June 2025 - Monthly Market Update

/Monthly Update || June 2025

“Nothing is easier than self-deceit. For what each man wishes, that he also believes to be true.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our eighty-first Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, for macro, May was characterized by the alleviation of tariff fears – a continuation from April – headlined by the US and China meeting for negotiations in Switzerland and coming away with a bilateral 115% reduction in tariffs. For crypto, May was characterized by a slew of crypto treasury deals with publicly traded companies. All-in, it was good enough for a new daily, weekly and monthly ATH in BTC.

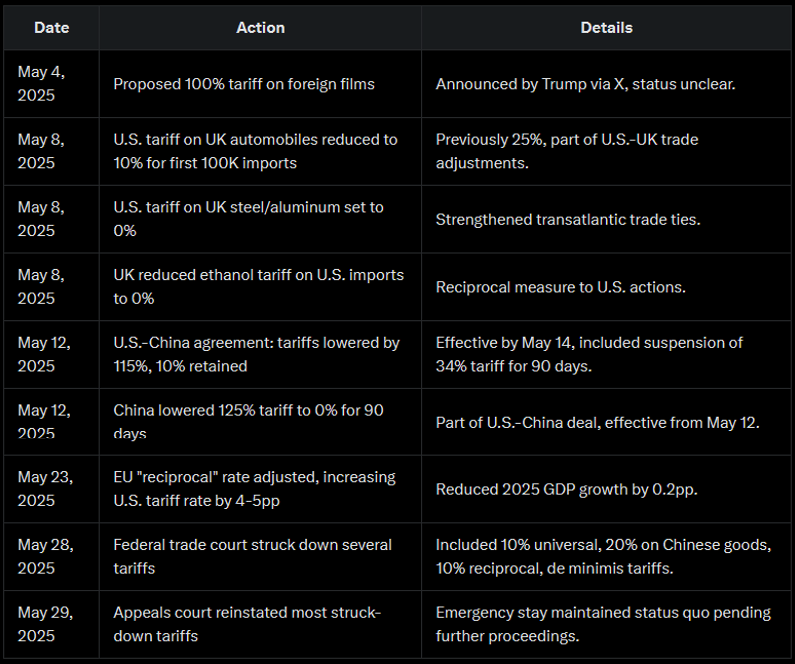

We’ll discuss the crypto treasury deals in more detail below. As for tariffs, the situation remains dynamic but directionally positive –

Source: Grok. As of 5/30/25.

Overall, risk markets took the events of May very positively. SPX +6%, NASDAQ +9%, VIX -25%. NASDAQ closed May 4% off of ATHs. Treasury yields were up in May – US10Y went from 4.16% to 4.6% in a straight line the first three weeks of May, before tightening the end of the month and closing at 4.4%. Bessent needs yields tighter. For yields to get tighter, Bessent needs buyers of Treasuries.

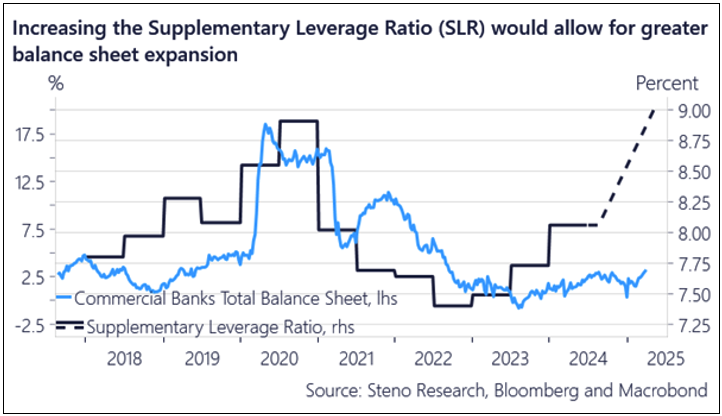

Never fear, he’s a got a solution for that –

Loosen up the capital restrictions on domestic banks, and domestic banks buy more Treasuries –

I would not consider this full-blown QE and thus I would not expect it to have full-blown QE effects. That said, it should be pretty supportive for risk assets broadly over the summer, assuming the tariff situation remains directionally on track. Panicans in shambles.

May Highlights

MSTR Buys $2.7bn BTC in Four Separate Tranches

BTC Spot ETFs See $5.2bn of Inflows

Publicly Traded Trump Media & Technology Group Raises $2.5bn to Buy BTC

GENIUS Stablecoin Bill Passes Senate Procedural Vote, Advances to Floor

David Bailey’s Nakamoto Holdings Reverse Merges into Publicly Traded KindlyMD, Raises $710mm to Launch Bitcoin Treasury Strategy

Twenty One Capital Buys $458mm BTC for Bitcoin Treasury Strategy, Also Raises Additional $100mm in Convertible Notes

Anthony Pompliano Takes SPAC Public in $220mm IPO

Publicly Traded SharpLink Gaming Announces $425mm Private Placement to Launch Ethereum Treasury Strategy

GameStop Buys 4,710 BTC Totaling ~$512mm With Previously Announced Capital Raise

Publicly Traded VivoPower Raises $121mm in Private Placement to Launch XRP Treasury Strategy

Coinbase to Acquire Deribit for $2.9bn

SEC Dismisses Lawsuit Against Binance

New Hampshire and Arizona First and Second States to Pass Strategic Bitcoin Reserve Bill

Japanese-Listed Metaplanet Buys $231mm BTC in Two Tranches, Now Own 7,800 BTC

French Publicly Traded “The Blockchain Group” Raises $72mm Through Convertible Bonds to Buy BTC

SEC Clarifies Staking Is Not Security Transaction

Bank Regulator OCC Confirms US Banks Can Buy/Sell/Custody Bitcoin

Coinbase Experiences Significant User Data Breach

Kraken to Launch Tokenized Stocks on Solana Blockchain

SUI Network AMM Cetus Protocol Hacked for $200mm

Trump’s World Liberty’s Stablecoin “USD1” Used to Close MGX’s $2bn Investment in Binance

Javier Milei Shuts Down Argentina Unit Investigating Libra Memecoin Scandal

Alex Mashinsky Sentenced to 12 Years in Prison

Stripe Introduces Stablecoin Accounts

| Asset Class | May | Apr | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 11% | 14% | -12% | 12% | 121% | 48% | 1% | -12% | 69% | 155% | -64% | BTC |

| NASDAQ | 9% | 1% | -8% | 2% | 25% | 5% | 2% | 8% | 8% | 54% | -33% | QQQ |

| S&P 500 | 6% | -1% | -5% | 1% | 23% | 2% | 6% | 4% | 10% | 24% | -19% | SPX |

| Total World Equities | 6% | 0% | -1% | 5% | 14% | -2% | 6% | 2% | 7% | 19% | -20% | VT |

| Emerging Market Equity | 4% | 0% | 4% | 9% | 4% | -9% | 8% | 4% | 2% | 6% | -22% | EEM |

| Gold | 0% | 5% | 19% | 25% | 27% | 0% | 13% | 5% | 8% | 13% | -1% | GLD |

| High Yield | 1% | 0% | 0% | 1% | 2% | -2% | 4% | -1% | 0% | 5% | -15% | HYG |

| Emerging Market Debt | 1% | -1% | 2% | 2% | 0% | -5% | 6% | -1% | 1% | 5% | -22% | EMB |

| Bank Debt | 1% | 0% | -2% | -1% | -1% | 0% | 0% | 0% | 0% | 3% | -7% | BKLN |

| Industrial Metals | 3% | -7% | 2% | -2% | 3% | -9% | 3% | 12% | -2% | -6% | -13% | DBB |

| USD | 0% | -4% | -4% | -8% | 7% | 8% | -5% | 1% | 3% | -2% | 8% | DXY |

| Volatility Index | -25% | 11% | 28% | 7% | 39% | 4% | 34% | -4% | 4% | -43% | 26% | VIX |

| Oil | 6% | -18% | 2% | -11% | 13% | 10% | -13% | 1% | 18% | -5% | 29% | USO |

SOURCE: TRADING VIEW. AS OF 5/31/25.

Public Company Bitcoin (Crypto?) Treasury Deals

As you can tell from the highlights above, the single defining feature of the crypto market in May 2025 was public companies interacting with Bitcoin and crypto. The easiest way to think about this is essentially copycats of the Saylor strategy. MicroStrategy started buying BTC in August 2020. Since then, Saylor has bought $40.6bn worth of BTC in dozens tranches. At the very beginning of Saylor’s journey, he was spending cash on hand to buy BTC. But soon he ran out of cash and has since issued many billions of common stock, preferred stock, and convertible notes to fund the BTC purchases.

The MSTR chart looks like this since he started doing all that lol –

Source: tradingview. As of 5/31/25.

At the beginning of all this in late 2020, people thought Saylor was crazy – just a guy taking a huge gamble with the relatively small public company he had outsized control over. Then the bear market hit, and people thought he was stupid and had made a huge mistake. During the bear, the market had limited appetite for MSTR securities, which put a lid on the size MSTR could issue to buy BTC. But as BTC bottomed and started going up, so did MSTR stock price, and along with it, the market’s appetite for MSTR securities – in a huge way. By March 2024, once the spot ETFs were putting up insane numbers, the convert market opened back up for Saylor and he started ramming billions of convertible notes to buy BTC. Once Trump won in November 2024, Saylor ramped the size up even more.

Source: Grok. As of 5/30/25.

So obviously, the appetite from both the common equity market and the convert market for these types of securities has been tremendous, and people have taken notice and started to act accordingly.

It started with ~$500mm market cap Semler Scientific in early 2024, issuing a $57mm convert to buy BTC. Not long after, Japan-listed Metaplanet, dubbed “Asia’s MicroStrategy” started buying BTC on its balance sheet, issuing both common equity and zero-coupon bonds.

For quite a while, many public BTC miners have not sold much or any of the BTC they mine to pay expenses, but instead have issued equity to cover expenses and kept the BTC on balance sheet. In late 2024, public BTC mining companies Marathon Digital and Riot Platforms issued both common and converts to buy BTC. GameStop joined the game in March 2025, issuing $1.3bn in convertible notes to buy BTC. By the time we get to May 2025, it’s a full-on gong show. We’ve got reverse mergers and SPACs jumping in to get a piece of the action. Trump’s DJT did $1.5bn of common and $1bn of converts to buy BTC.

Source: Grok. As of 5/30/25.

Additionally, as of this month, we now have our first public company issuances for non-BTC Treasury Strategies – with Sharplink Gaming doing a $425mm PIPE to buy ETH and VivoPower doing a $121mm PIPE to buy XRP.

So What?

All things considering (very positive macro plus the Monthly Highlights), I would say BTC actually traded pretty crappy in May. BTC +11% is weak with that backdrop. Perhaps OG whales are getting unnerved by all this public company treasury strategy stuff and selling huge size into demand?

If the common equity and convert markets stay open for these types deals, it’s the kind of thing that can take BTC to $120/$130/$140/$150k+.

All of this convert stuff very obviously has the potential makings of the next market collapse. It reminds me a ton of GBTC. Great on the way up, brutal on the way down. There is path where MSTR and these other companies could be forced to sell BTC to fund maturities. It’s years away, but it’s possible and that would just be SUCH a Bitcoin thing to happen.

The fact that this financial engineering is what is dominating crypto market activities is indicative of how little is going on fundamentally with crypto. The landscape of actual use cases for crypto is so barren that the only thing left to do is financial engineering.

Market Update - Liquid Crypto Asset Investing

| May | Apr | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 11% | 14% | -12% | 12% | 121% | 48% | 1% | -12% | 69% | 155% | -64% |

| ETH | 41% | -2% | -45% | -24% | 46% | 28% | -24% | -6% | 60% | 91% | -67% |

| XRP | 0% | 5% | 0% | 5% | 238% | 240% | 29% | -24% | 2% | 81% | -59% |

| BCH* | 11% | 21% | -31% | -7% | 36% | 25% | -12% | -44% | 121% | 157% | -75% |

| EOS | -4% | 9% | -20% | -17% | -8% | 50% | -11% | -48% | 30% | -2% | -72% |

| BNB | 10% | -1% | -14% | -6% | 124% | 24% | -3% | -4% | 94% | 27% | -52% |

| XTZ | 3% | -15% | -49% | -55% | 28% | 82% | -11% | -43% | 40% | 39% | -84% |

| XLM | -3% | 3% | -20% | -20% | 157% | 237% | 8% | -35% | 9% | 81% | -73% |

| LTC | 4% | 1% | -19% | -15% | 42% | 54% | -11% | -28% | 44% | 4% | -52% |

| TRX | 8% | 3% | -6% | 5% | 136% | 63% | 25% | 1% | 14% | 98% | -28% |

| Aggregate Mkt Cap | 11% | 10% | -19% | 0% | 96% | 46% | -4% | -14% | 63% | 119% | -64% |

| Aggregate DeFi* | 28% | -1% | -19% | 2% | 50% | 52% | -15% | -21% | 47% | 132% | -77% |

| Aggr Alts Mkt Cap | 7% | 14% | -34% | -19% | 72% | 47% | -13% | -15% | 58% | 90% | -64% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 5/31/25. BCH INCLUDES SV.

BTC made new ATHs in May, briefly kissing $111k before pulling back into month-end and closing May at $105k – right at prior ATHs –

Source: TradingView. As of 5/31/25.

Several times over the last few months I’ve mentioned how BTC gets sluggish over $100k, like the buying dries up relative to sellers coming out, and BTC struggles to hold that big round number. BTC crossed above $100k again on May 8th due to the China tariff negotiations and has traded above since – the longest stretch of closes above $100k that BTC has ever had.

And yet, BTC did not blast off after making new ATHs in May for the first time since Jan 20th. Instead, that move higher was faded. Right now, BTC is testing prior ATHs as support. It’s too early to say whether this level will hold or whether we will fall back into the prior range. It still seems to me that buying dries up and sellers overwhelm up above the $100k level. It’s noteworthy this price action occurred with a backdrop of very positive newsflow for BTC – big ETF buys, big Saylor buys and all the other stuff included in Monthly Highlights and discussed above.

It remains to be seen how much longer we will need to churn this ~$100k level, with everyone that’s in the mood to sell over $100k getting rid of their coins to people that want to buy $100k. My guess is we will revisit sub-$100k again in 2025, and then we’ll see how the buying strength is down there relative to the selling. The good news is that this >$100k price action in May occurred without too much froth – funding rates and CME basis didn’t blow out and OI remained in a decent spot. So I think there is limited risk to a big leverage blowup if prices head lower from here. But we may need to continue churning around this $100k level for a while longer.

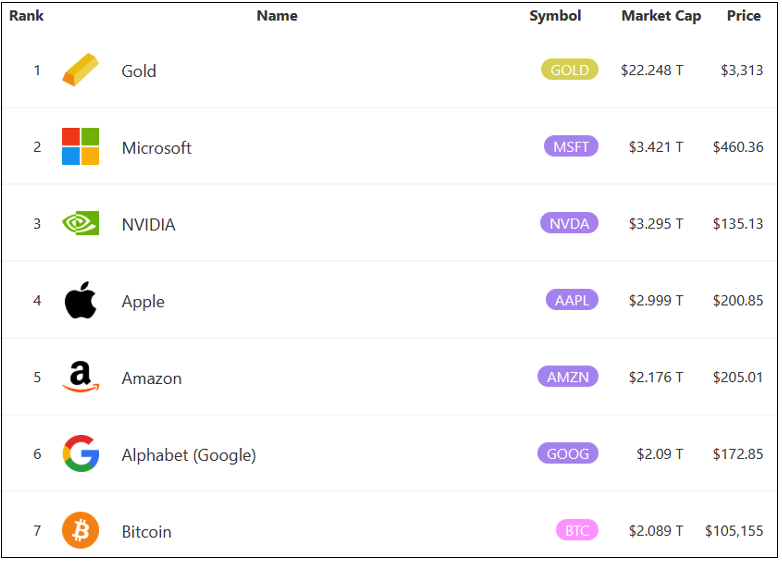

I think what is clear to me is that BTC is huge - $2.1tn market cap at current levels. Only six assets on planet Earth are larger, 5 tech companies and one element on the periodic table –

Source: 8marketcap.com. As of 6/1/25.

So it just takes a TON of buying to keep pushing this thing higher. Absent the US government buying BTC in size (which I don’t think is on the table), I think BTC is just too big to act like a rocket ship from these levels. Perhaps a structural devaluation of the dollar via a Mar-a-Lago accord multilateral currency agreement, but I’m not sure where we are on that at the moment.

ETH had a huge month in May, +41%. Basically all that came in three days as everything was ripping on the China tariff negotiation news –

Source: TradingView. As of 6/1/25.

There was also the first public company ETH treasury strategy announced on May 27th with SharpLink Gaming, to the tune of $425mm. But price didn’t actually respond much to that news. My guess is that extremely aggressive but short-lived price action was mostly the result of a short squeeze. The ETH spot ETFs didn’t see notable inflows during those three days, or during the month of May for that matter. AFAIK there were not any strongly positive fundamental changes to the ETH narrative in May.

ETH Open Interest did NOT spike during the price pump, but it has increased ~18% SINCE the price pump –

Source: Coinglass. As of 5/31/25.

Other than a short squeeze, I think the main driver of the ETH pump was the expectation of ETH staking ETFs being approved soon, potentially June. Off of very oversold levels, that feels like enough to drive significant buying that moved price up aggressively. Assuming we get staking ETFs sometime this summer, will that lead to significant pickup in ETH ETF inflows? Tough to say. Doesn’t feel like a strong yes, but if Larry Fink decides to kingmake his ETH ETF like he has his BTC ETF, ETH price is likely headed higher. The Alt landscape is EXTREMELY starved for narratives right now, so even the hint of some buyable catalyst could easily be enough to get ETH moving higher from here. Maybe staking ETFs will be that.

Hyperliquid was a name that got a lot of airtime in May. It is a DEX (relative) newcomer that has seen a lot of traction from traders. In particular in May, HYPE was in the spotlight as a degen leverage trader named James Wynn had his VERY short lived main character arc, opening a 40x leveraged long to the tune of $1.25bn size and getting liquidated, losing >$100mm of capital. Rough stuff. You can read more about his situation here if you care. As for the HYPE chart, it’s a doozy -

Source: TradingView. As of 6/1/25.

Down 65% in 48 days, up 300% in the same amount of time. The big knock on HYPE is its valuation - $11bn market cap (#10 ranking, excluding stables) and $33bn FDV. Lots of people like the product. Lots of people also like the token. I struggle with the valuation.

SOL was +6% in May – pretty light performance given NASDAQ +9% and BTC +11%.

Source: TradingView. As of 6/1/25.

SOL price failed at that major point of control shown in white. SOL should be getting spot ETFs pretty soon, potentially June. That should be good for $200+ on the approval announcement, and then we’ll get to see how much pent-up demand there is for SOL exposure that couldn’t get it elsewhere. TBD there. I’ve written here before about the potential death of the “own the casino” narrative for SOL. I’m not so sure boomers are going to be chomping at the bit to get SOL ETF exposure, but maybe.

Below is the crypto universe ranked by market cap. You can see 1M and YTD price performance and you can see how badly most names are dragging BTC YTD –

Source: TradingView. As of 6/1/25.

Even with ETH’s monster May, it still trails BTC by 37% YTD. Many Alts have fared even worse than ETH YTD. 2025 was supposed to be 2021 in terms of “crypto cycles” but it is now crystal clear that isn’t happening. There is no Alt season because there are no inflows into Alts. There are no inflows into Alts because no one is using them. No one is using them because they don’t do anything.

In 2017 you could sell the dream (also all this stuff was 3% the market cap it is now). In 2021 you had some real usage in DeFi and NFTs and a bit of gaming and also you had a shitload of “reckless lending intertwined with fraud used to heavily lever long to speculate on vaporware”. This time around, in 2025, you have the curtain pulled back. You also extracted billions of dollars of maximum risk-seeking capital with Pumpfun and the memecoin mania. This capital was the ingredients of an “Alt Season”, and the degens gave it all away to Pumpfun equity investors and a memecoin cabal that’s probably 300 people deep. Everyone else loses.

And all the eyeballs (there are many) with all the capital (there is a lot) that’s on the sidelines peering into the Alt landscape…they’re not convinced. At all. Neither should they be. So that’s how you get the Alt price action we’ve had thus far. And I don’t see a single thing on the horizon that’s going to change that near-term (this year). Hate to be a Debbie Downer, but gotta call a spade a spade.

Closing Remarks

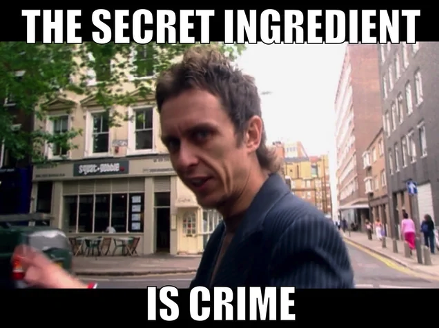

In a Telegram chat I’ve been in for years with a tightknit group of crypto folks, we’ve taken to using this meme over the last several months –

In particular, the usage of this meme ratcheted up when Trump launched the TRUMP and MELANIA memecoins a couple days before his inauguration. It’s an acknowledgement of the free-for-all that crypto has now become in the second Trump era we find ourselves in. The SEC dismissed dozens of pending crypto cases. The CFTC added to that list. Trump fired the SEC crypto enforcement task force. Justin Sun bought $75mm of Trump’s WLFI and immediately thereafter, the SEC paused its case against him. DWF Labs, truly some of the very worst actors in all of crypto, bought $25mm of Trump’s WLFI. The WSJ wrote an article in March about Binance and Changpeng trying to bribe the Trump admin. They wrote another article about it in May. Then Binance had its $2bn investment from MGX be funded in WLFI’s USD1 stablecoin. A couple days ago, SEC dropped its case against Binance.

Sigh…Don’t get me wrong, Gary Gensler sucks and Maxine Waters does too. But like, is this what we really want? Trump held a dinner this month for the top 220 holders of his TRUMP memecoin. If you were top 25, you got a private VIP meet and greet. It appears WLFI and TRUMP are basically the grift vehicles for the Trump family. Maybe if the CCP buys enough TRUMP, he’ll give them a nice deal on tariffs?

The GENIUS stablecoin bill is making progress in the Senate and will likely get passed this year. Once that’s done, Congress will turn to getting a market structure bill passed (FIT21 already passed the House). These are both good and necessary things. But I HATE the open season grift backdrop this is occurring in. What does it mean for the future of crypto? Fast forward a year from now, and we have stablecoin regulation and market structure regulation mandated by legislation. By that point, what other bad actors will have curried favor with greatest country in human history by enriching the family of the President of said country? Where will we be on crypto adoption? Where will we be on viable crypto use cases, outside of BTC and stablecoins?

Careful what you wish for I guess, right?

"A shortcut becomes a long way."

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS