August 2025 - Monthly Market Update

/Monthly Update || August 2025

“I believe denying clients the ability to be hyper-traders is doing them a favor.”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our eighty-third Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, July was the month of “DAT”s – Digital Asset Treasuries – public companies issuing securities to buy crypto on their balance sheet. We will go into depth on DATs (for the second time in three months) below but suffice it to say here that this was the dominant theme of crypto markets in July and ETH was the big beneficiary, +49% on the month, it’s largest monthly gain since July 2022.

BTC also had its own fair share of “DAT” events. This led to BTC having a nice month too, ripping 10% above prior ATHs to briefly kiss $123k before pulling back and closing the month at $116k, +8% in July.

The other major event for crypto in July was the signing of the GENIUS stablecoin bill into law. Trump hosted a shindig for crypto VIPs at the White House for the occasion. He gave a speech that was at least 50% standup comedy. You should watch it. Funny stuff.

While this signing was not unexpected, it still felt like a watershed moment for the crypto ecosystem –

It’s honestly incredibly impressive that crypto has the pull that it does in Washington. Trump has only signed eight bills into law since taking office in January – Laken Riley; stopgap funding; three congressional review act resolutions; Take It Down; Big Beautiful Bill; and now the GENIUS act. Let’s not forget that Trump issued the crypto executive order only a few days after taking office.

It’s a bit surreal. We have a president and an administration that are huge crypto bulls. Trump’s publicly traded DJT owns over $2bn of BTC. We have massive support from the US government to a degree that would have been completely unimaginable just a couple years ago.

TBD on what exactly we’ll do with. In July, we did DATs.

July Highlights

Trump Signs GENIUS Stablecoin Act into Law

MSTR Buys $3.7bn BTC in Three Tranches

Fundstrat’s Tom Lee Takes Over as Chairman of Publicly Traded BitMine Immersion Technologies; Converts to ETH Treasury Strategy; Buys 566,776 ETH in Several Tranches, Worth >$2bn; Aims to Buy 6mm Total ETH

NASDAQ-listed Trump Media and Technology Group Buys $2bn of BTC with Proceeds from Previously Announced $2.5bn Capital Raise

MARA Holdings Issues $950mm of Convertible Notes to Buy BTC

NASDAQ-listed 180 Life Sciences Pivots to ETH Treasury Strategy, to Rebrand as ETHZilla; Secures $425mm in PIPE Funding to Buy ETH

NASDAQ-listed Volcon Announces Bitcoin Treasury Strategy, Issues $500mm of Equity to Buy $412mm of BTC

Metaplanet Buys $421mm of BTC in Three Tranches

NYSE-listed Sequans Raises $384mm in Equity and Debt to Buy BTC

NASDAQ-listed Bit Digital Buys $239mm of ETH in Two Tranches, Funded Through Equity Issuance

NASDAQ-listed SharpLink Gaming Buys >$500mm of ETH in Six Tranches, Funded Through Equity Issuance

NASDAQ-listed Fundamental Global Pivots to ETH Treasury Strategy, Rebrands as FG Nexus, Secures $200mm PIPE Funding to Buy ETH

Andrew Keys Launches “The Ether Machine” by Merging Into NASDAQ-listed SPAC “DYNX”; Expected to Close Q4-25; Company Will Launch with $1.5bn in ETH and $1.6bn in Committed Capital

SEC Approves Conversion of Grayscale Digital Large Cap Fund into ETF (BTC, ETH, XRP, SOL & ADA)

BlackRock Files for Staking on Spot ETH ETF

“40 Act” Spot SOL Staking ETF “SSK” Launches, Receives >$130mm Inflows in July

CoreWeave To Acquire Core Scientific for $9bn

SEC Approves In-Kind Creations and Redemptions for Spot Crypto ETFs

Galaxy Announces Sale of >$9bn of BTC from Satoshi-era Holder

Coinbase Launches Perps For US Retail Customers

BitGo Files Confidential S-1 for IPO

JPMorgan Chase Partners with Coinbase to Give Banking Customers Access to Crypto

PNC Bank Partners with Coinbase to Give Banking Customers Access to Crypto

Peter Thiel and Palmer Luckey to Launch Erebor, A Digital Bank for Crypto and Tech Companies

| Asset Class | Jul | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 8% | 30% | -12% | 24% | 121% | 48% | 1% | -12% | 69% | 155% | -64% | BTC |

| NASDAQ | 2% | 18% | -8% | 11% | 25% | 5% | 2% | 8% | 8% | 54% | -33% | QQQ |

| S&P 500 | 2% | 11% | -5% | 8% | 23% | 2% | 6% | 4% | 10% | 24% | -19% | SPX |

| Total World Equities | 2% | 10% | -1% | 11% | 14% | -2% | 6% | 2% | 7% | 19% | -20% | VT |

| Emerging Market Equity | 1% | 10% | 4% | 16% | 4% | -9% | 8% | 4% | 2% | 6% | -22% | EEM |

| Gold | -1% | 6% | 19% | 25% | 27% | 0% | 13% | 5% | 8% | 13% | -1% | GLD |

| High Yield | -1% | 3% | 0% | 2% | 2% | -2% | 4% | -1% | 0% | 5% | -15% | HYG |

| Emerging Market Debt | 0% | 2% | 2% | 4% | 0% | -5% | 6% | -1% | 1% | 5% | -22% | EMB |

| Bank Debt | 0% | 1% | -2% | -1% | -1% | 0% | 0% | 0% | 0% | 3% | -7% | BKLN |

| Industrial Metals | -3% | 3% | 2% | 2% | 3% | -9% | 3% | 12% | -2% | -6% | -13% | DBB |

| USD | 3% | -7% | -4% | -8% | 7% | 8% | -5% | 1% | 3% | -2% | 8% | DXY |

| Volatility Index | -1% | -24% | 28% | -4% | 39% | 4% | 34% | -4% | 4% | -43% | 26% | VIX |

| Oil | 9% | -5% | 2% | 5% | 13% | 10% | -13% | 1% | 18% | -5% | 29% | USO |

SOURCE: TRADING VIEW. AS OF 7/31/25.

“DAT”s A Lotta Financial Engineering

The birth of a new piece of crypto jargon! DATs! You can tell by the Monthly Highlights how dominant this theme was in July. It’s all a lot to take in, so let’s get the basics out of the way.

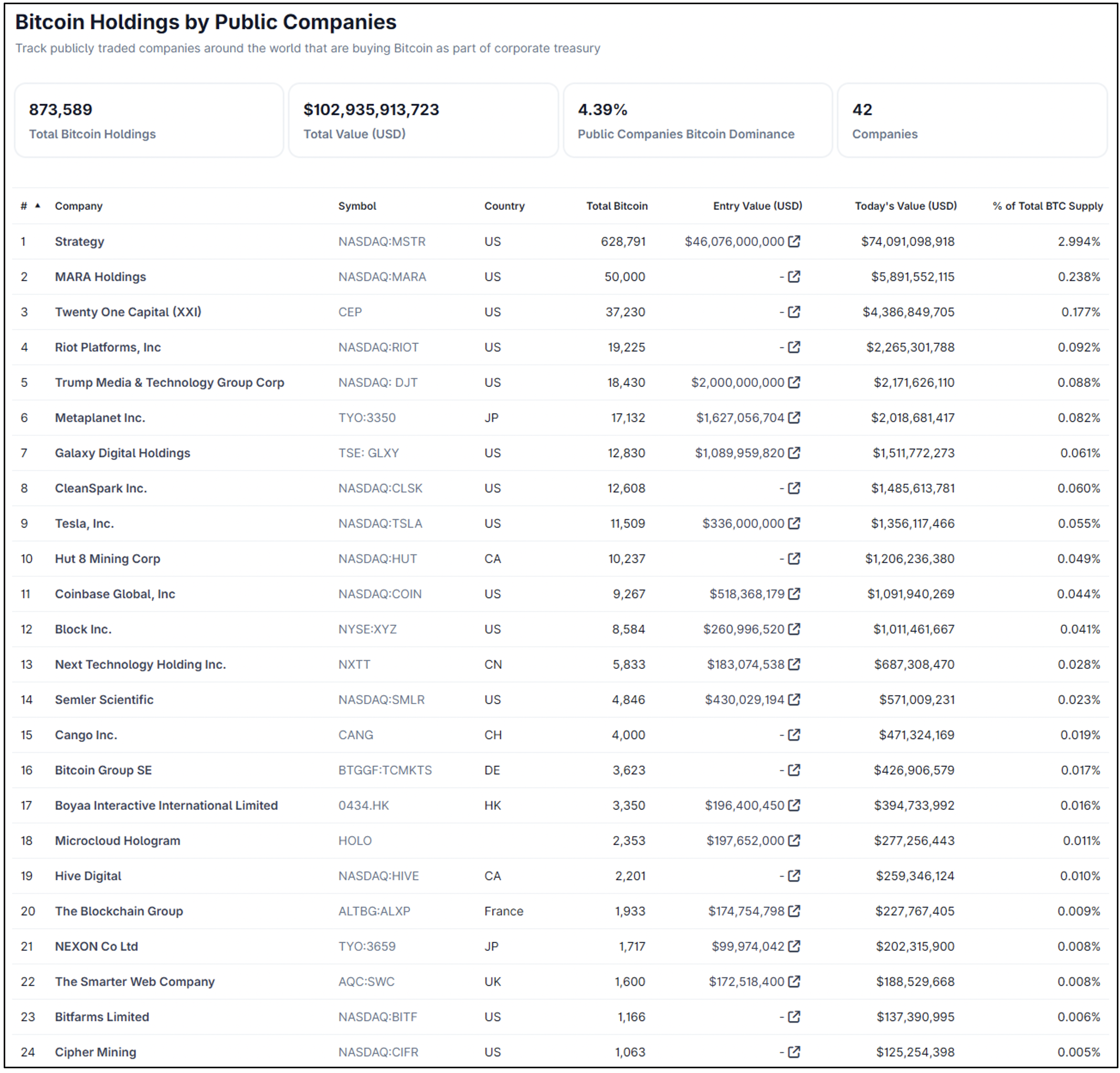

There are currently 24 public companies that hold at least $100mm of BTC –

Source: tradingview. As of 6/30/25.

As you can see, MSTR is the outlier here, accounting for 72% of all the BTC held by public companies.

There are currently 5 public companies that hold at least $100mm of ETH –

Source: Coingecko. As of 7/30/25.

Tom Lee’s BMNR is the leader here, with $2.1bn of ETH, all of which was bought in July.

Looking at it a different way, here’s a table for public companies that announced crypto buys in July -

Source: Grok. As of 7/30/25.

Yeah so uhh…this was a big deal for July. I used Grok for those numbers, and it forgot about a few that I had to remind it about. So it could have forgotten about some other ones that I didn’t see. So don’t take these numbers as gospel, but they should be pretty close.

A huge amount of buying across 15+ companies. More than $10bn total.

How have these stocks traded?

BMNR ripped 38x on the Tom Lee ETH news. It has since traded off but is still +7x since the announcement.

Source: TradingView. As of 7/30/25.

MSTR, the grandaddy of them all, traded up the first part of July and then gave most of it back –

Source: TradingView. As of 7/30/25.

DJT stock was flat in July, but down 60% since Trump won the election. Price is near the lows –

Source: TradingView. As of 7/30/25.

VLCN made the pivot with a $500mm PIPE to buy BTC. Price ran up 5x but rapidly collapsed and is currently +43% since announcement –

Source: TradingView. As of 7/30/25.

ATNF, the stock soon to be known as ETHZilla, is +300% since announcement, and hasn’t given anything back –

Source: TradingView. As of 7/30/25.

SBET was up strongly in the first part of July before giving a lot of it back. Still ended up more than a double from announcement –

Source: TradingView. As of 7/30/25.

BTBT did a relatively mild pump and dump, up about a double and then giving the majority of that back –

Source: TradingView. As of 7/30/25.

Metaplanet, aka Asian MSTR, had a massive rip earlier this year, but was down 28% in July while buying $424mm of BTC. Metaplanet now owns ~$2bn of BTC -

Source: TradingView. As of 7/30/25.

FGF effectively pump and dumped –

Source: TradingView. As of 7/30/25.

SQNS did a 325% pump and dump –

Source: TradingView. As of 7/30/25.

So What?

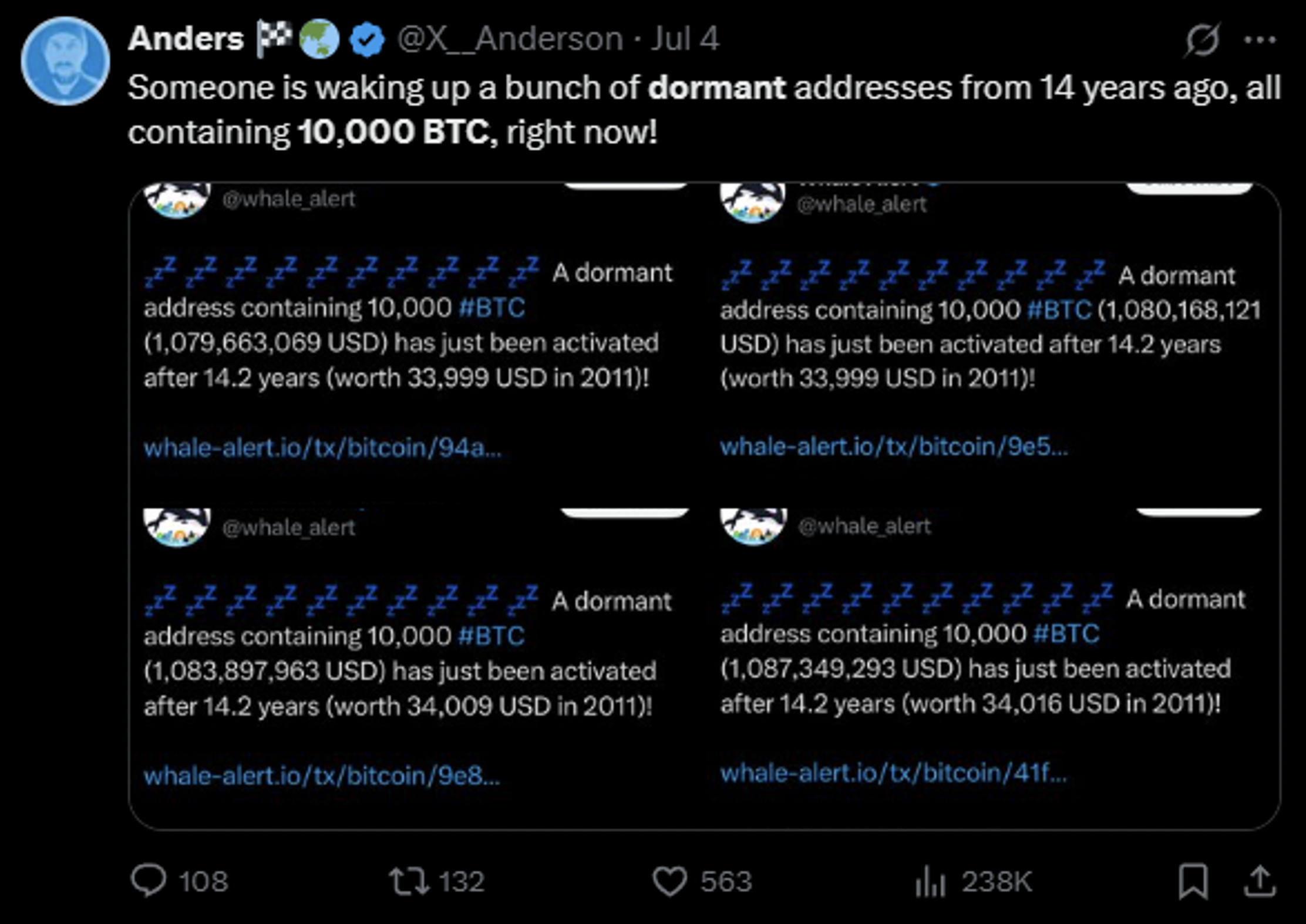

It was quite the ride in July for all this stuff. I can’t help but look to draw parallels between The DAT Attack and the event below -

These wallet movements were tracked on chain because the wallets had been dormant for a loooong time –

So there was some reason a guy that had been holding BTC untouched since 2011 decided to puke the whole thing right now. Who knows? Maybe the $9bn puke of 2011-era BTC had nothing to do with The DAT Attack. Could have been coincidence...

The point I’m trying to make here is that this feels like end of cycle type stuff to me. Feels like we’ve really run out of stuff to do if this is what the industry is focused on. It is financial engineering in its purest form. There is no value created from these deals. These vehicles don’t provide access to assets that isn’t available elsewhere. DATs are an exploitation of a capital markets glitch.

Granted, it is a glitch that has worked tremendously well for MSTR and Saylor and the price of BTC. So in a way, you can hardly blame others for trying. But it still strikes me as really stretching to find the last incremental dollar we can figure out how to get shoved into crypto to pump our bags. Frankly, it feels desperate.

It also feels like we could be sewing the seeds of the next crypto collapse with all this financial engineering. If there’s even a hint that one or more of these companies may start selling their crypto for one reason or another, the market will likely get quite spooked at that. If the selling actually comes to fruition, the bottom could fall out. It’s hard to time something like that. It doesn’t feel near-term at all to me. Not even this year. Maybe not even 2026. And it could keep working for a while from here. If Tom Lee and SBET can keep finding appetite for their common equity, they will keep buying ETH and ETH price will keep going up. Tom’s thesis on ETH is simple – if stablecoin market cap is going to 10x in the coming years like Scott Bessent said it would, then the price of ETH is probably going to go up a lot. Maybe it ends up being that simple.

There’s also a path where this trend dies out, and we don’t see continuous month after month of these types of deals. Maybe the ETH appetite ends up being a small fraction of what Saylor has been able to do with BTC. I could see that.

Market Update - Liquid Crypto Asset Investing

| Jul | Q2-25 | Q1-25 | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 8% | 30% | -12% | 24% | 121% | 48% | 1% | -12% | 69% | 155% | -64% |

| ETH | 49% | 36% | -45% | 11% | 46% | 28% | -24% | -6% | 60% | 91% | -67% |

| XRP | 35% | 7% | 0% | 45% | 238% | 240% | 29% | -24% | 2% | 81% | -59% |

| BCH* | 11% | 59% | -31% | 22% | 36% | 25% | -12% | -44% | 121% | 157% | -75% |

| EOS | -10% | -8% | -20% | -34% | -8% | 50% | -11% | -48% | 30% | -2% | -72% |

| BNB | 19% | 9% | -14% | 12% | 124% | 24% | -3% | -4% | 94% | 27% | -52% |

| XTZ | 44% | -18% | -49% | -39% | 28% | 82% | -11% | -43% | 40% | 39% | -84% |

| XLM | 69% | -10% | -20% | 21% | 157% | 237% | 8% | -35% | 9% | 81% | -73% |

| LTC | 24% | 4% | -19% | 3% | 42% | 54% | -11% | -28% | 44% | 4% | -52% |

| TRX | 16% | 17% | -6% | 28% | 136% | 63% | 25% | 1% | 14% | 98% | -28% |

| Aggregate Mkt Cap | 13% | 24% | -19% | 13% | 96% | 46% | -4% | -14% | 63% | 119% | -64% |

| Aggregate DeFi* | 31% | 20% | -19% | 26% | 50% | 52% | -15% | -21% | 47% | 132% | -77% |

| Aggr Alts Mkt Cap | 18% | 25% | -34% | -2% | 72% | 47% | -13% | -15% | 58% | 90% | -64% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 7/31/25. BCH INCLUDES SV.

BTC was +8% in July with NASDAQ and SPX both +2%. Most everything in crypto outperformed BTC by a healthy amount in July. You can see the monthly and YTD performance here –

Source: TradingView. As of 7/31/25.

As mentioned earlier, BTC made meaningful new highs in July, briefly kissing $123k before pulling back and closing the monthly at $116k. The chart below shows the current setup –

Source: TradingView. As of 7/31/25.

In May and June (yellow hammers), you had two failed breakouts above the prior ATH at ~$108k. But then you held $100k as support twice in June, and in early July (yellow thumbs up) you had the prior ATH hold as support and we took off from there.

It is noteworthy that even now, BTC is leaking lower and in danger of giving back that early July pump, to go retest $108k again as support. The lack of strong follow-through after a decisive break to a new ATH is a new type of behavior from BTC. This is not the BTC price action of prior cycles. BTC really is acting MUCH more like a macro asset. And it can handle size like a macro asset too. On the buy side, as previously mentioned, there were ~$7bn of buys just from DATs. The ETFs did another ~$6bn of buys. That is THIRTEEN BILLION DOLLARS of publicly announced buying in the month of June. And price was +8%. On the sell side, an OG whale single handedly puked $9bn of 2011 era BTC…and price was +8%. So this is just a huge asset that we’re dealing with now – just a hair smaller than Google. And it’s kinda starting to move like Google.

As I mentioned last month, I don’t think we rocket to $150k+ in 2025. It’s possible but not my base case. I think BTC will generally keep directionally grinding with macro and macro looks generally fine to me. Yeah we could def get a pullback in the next couple months. Stocks have had a hell of a ripper-

Source: TradingView. As of 7/31/25.

+40% completely unabated since the first week of April. That’s a ripper by any measure. We’re probably overdue for at least a bit of a cooler. But I think directionally, it looks fine and should be generally supportive of BTC and crypto broadly.

On the back of Tom Lee, ETH had itself a MONTH. ETH has been in a VERY broad range for 4 ½ years. And in July, ETH went from the midpoint of the range to the top of range-

Source: TradingView. As of 7/31/25.

At the moment, ETH is sitting right at the $4k point of major resistance. As previously mentioned, you had nearly $4bn of DAT buying for ETH. Additionally, you had ~$5.4bn of ETF buying. So that’s >$9bn of announced public buys of ETH in July. That’s how we went from $2500 to $4,000.

Where ETH goes from here, will be dependent on how much Wall St is picking up what Tom Lee is putting down. If you get another $9bn of DAT + ETF in August, my guess is we’re looking at $5k a month from now. I struggle to have high conviction on whether or not we will see strong DAT follow-through in August and beyond. The stocks involved mostly aren’t really trading all that well. But BMNR and SBET are trading decent and maybe they can carry the load and keep issuing big chunks of equity to buy more ETH.

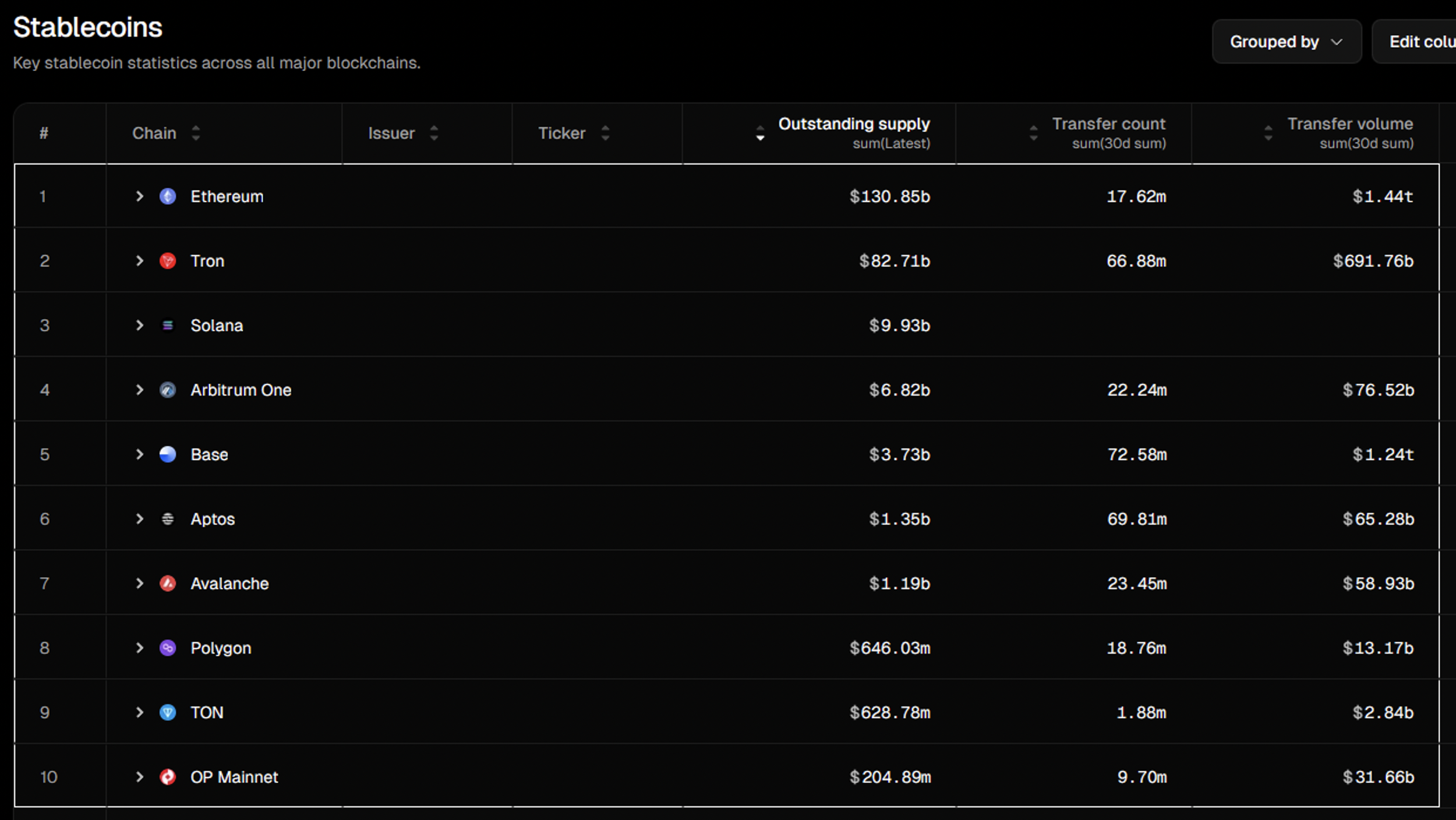

Below is a chart of stablecoin supply, transfer count and $ transfer volume broken out by the blockchain on which that stablecoin moves –

Source: Token Terminal. As of 7/31/25.

So ETH is the big leader and ETH + TRX make up ~90% of all the stablecoin supply. A question arises about what the “appropriate” market cap is for the blockchain(s) that carry stablecoins. ~$238bn of stablecoins currently. Bessent says that’s going to $2tn in the coming years. 90% of it is on ETH and Tron. ETH market cap is $448bn with 55% of the stablecoin supply. TRX market cap is $31bn with 35% of the stablecoin supply.

Is TRX cheap here? Is ETH expensive here? What is the relationship between the market cap of stablecoins and the market cap of the blockchain that the stablecoins are moving on?

You can’t exactly pick up The Intelligent Investor and flip to the right page to give you an answer for that. We’re out here in a wacky world of magic internet money. But Trump just signed the GENIUS act into law and the Treasury Secretary says stablecoin market cap is going to 10x in the coming years. So does that make ETH a buy here at a half trilly? Is it going to a trilly and beyond?

It would be an easier call to make if I had conviction around any of the other use cases for ETH other that shuttling stablecoins…But I don’t. As I’ve said many times before, Bitcoin has product-market fit and stablecoins have product-market fit and everything else is somewhere between a solution looking for a problem and outright vaporware grift.

ETH is 25th largest asset in the world, wedged right between Costco and Exxon –

Source: companiesmarketcap.com. As of 7/31/25.

As shown on the previous chart, you can move stables on many different blockchains. And people do. Solana has $10bn of stables on it; Arbitrum has $7bn, Base has $3.7bn. The list goes on. So it’s not like there is some kind of monopoly on block space to move digital dollars. You have plenty of block space available on a variety of L1s and L2s that are cheap and fast.

So I can’t help but get a bit of heartburn at half a trilly for ETH as the stablecoin shuttler. But if Tom Lee and the gang can keep successfully shilling Wall St, my heartburn won’t matter. ETH is heading higher.

SOL continues its battle with $200, where it failed again in July, while consolidating under prior ATH –

Source: TradingView. As of 8/1/25.

There are certainly finite dollars to go around for Alts, so SOL is definitely competing for buyers against ETH. To the extent ETH is getting the spotlight, it is to the detriment of SOL.

SOLETH is an interesting chart. It’s down 45% since late April, mostly due to the denominator -

Source: TradingView. As of 8/1/25.

That’s the largest pullback in SOLETH since the bottom at the FTX collapse. We know why the pullback is happening – ETH has been the biggest beneficiary of the DAT Attack. On the positive side for SOL, it should be getting a spot ETF very soon, potentially in August. That should be good for a decent pop – TBD on how the ETF inflows will be once they actually launch.

There weren’t many names that outperformed ETH in July. ENA was one of them. It makes sense to me that this would act as ETH beta, especially coming off of such low levels. It’s also a stablecoin project so it’s a way to play the GENIUS bill. TBH I have no view on where this goes from here, just worth noting how strong of a month it had in July –

Source: TradingView. As of 8/1/25.

Pump.fun launched a token in July. The chart looks like this. As a reminder, Pump is one of the most cancerous, extractive things to ever happen to crypto. A true poison to this ecosystem. It’s already been dying over the last several months. Hopefully it continues to die -

Source: TradingView. As of 8/1/25.

Below is OTHERS (aggr mkt cap excluding top 10). It’s a chart that failed hard at prior ATH in the wake of Trump winning, pulled back 60% in a straight line and has been attempting a jagged recovery since Trump put the tariffs on pause –

Source: TradingView. As of 8/1/25.

There is a lot of junk in this index, to put it lightly. This chart does represent the tail, tail end of the risk appetite spectrum. And it is noteworthy this chart is +240% in the last two years. So it’s not like it’s been dead weight. But compared to BTC, Alts broadly have been brutalized –

Source: TradingView. As of 8/1/25.

Overall, ETH was really the star of the show in July and remains in the spotlight heading into August, for the reasons outlined above. BTC is doing fine. Chugging along. Alts broadly still strike me as starved for capital and saddled with bagholders that would love to offload at higher prices. There continues to be little to be excited about in terms of Alt fundamentals, other than guessing whether a half trilly is an attractive entry point for the primary stablecoin shuttler.

Closing Remarks

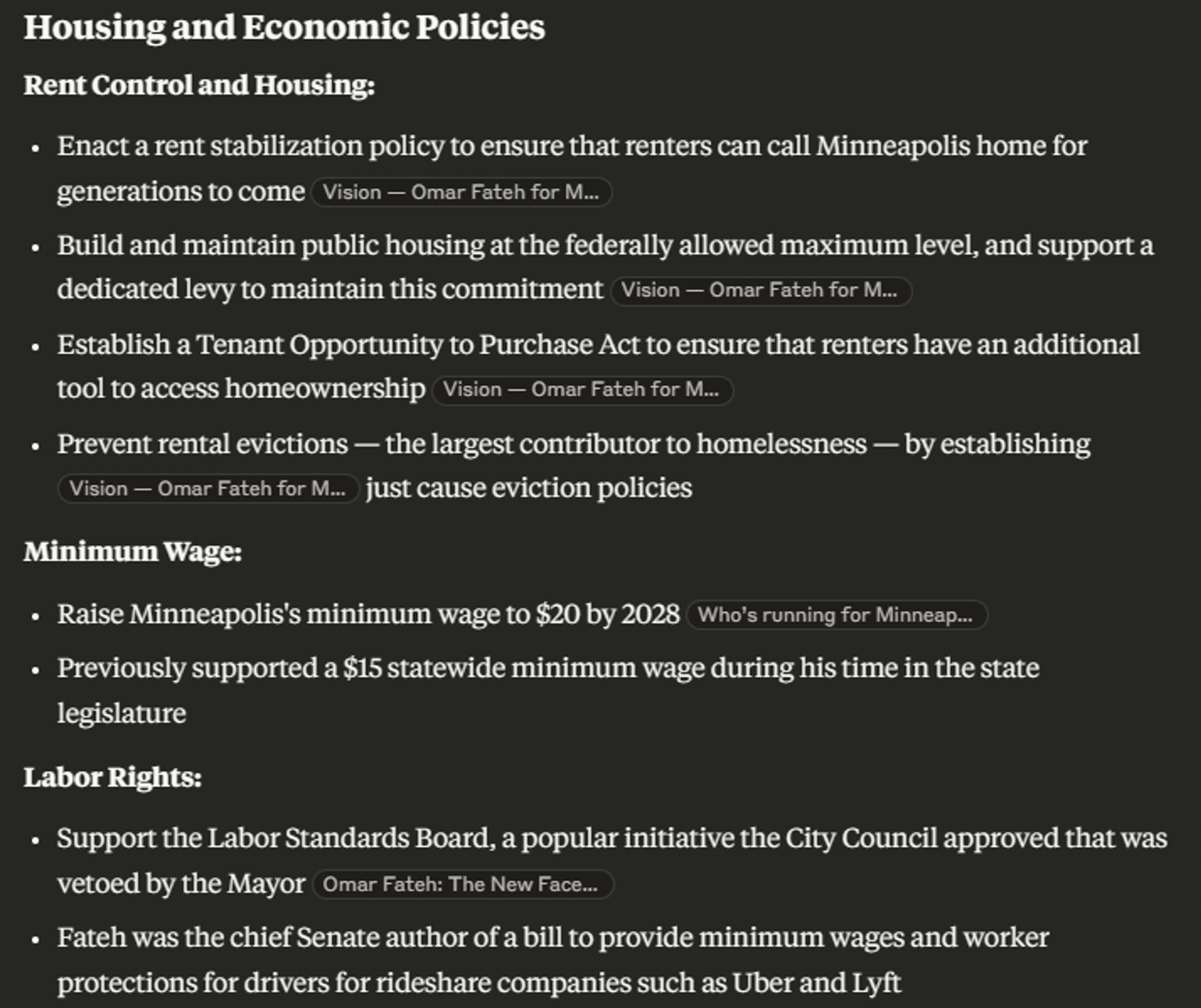

In last month’s Closing Remarks, I talked about Zohran Mamdani, the Muslim socialist running for, and apparently significantly leading in the race for, mayor of New York City. July brought us Omar Fateh, another Muslim socialist running for mayor, this time in Minneapolis. It is accurate to characterize both Mamdani and Fateh as radical left.

Minnesota, home of the great Tim Walz, is one of the most left-leaning states in the US. So it shouldn’t come as an enormous surprise that a guy like Fateh has a good chance at becoming the next mayor of Minneapolis –

Source: Polymarket. As of 8/1/25.

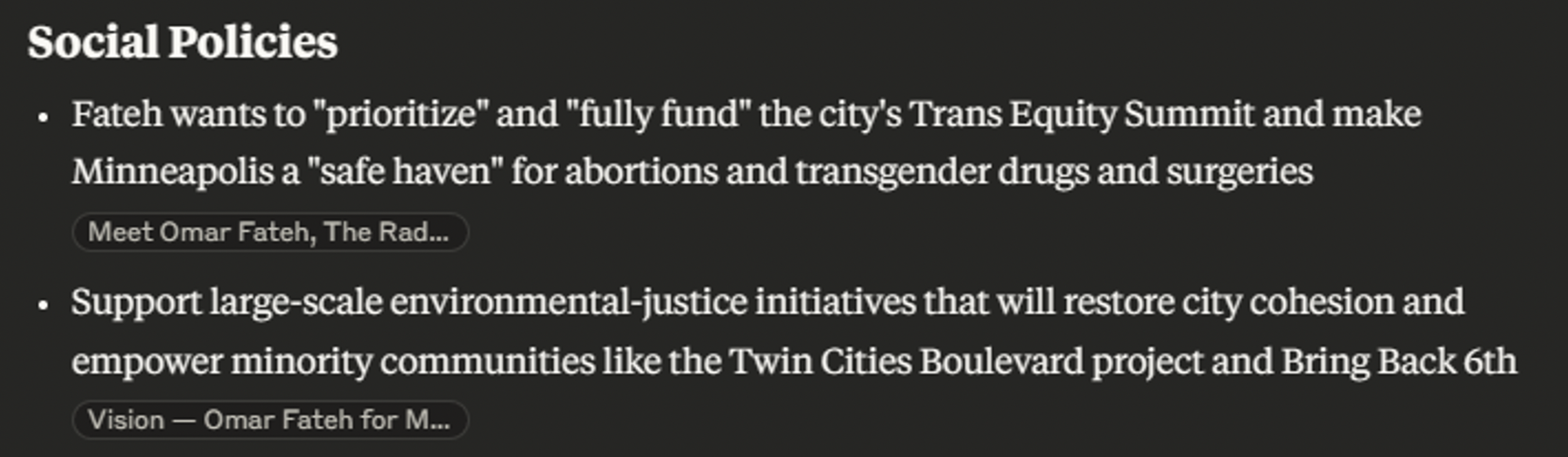

I looked into Fateh’s policy proposals. Here are the highlights -

Source: Claude. As of 8/1/25.

Source: Claude. As of 8/1/25.

Source: Claude. As of 8/1/25.

As so often is the case, it gets a little gray when you start looking into how Fateh proposes to pay for these various initiatives. He proposes a tax on stock option income, but that requires law changes at the state legislative level. Although at least some of these policies (e.g., prevent evictions, defund the police) don’t require additional funding.

So what do we think about these proposals? When you imagine a city with these policies implemented, do you imagine a thriving city? A city that you want to live in?

That’s a personal decision, influenced by a whole host of personal civic ideologies. But when I look across the most left-leaning cities in America (e.g., SF, Seattle, Portland, Detroit, Minneapolis) things are objectively not going well –

Source: Claude. As of 8/1/25.

So there really is not a fact pattern you can look to for the implementation of radically left policies going well at the city level. But when you get to the levels of wealth inequality that the US is currently experiencing, people are going to vote to try it out anyways. I doubt Omar Fateh is the last we see of this.

"Wisdom is better than tools."

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS