads to the top of the range again, and then we’ll see how many sellers come out over $200.

Regarding SOL fundamentals, the driver over the last 18 months has been - “Own SOL. Own the casino”. In this tweet thread from late Feb I talked about how that narrative might be coming to an end, as the terribly extractive Pumpfun era was potentially drawing to a much needed close.

To prove my point about the extractiveness of Pumpfun, Exhibit A –

And to prove my point about the Pumpfun era potentially drawing to a much needed close, Exhibit B –

If SOL’s investment case of “own the casino” is now in doubt, I do think that calls into question SOL’s ability to say double, or triple from here.

Not to sound like a broken record, but the rest of the Alt landscape continues to lack any sort of discernible, credible narrative that would drive significant inflows and sustained outperformance. In fact, I think this might be SOL’s best bull case – there is jack shit going on with the rest of crypto fundamentals.

Below is a chart of the crypto universe, sorted in descending order of trailing 30D performance. You see BTC down there at +17%. You can see the names above BTC that outperformed over the last month. Not a lot of names and essentially all of them have underperformed BTC by a lot YTD -

Source: TradingView. As of 5/1/25.

SUI is an interesting chart. It was +62% in April after pulling back 65% since early Jan –

Source: TradingView. As of 5/1/25.

I won’t pretend to be an expert on the SUI ecosystem, but it’s not too hard to go poke around. And I don’t see anything particularly noteworthy. Appears to just be yet another regurgitation of pointless ponzi vaporware that we’ve seen on dozens of other chains that never leads to anything substantial. If you feel differently, please reach out. I’d love to stand corrected.

TAO is a similar chart to SUI. Down 75% since early Dec, then up 63% in April -

Source: TradingView. As of 5/1/25.

It’s a name that has received a lot of attention as perhaps the marquee “decentralized AI” name, after trading incredibly well in late 23/early 24. Yet it has plenty of naysayers. Some say the TAO token structure doesn’t make sense with all the subnets, but it did undergo a token restructuring in February. Some say the activity in the ecosystem is mostly fugazi/pointless, but it has continued to hold a decent amount of developer mindshare. I have my doubts about the long-term sustainability of the project overall, but it’s still worth keeping an eye on. AI in the grownup world literally couldn’t be hotter.

So what Alt do you buy when no Alts offer compelling fundamental investment cases? Well that’s easy –

Source: TradingView. As of 5/1/25.

Fartcoin down 91% in a straight line from mid-Jan to early March. Then up 450% in a straight line since then. Currently about a double from here to get back to prior ATH. It’s probably the best-looking chart in crypto. What does that tell you?

Closing Remarks

Just as I was writing this, MSTR announced earnings and Saylor came through with this headline-

Alongside the nonstop Saylor train, there was this “Twenty One Capital” announcement this month and subsequent merger with publicly-traded Cantor Equity Partners. If you want to learn more, this podcast is a good resource. It appears Twenty One Capital is going to run more or less the same playbook as Saylor – issue various equity, debt and convertible instruments to buy BTC on the balance sheet. As you can see from this CEP chart, the market, uhh, liked that –

Source: TradingView. As of 5/1/25.

To further go with this trend, Bitwise announced three actively traded options income ETFs, that buy and sell options to generate dividend income while also partially holding the underlying stocks of MSTR, COIN and MARA. Last month Gamestop issued $1.3bn in converts to buy BTC on its balance sheet. Numerous publicly traded miners have issued securities, not to buying mining equipment to mine BTC, but to just buy BTC.

The whole thing overall is noteworthy. There seems to be a LOT of appetite for slicing and dicing the risk profile of BTC in different ways and then selling those different pieces of risk off to different types of end buyers that may or may not hedge aspects of that risk. I think an accurate way to characterize the launch and initial success of Twenty One Capital is that MSTR, despite tremendous amounts of capital raising, is not sufficiently meeting all the demand there is to buy the type of risk profile that MSTR offers. That is interesting.

People have called MSTR an “infinite money glitch”. I think that’s reasonably accurate. I can’t help but be worried about all this financial engineering sewing the seeds of an eventual collapse somehow. It just smells too much like GBTC. But for now, there’s a good chance it’s going to be all this financial engineering that drives us higher.

"Even dead trees add to the mountain's splendor."

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS