September 2025 - Monthly Market Update

/Monthly Update || September 2025

“Investing is a hard area for most people to figure out what to do.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our eighty-fourth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, for the second consecutive month, DATs (Digital Asset Treasuries) took all the limelight for crypto markets in August. Check the Monthly Highlights below – there was some other stuff going on too, but it all took a backseat to the DAT Attack. The DAT Attack was primarily an ETH trend, led by BMNR and SBET, which led to the second consecutive month of significant outperformance for ETH vs BTC. ETH +19%, BTC -6%.

The BTC and ETH ETF flows followed the DAT Attack trend – with far and away the widest monthly disparity ever between the two ETF flows. ETH ETFs did $3.9bn of inflows. BTC ETFs did $749mm of outflows. Big shift.

As we march closer to the three-year anniversary of the collapse of FTX that marked the cyclical bottom in crypto markets, a pretty regular topic of conversation amongst active market participants is how strange this cycle has been relative to prior cycles. BTC price is currently +60% from prior cycle highs. ETH essentially kissed prior ATHs last week before failing. SOL made a very short-lived spike above prior ATHs in January of this year and then collapsed 65% and currently remains well below prior ATHs. Almost no Alts have made new ATHs. Most are well below their prior ATHs and have deeply underperformed BTC.

And this price action has generally matched the fundamentals of crypto adoption this cycle. BTC adoption has grown significantly. Stablecoin adoption has grown significantly. And there has been VERY little other adoption of crypto projects outside of these two use cases (Helium adoption has been impressive but the token trades terribly). Besides Hyperliquid, there have been essentially no new noteworthy project launches this cycle (pump.fun was noteworthy but like, in the same way fentanyl is noteworthy).

Outside of BTC and stables, this cycle’s biggest “product” has been memecoins - which are terribly extractive and financially nihilistic and prey on the worst parts of human nature. And at this point in September 2025 the extraction from memecoins has been so tremendous that you mostly killed off the traders involved in it - so the memecoin market is mostly dead and it’s not clear it’s coming back any time soon.

In terms of headcount – full time industry employees and active market participants, crypto is almost certainly significantly smaller than it was four years ago (I cannot prove this quantitatively but I and everyone else I know that is knee deep in crypto feels this way).

So that’s the backdrop for these DATs to step into the limelight. And they do kinda go with the theme because they don’t do anything, like most of crypto. There is no value being created. It is pure financial engineering – capitalizing on a glitch in modern financial markets. And there are many market participants that see this as end of cycle type stuff. It looks a lot like the last gasp of an industry unable to come up with anything more legitimate to do. You couldn’t get people to buy crypto for the fundamentals because the fundamentals aren’t great. So you come up with this financial engineering/glitch exploitation thing.

Speaking of exploitative, it’s clear why the leaders of these DATs are doing what they’re doing. They stand to make a shitload of money if they can manage to punt their stock in time before the whole thing collapses. Tom Lee is sitting on something like $150mm of BMNR stock and warrants. I’m sure Tom has had a nice career over the last 20+ years on Wall Street, but I doubt he’s had a $150mm nice career. You start digging into these DAT advisory agreements, and you see the massive paydays these guys are lining up for themselves. Bitmex research wrote a great article on this topic. It’s worth the read. Very reminiscent of SPAC mania – scammy in a very similar type of way. TBD on whether they end up with the same fate.

And then one of the weirdest aspects of this whole setup is the juxtaposition against how bullish this presidential admin is on crypto. And how much airtime crypto gets. Trump and his entire family are BALLS long crypto. Despite ALL our ails I mentioned above, crypto is front and center in the news nearly every day at the highest levels. And we have massive support from nearly every corner of the US government. That part is just…weird. I never could have imagined all this stuff would be worth $4 trillion (on paper) and we would have SO much support from the US government and yet have SO little to show for ourselves outside of BTC and stables. Crypto has come so far, while accomplishing so little. From that perspective, DATs fit in perfectly.

August Highlights

ETH ETFs See $3.9bn of Inflows, BTC ETFs Sees $749mm of Outflows

ETH DAT BMNR Buys $4.3bn ETH in Four Tranches, Funded Through Equity and Warrant Issuance, Now Holds $8.2bn ETH

ETH DAT SBET Buys $1.05bn ETH

TON DAT VERB Buys $713mm TON

BTC DAT NAKA Buys $679mm BTC

BTC DAT MSTR Buys $426mm BTC

ETH DAT ETHZ Buys $489mm ETH

SUI DAT SUIG Buys $296mm of SUI

BNB DAT BNC Buys $230mm BNB

Galaxy, Jump and Multicoin to Raise $1bn, Launch Solana DAT

Pantera to Raise $1.5bn, Launch Solana DAT

Crypto.com Partners with Trump’s Publicly Traded “DJT” and SPAC “YORK” to Create CRO DAT; To Contribute $1bn CRO, $200mm Cash and $220mm Warrants

“Bullish” IPOs at $37/sh, Closes First Day at $70, Raises $1.1bn

White House Crypto Council Executive Director Bo Hines Steps Down, Joins Tether As Strategic Advisor

Elon’s Attorney Alex Spiro Said to Be Chairman of Coming $200mm DOGE DAT

CFTC Said To Establish Path For US Citizens to Trade on Offshore Crypto Exchanges

Trump Chooses Crypto Friendly Chief Economist Steve Miran for Fed Board Seat

Trump Signs Executive Order to Allow Crypto, Private Equity, Real Estate in 401k’s

Trump Signs Executive Order to Stop Unfair Banking of Crypto Industry

Bessent Says US Government Won’t Buy BTC, Will Retain Seized Assets

SEC Updates Accounting Guidance on Stablecoins, To Be Treated As Cash If Guaranteed Redemption Mechanism In Place

SEC Releases Statement Saying Liquid Staking Activities Are Not Securities

US Department of Commerce to Issue Statistics on Blockchains, Partners with Pyth, Chainlink, Coinbase, Kraken, etc

Trump Jr’s VC Firm Invests “Double Digit Millions” Into Polymarket, Trump Jr To Join Advisory Board

Wyoming Debuts First “State Stablecoin” on Seven Blockchains

Stripe Partners with Crypto VC Paradigm to Build “Tempo” L1 Blockchain

Circle To Launch L1 Blockchain “Arc” with USDC As Native Gas Token

Ripple Acquires Stablecoin Platform “Rail” for $200mm

Paxos Settles with NYDFS for $48mm Over Binance Partnership Compliance Failures

Barry Silbert Returns to Grayscale as Chairman in Preparation for IPO

Do Kwon Pleads Guilty to US Fraud Charges

Tornado Cash Creator Roman Storm Found Guilty of Money Transmitting Charge

| Asset Class | Aug | Jul | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -6% | 8% | 30% | -12% | 16% | 121% | 48% | 1% | -12% | 69% | 155% | -64% | BTC |

| NASDAQ | 1% | 2% | 18% | -8% | 12% | 25% | 5% | 2% | 8% | 8% | 54% | -33% | QQQ |

| S&P 500 | 2% | 2% | 11% | -5% | 10% | 23% | 2% | 6% | 4% | 10% | 24% | -19% | SPX |

| Total World Equities | 3% | 2% | 10% | -1% | 14% | 14% | -2% | 6% | 2% | 7% | 19% | -20% | VT |

| Emerging Market Equity | 3% | 1% | 10% | 4% | 19% | 4% | -9% | 8% | 4% | 2% | 6% | -22% | EEM |

| Gold | 5% | -1% | 6% | 19% | 31% | 27% | 0% | 13% | 5% | 8% | 13% | -1% | GLD |

| High Yield | 1% | -1% | 3% | 0% | 3% | 2% | -2% | 4% | -1% | 0% | 5% | -15% | HYG |

| Emerging Market Debt | 1% | 0% | 2% | 2% | 6% | 0% | -5% | 6% | -1% | 1% | 5% | -22% | EMB |

| Bank Debt | 0% | 0% | 1% | -2% | -1% | -1% | 0% | 0% | 0% | 0% | 3% | -7% | BKLN |

| Industrial Metals | 2% | -3% | 3% | 2% | 5% | 3% | -9% | 3% | 12% | -2% | -6% | -13% | DBB |

| USD | -2% | 3% | -7% | -4% | -10% | 7% | 8% | -5% | 1% | 3% | -2% | 8% | DXY |

| Volatility Index | -8% | -1% | -24% | 28% | -11% | 39% | 4% | 34% | -4% | 4% | -43% | 26% | VIX |

| Oil | -6% | 9% | -5% | 2% | -1% | 13% | 10% | -13% | 1% | 18% | -5% | 29% | USO |

SOURCE: TRADING VIEW. AS OF 8/31/25.

“DAT”s All Folks?

Here’s a summary of DAT activity in August (for deals above $50mm). This is from Grok, so it could have missed some stuff. But this should be pretty close –

Source: Grok. As of 9/1/25.

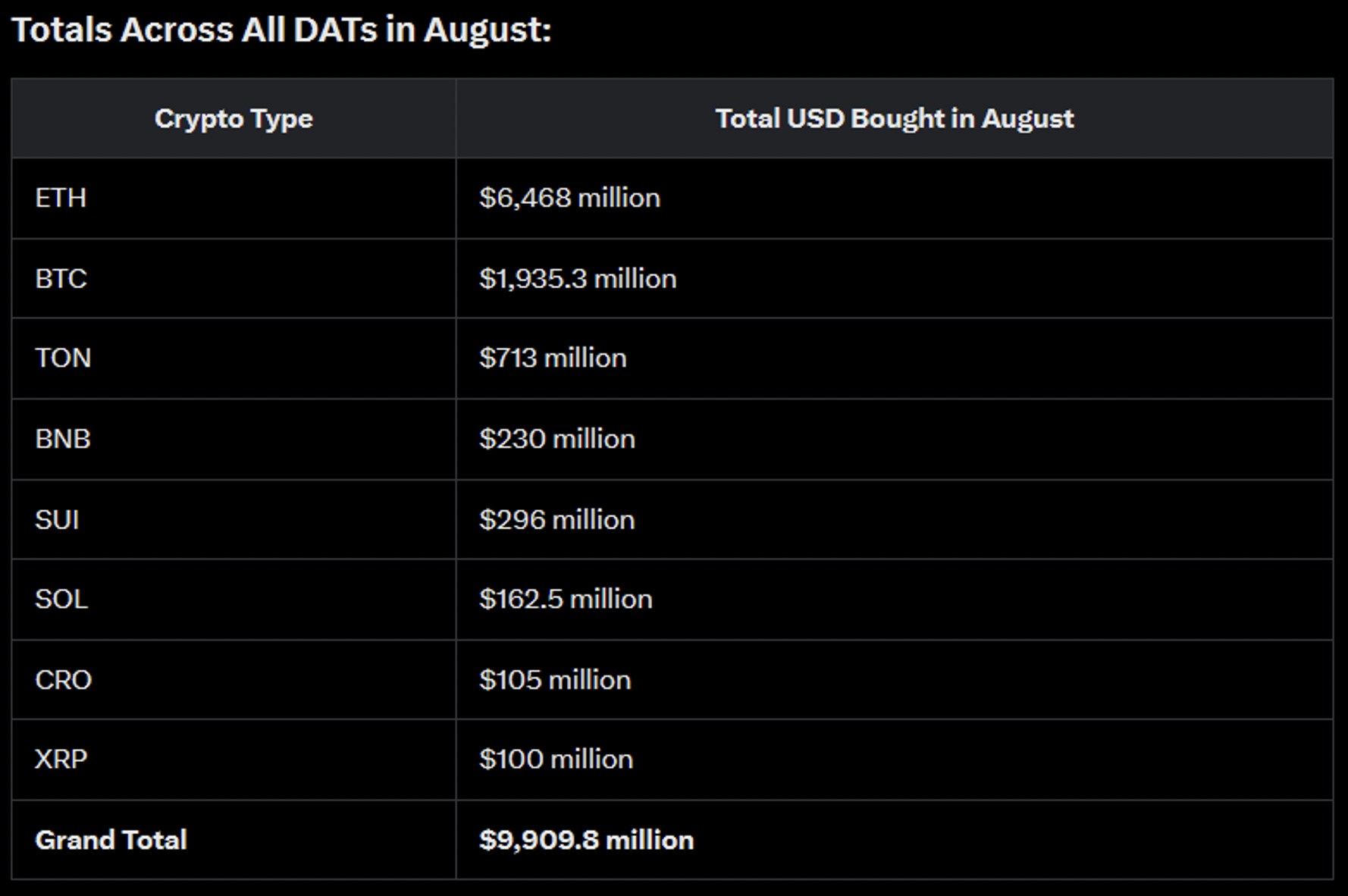

The totals look like this –

Source: grok. As of 9/1/25.

So yeah. You see why I’m talking about this yet again for this month’s letter. Another >$10bn of total buying from DATs for the second consecutive month. A huge amount of buying.

That’s $6.5bn of ETH DAT buying + $3.9bn of ETH ETF buying. Granted, not all of that ETF buying would be directional – there’s likely some amount of arb/carry trade in there. But still, that’s still >$10bn into ETH just through those two avenues in August. And that’s on top of $3.95bn of ETH DAT buying and $5.4bn of ETH ETF buying in July. So that’s ~$20bn of ETH buying in July and August from DATs and ETFs. Sheesh.

The million (billion? Trillion??) dollar question is how much more dry powder is left for this stuff. And a big part of that answer is going to be how well the stocks hold up, particularly as the PIPE investors get unlocked in these deals and look to realize (in some cases) significant profits. Is there appetite from retail or whoever else to buy the DAT shares at current levels and allow the PIPE investors to exit? Can BMNR and maybe SBET and maybe a couple of these other ones actually get a real flywheel going and transcend into the MSTR stratosphere? There has been relatively little converts or prefs issued so far for these DATs. That’s a whole different pool of capital that could be tapped. But the stocks need to get big enough, the NAVs big enough, in order to be able to support sizeable convert/pref issuance like MSTR. It’s obvious that is the goal. But can they get there?

And what about these SOL vehicles coming down the PIPE (pun intended)? The one from Multicoin and the competing one from Pantera? Can they catch traction like BMNR and SBET? If so, SOL seems like it’s likely due for an ETH-style ripper. What about any of the other junk down market cap? SUI? DOGE? Lots of questions.

Let’s take a look at some of these charts.

BMNR has been a wild ride. +30x in four days. Down 78% in a few weeks. Up 128% in a week. Down 37% in a couple weeks. Unclear how much PIPE investors have sold at this point. Stock trades ~$2bn/day.

Source: tradingview. As of 8/31/25.

SBET looks quite similar. +40x. Down 92%. +323%. Down 55%. Again, unclear how much the PIPE investors have sold. Stock currently trading ~$400mm/day.

Source: TradingView. As of 8/31/25.

Can’t forget the grandaddy of them all. MSTR. This stock is in a different league than the rest of the DATs in pretty much every way that matters. This is the stretch goal for all the other DATs – get to the scale MSTR has. MSTR has traded pretty shitty since The DAT Attack started. Which is understandable. People selling MSTR to chase the shiny new thing. MSTR trades ~$3.5bn/day.

Source: TradingView. As of 8/31/25.

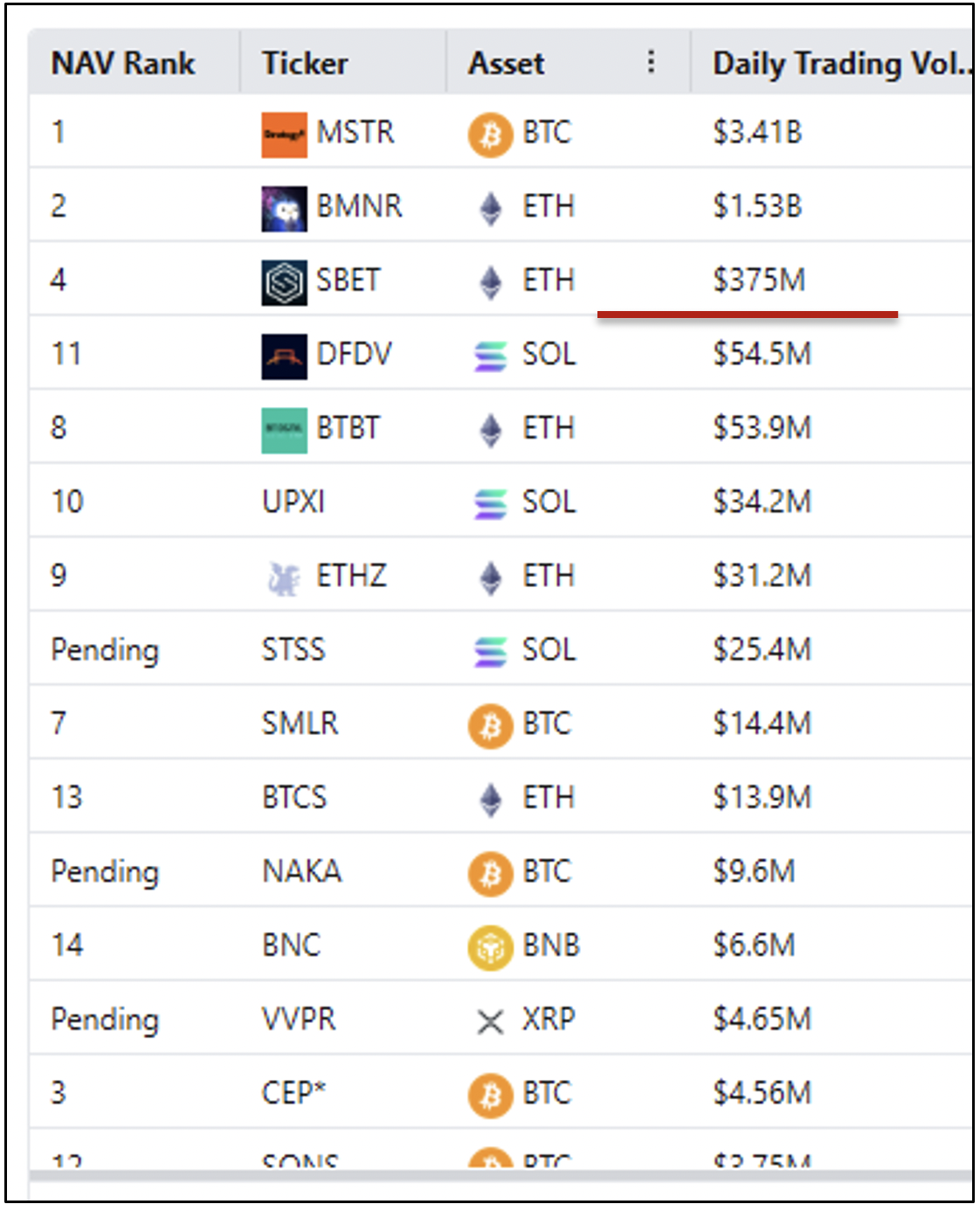

As soon as you get past MSTR for BTC and BMNR and SBET for ETH, the trading volume in all these things falls off hard –

Source: blockworks. As of 8/31/25.

That is, uhh, less than ideal if you’re in the PIPEs for these things trying to hit a quick flip and get out.

Let’s look at some more. CEP is Cantor Equity Partners – the SPAC taken over by Tether and Softbank, led by Jack Mallers. Chart looks like this and it trades $5mm/day -

Source: TradingView. As of 8/31/25.

Next up is Andrew Keys’ ETHM. It’s up 6% from announcement price and trades $3mm/day. Seems cooked to me –

Source: TradingView. As of 8/31/25.

Here’s ETHZ. Up 19x on announcement, down 83% from the top. Currently trades ~$30mm/day.

Source: TradingView. As of 8/31/25.

UPXI is a SOL DAT. They own $418mm of SOL. Up 19x. Down 88%. Up 185%. Trades ~$45mm/day.

Source: TradingView. As of 8/31/25.

Here is DFDV. Another SOL DAT. Owns $383mm of SOL. +81x on announcement. Down 63%. Trades ~$45mm/day.

Source: TradingView. As of 8/31/25.

A few of the other charts are in this general ballpark. Many are much worse. I tried to find the unlock schedules on the PIPEs for these but I couldn’t (unclear if that is public, Grok couldn’t find it).

I don’t have a strong sense of whether they can keep hammering the equity markets in these penny stocks-turned-DATs. It seems like there is a decent chance BMNR could make it to Valhalla – aka the MSTR of ETH. And maybe this Multicoin vehicle coming can end up being the MSTR of SOL. Kyle Samani is a pretty compelling talking head. Maybe not Saylor status but still pretty compelling. I feel pretty strongly that ETH and SOL are not as compelling of assets as BTC is. And that makes a real difference. I think it’s just harder to convince Wall Street to get behind an ETH DAT or a SOL DAT relative to a BTC DAT because BTC is a fundamentally better asset. But ETH figured out a way to do nearly $20bn of inflows into DATs and ETFs over the last two months based on a purely financial engineering thesis. So obviously you’ve already convinced a huge chunk of capital to get on board, at least for a quick trade.

I’ve been trying to convince myself to buy some of these DATs. Haven’t gotten there. May never get there. And who knows. This may be the last gasp of a cycle that couldn’t come up with anything better than this silliness. Would be fitting.

Market Update - Liquid Crypto Asset Investing

| Aug | Jul | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -6% | 8% | 30% | -12% | 16% | 121% | 48% | 1% | -12% | 69% | 155% | -64% |

| ETH | 19% | 49% | 36% | -45% | 32% | 46% | 28% | -24% | -6% | 60% | 91% | -67% |

| XRP | -8% | 35% | 7% | 0% | 34% | 238% | 240% | 29% | -24% | 2% | 81% | -59% |

| BCH* | -3% | 11% | 59% | -31% | 18% | 36% | 25% | -12% | -44% | 121% | 157% | -75% |

| EOS | -5% | -10% | -8% | -20% | -37% | -8% | 50% | -11% | -48% | 30% | -2% | -72% |

| BNB | 9% | 19% | 9% | -14% | 22% | 124% | 24% | -3% | -4% | 94% | 27% | -52% |

| XTZ | -7% | 44% | -18% | -49% | -44% | 28% | 82% | -11% | -43% | 40% | 39% | -84% |

| XLM | -12% | 69% | -10% | -20% | 6% | 157% | 237% | 8% | -35% | 9% | 81% | -73% |

| LTC | 3% | 24% | 4% | -19% | 6% | 42% | 54% | -11% | -28% | 44% | 4% | -52% |

| TRX | 5% | 16% | 17% | -6% | 34% | 136% | 63% | 25% | 1% | 14% | 98% | -28% |

| Aggregate Mkt Cap | 0% | 13% | 24% | -19% | 13% | 96% | 46% | -4% | -14% | 63% | 119% | -64% |

| Aggregate DeFi* | 11% | 31% | 20% | -19% | 39% | 50% | 52% | -15% | -21% | 47% | 132% | -77% |

| Aggr Alts Mkt Cap | 7% | 18% | 25% | -34% | 6% | 72% | 47% | -13% | -15% | 58% | 90% | -64% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 8/31/25. BCH INCLUDES SV.

A few macro charts to start.

GS Unprofitable Tech Index. Near the tail end of the risk curve in tradfi. Appears to have broken out of a 3 ½ year consolidation. Bullshit appears to be heading higher. This bodes well for crypto.

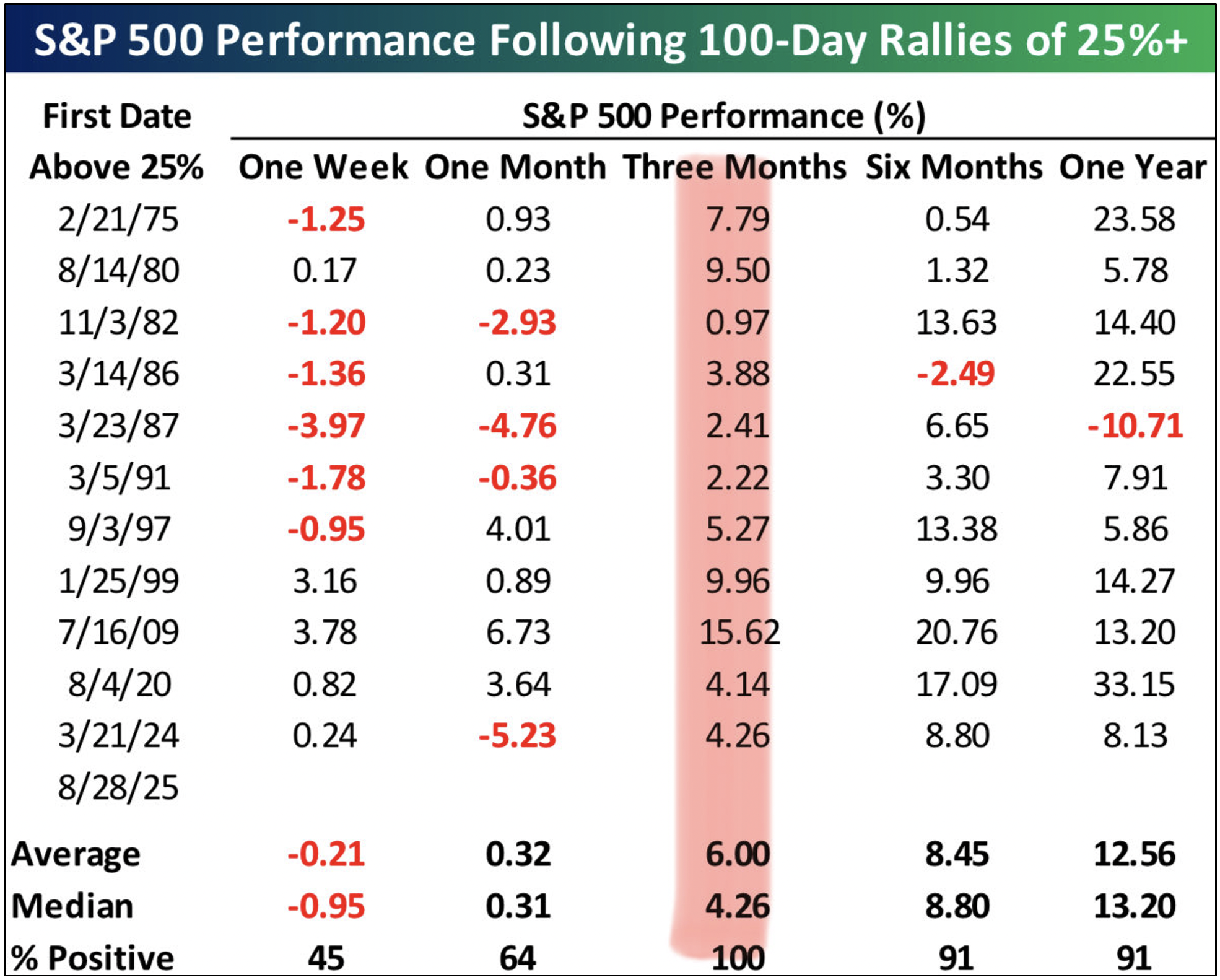

The SPX has now rallied over 25% in the last 100 days. This doesn’t happen all that often. When it does, in every. Single. Instance. Stocks are higher three months later-

Source: @topdowncharts. As of 8/31/25.

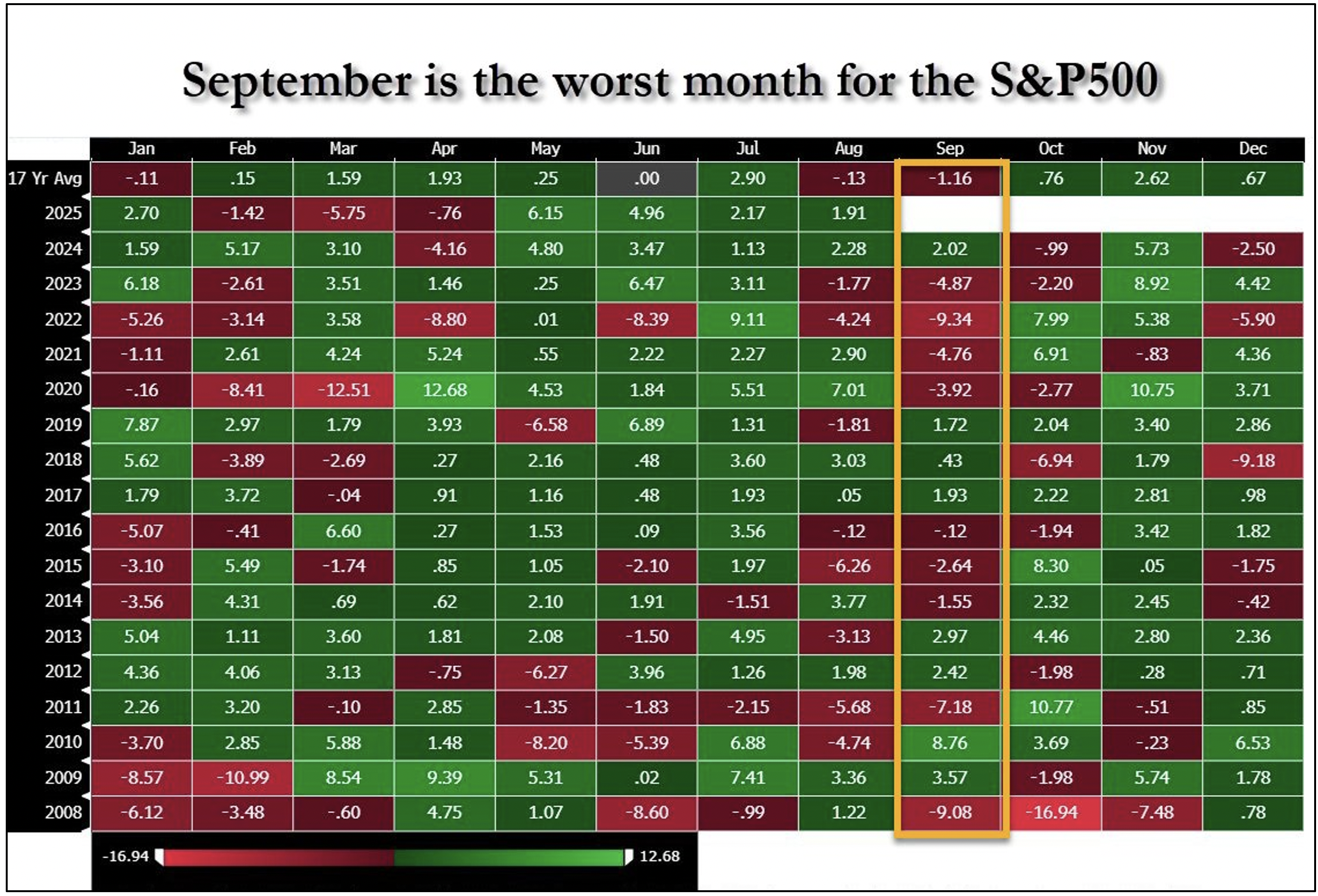

We are moving into the roughest part of the year for stock seasonality –

Source: @zerohedge. As of 8/31/25.

We are also moving into the roughest part of the year for VIX seasonality. The chart below shows that perfectly. A good reason for some near-term caution. Maybe Trump really is dying??

Gold has been consolidating for four months after going on a total heater. This does not strike me as a chart that is about to break down.

Source: tradingview. As of 8/31/25.

This is kinda interesting. BTC on pace to NOT be the best performing asset in a "3 up" year for the first time ever (year obviously not over yet though).

All eyes on ETHBTC. After getting slaughtered for 2 ½ years, ETHBTC is +124% off the lows. This is entirely a DAT story. Unclear how much further DATs can carry this chart –

Source: TradingView. As of 8/31/25.

ETHUSD is at the tippy top of a very broad 4+ year range. If the ETH DATs + ETF flows do another $10bn month in September, price will almost certainly break out of this range next month.

Source: TradingView. As of 8/31/25.

BTC is +568% off the FTX collapse lows. Hugging tight to a very steep trendline. It’s a $2.1tn asset. Is it time to take a breather?

Source: TradingView. As of 8/31/25.

SOL is flirting with the $200 level again, which has been a continuous struggle. If these new SOL DATs get done, this should be testing new ATHs soon –

Source: TradingView. As of 8/31/25.

SOLBTC is coming back to test the underside of the prior two-year range, which it fell out of at the beginning of this year. More SOL DATs probably take this back up to the top of the prior range –

Source: TradingView. As of 8/31/25.

SOLETH has had a big retracement in the last few months. It may be bottoming here. DATs will likely be the deciding factor there.

Source: TradingView. As of 8/31/25.

Hyperliquid is a name that’s come up a few times this year because it’s traded exceptionally well this year. It’s a DEX but not actually a DEX because it’s centralized and permissioned. But it’s KYC-free with a bunch of nice product features, none of which are nicer than being KYC-free. They have a big unlock starting in two months. My guess is this chart is in the process of topping –

source: tradingview. as of 8/31/25

Here's Total3 (Aggr Mkt Cap – BTC – ETH). It’s bumping up against prior ATH for the third time. Generally speaking, quadruple tops aren’t really a thing in TA. So I’m inclined to think this heads higher in coming months. If only we could get some fundamentals to take us there.

source: tradingview. as of 8/31/25

And here is OTHERS (Aggr Mkt Cap – Top 10). This did a clean double top into prior ATH in early Dec 2024 after the Trump win and has been doing a big consolidation since then. There ain’t much to get excited about with the fundamentals behind this chart. Unclear whether this will make meaningful new ATH in the coming months.

source: tradingview. as of 8/31/25.

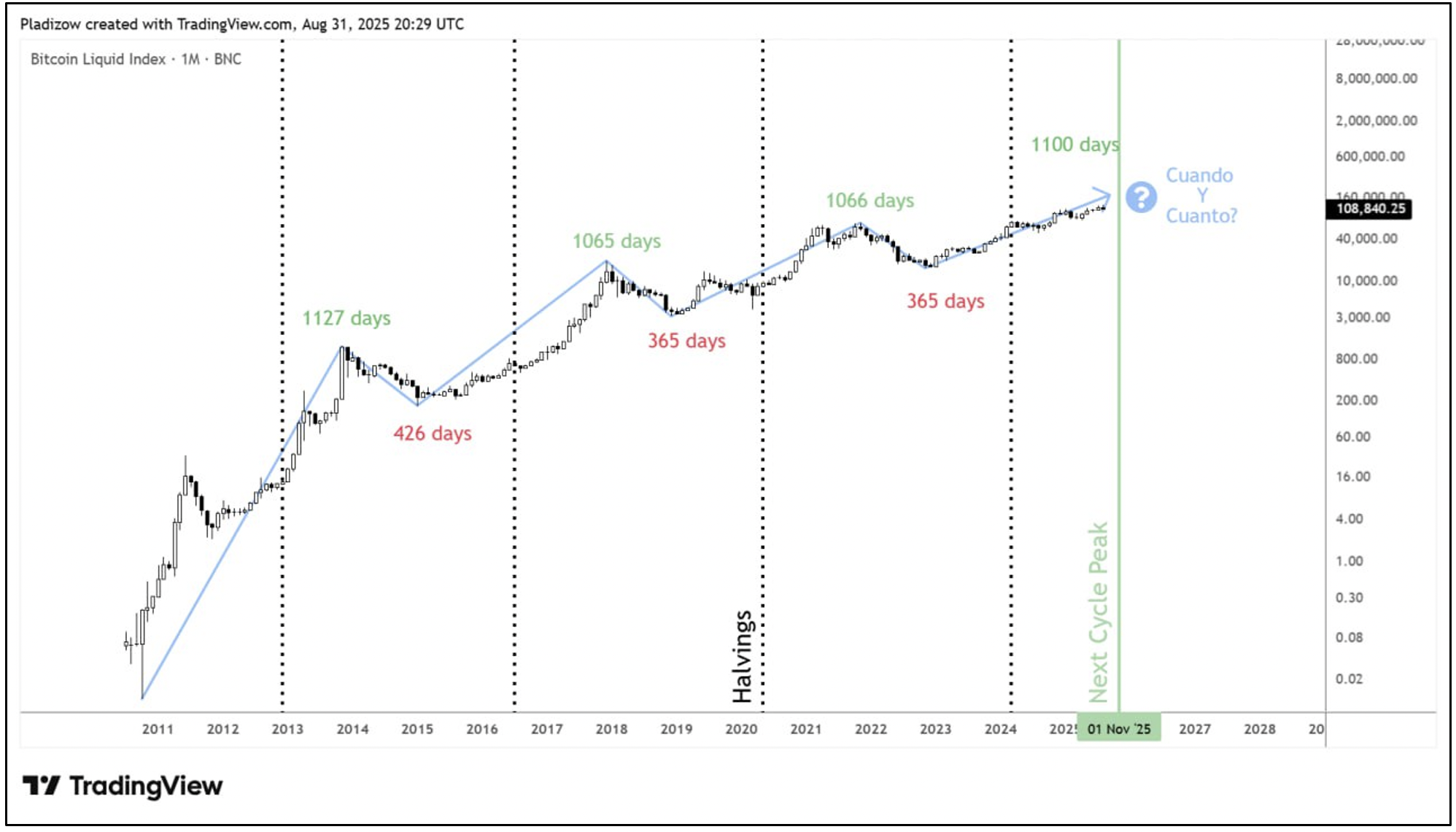

I’ll leave you with these two cyclical charts of BTC from my friend Pladizow.

The first is BTC monthly candles, with BTC monthly RSI in the panel below. In the first three cycles, you see that the cross of the monthly RSI above 70 was historically “go time”, essentially the start of the blow off top –

source: @pladizow. as of 8/31/25.

The chart highlights that right around 12-13 months after the cross of the RSI above 70, the cycle ends. You can see above that this cycle is doing something its never done before – no blow off top. This highlights the “this time is different” nature of this cycle for BTC.

The second chart from Pladizow just shows time between cyclical tops and bottoms for BTC. It’s pretty crazy how closely these have lined up historically. You get about 1100 days from the cyclical bottom to the next cyclical top, and then you draw down for a year or a bit longer. If that 1100-day cycle holds for this cycle, we will peak in two months.

source: @pladizow. as of 8/31/25.

Closing Remarks

I added those last two charts to get you in a state of mind of thinking about the end of the cycle (or not). Sitting here in September 2025 as a crypto market participant, you either have two choices – either you think we’re still doing the “3 up 1 down” cycle thing, or you think this time is different.

If you believe we’re still doing the “3 up 1 down” thing for crypto markets, then you’re basically looking for the exit right now. You’re selling every rip. You’re wary of buying the dip. You may think we just put in the cycle high for BTC at $124k. Granted, that’s less than a double from prior ATHs, but it’s still +690% off the FTX bottom in less than three years. And that’s a hell of a return by any measure.

If you’re still a “3 up 1 down” guy, you realize that you didn’t get a blow off top in BTC, but BTC is also huge now, so it’s kinda hard to blow off a >$2tn asset. You did get a form of capital rotation into ETH, which is a hallmark sign of prior cycles. Granted, it was a pretty weak rotation, but also ETH’s narrative is weak relative to BTC’s this cycle. You realize you never got an Alt Szn, but you also realize that the memecoin mania eviscerated so much high-risk capital and there was so much worthless project dilution that the market never got its sea legs up enough to put together a broad Alt Szn. If you’re a “3 up 1 down” guy, you probably already have a meaningful cash position and you’re looking to grow it in the coming months.

And then there’s the “this time is different” camp. If you’re in this camp, you’ll point out that the emission schedule for BTC is too low to matter much anymore. And you’ll point to (as I have previously) that last cycle wasn’t actually a “3 up 1 down” cycle either. It was a “the Fed did $3tn of QE in six weeks and then Paul Tudor Jones wrote a letter calling Bitcoin the fastest horse, and then 18 months later the Fed began aggressively tightening rates to fight inflation” cycle. You might say it's not that “this time is different”. It’s that last time was different too and just got mislabeled as another ”3 up 1 down” cycle by chance.

I’m more in the latter camp. Macro is what will drive BTC and crypto broadly. If BTC is down next year, it will almost certainly be because of macro. What would drive that? The most likely culprit in my view would be a pickup in inflation due to rate cuts. Powell is out in May 2026. Whoever Trump puts in will likely be very dovish. Rates cut galore. Inflation picks up. Fed has to quickly reverse course. Market hates it. Risk asset puke. BTC and crypto down. And that would be the path where a macro cycle is once again disguised as a “3 up 1 down” cycle, just like last time.

There is even a path where the market front runs this whole thing. Stocks have traded INCREDIBLY well over the last couple years considering how high rates have been. When the Fed embarked on their historically aggressive rate tightening campaign starting in early 22, I NEVER would have imagined the economy and the stock market would hold up as well as it has. I remember writing as much back then in this letter. I thought they were going to quickly break something. They did actually break something. That was the SVB crisis. But they smoothed it over with a simple QE-adjacent program and since then, things have been ok.

So maybe we’re kind of in Opposite Land now, where the stock market won’t actually like additional rate cuts. And when Trump gets a dove in at Fed chair to deliver those rate cuts, the market won’t like the easy monetary policy. And maybe that’s how we get another macro cycle disguised as a “3 up 1 down” cycle in 2026.

"If you take shade, do it under a large tree.”

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS